Corruption, Democracy, and Political Uncertainty

On January 29th, Transparency International released the Corruption Perceptions Index for 2018 revealing an alarming association between corruption and the level of democracy. The results disclose that most of the 180 countries studied have failed to confront corruption. Further analysis exhibits that countries with high rates of corruption are the ones with low levels of political rights and democratic institutions.

The proliferation of populist political leaders around the world and their attempt to contain the rule of law and civil society reflect the importance of such an analysis. In an issue of the Criterion of the Month last year, we demonstrated a similar startling relationship when we studied government transparency evolution in the last decade. We found that compared to 2007, the respondents from 60% of the countries we study, perceived their governments to be less transparent in their policies in 2017.

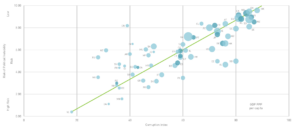

This issue of the Criterion of the Month studies a similar correlation between corruption and the IMD World Competitiveness Dataset measure of the political environment of the country as perceived by mid- and upper-level executives. In the Executive Opinion Survey high level managers are asked to evaluate the risk of political instability in their country. In Figure 1, the vertical axis captures such a risk with low figures reflecting a high level of political instability. The horizontal axis depicts the corruption perceptions just released by the Transparency International. The index varies between zero and 100, with the higher values reflecting low levels of corruption. Figure 1 also includes the size of the economy measured by the GDP per capita (in $US ppp units) indicated by the dimension of the circle denoting a country.

With respect to the Corruption Perceptions Index, the region of Western Europe dominates the ranking. Out of the sixteen countries with the lowest perception of corruption only Canada (in the 10th position) and Hong Kong (in the 15th) are not European countries. The same holds true for the perceptions of political instability. Respondents in European countries perceive low levels of political instability.

Figure 1: Relationship between Risk of Political Instability & Corruption Perceptions Index 2018

It is not surprising, therefore, to observe a strong positive relationship in Figure 1 among the corruption index and political instability. In fact, their correlation coefficient is 0.78 implying that countries that effectively control corruption are the ones characterized by political stability.

A strong positive association also exists between these variables and the size of the economy with a correlation coefficient equal to 0.70 between the corruption index and GDP per capita and equal to 0.61 between political stability and GDP per capita. In other words, citizens in countries with low levels of corruption not only experience a stable political environment but also enjoy high income per capita.

In a sense, Figure 1 seems to depict a vicious cycle: high levels of corruption go hand in hand with the feeling of uneasiness about political risk which further increases corruption and so on. This downward spiral movement is also associated with lower levels of GDP per capita.

Transparency International points to a similar vicious cycle between corruption and democratic institutions: weak institutions allow higher levels of corruption that, in turn, undermine the rule of law further weakening the democratic institutions allowing for even higher levels of corruption and so on.

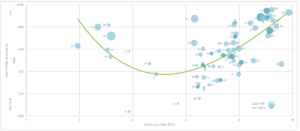

It is instructive to analyze whether such a relationship exists between the risk of political instability and the Democracy Index as provided by the Economist Intelligence Unit. Figure 2 depicts the now familiar risk of political instability in the vertical axis while the horizontal axis captures the Democracy Index. The latter ranges from 0 to 10 with higher values reflecting better performance in five dimensions: electoral process and pluralism; civil liberties; the functioning of government; political participation; and political culture. As before, the size of the economy is also depicted.

Figure 2 suggests a complex relationship among the three variables, reflected by the U-shaped curve. In the areas characterized as Full Democracy, Flawed Democracy and Hybrid Regimes (that is regimes with elements of an authoritarian rule), there exists a positive association between the Democracy Index and political stability. That is, the stronger the democratic foundations, the lower the risk of political instability. In fact, if we include in a sample the countries to the right of the Ukraine, the correlation coefficient between the two variables under consideration is equal to 0.70. Moreover, the correlation coefficient between the Democracy Index and the GDP per capita for these countries is positive and equal to 0.57.

Figure 2: Relationship between Risk of Political Instability & Democracy Index 2018

Therefore, countries that move to the right of the graph, strengthening their democratic institutions are also the countries that are decreasing the risk of political instability and increase the income per capita.

Yet, if we study the sample of counties to the left of the Ukraine, that is the ones that are classified as Authoritarian Regimes and Hybrid Regimes, the relationship is strongly negative, with a correlation coefficient equal to -0.70. This implies that the more authoritarian a regime, the lower the risk of political instability. In addition, the correlation between the Democracy Index and GDP per capita for this region is also negative and equal of -0.52.

Figure 2, eloquently captures, I think, the challenges of strengthening democratic institutions in the countries that are under an authoritarian regime. Transitioning the political environment by introducing political rights and participation, pluralism and civil rights, the sense of the ‘new’ realities undoubtedly will introduce a feeling of uncertainty and thus a perception of political instability.

The question for social scientists then is how this transition will be structured in a way that reduces the feeling of uncertainty to the citizens of a country and enhances the benefits of the application of broader inclusion and participation in the society.

Research Information & Knowledge Hub for additional information on IMD publications

With stagnant import volumes since 2021, and import prices at levels below those suggested by fundamentals, foreign exporters face an uphill battle to convert access to the Chinese market into revenues. Notably, the volume stagnation predates the ...

It has become conventional wisdom to view Europe as an economic powerhouse past its prime, overshadowed by the steady advance of the US and meteoric rise of China. Critics cite Europe’s shrinking share of global GDP, excessive regulation, and slug...

The UAE has been making waves recently in the technology world. A $1.5 billion deal between American tech giant Microsoft and Abu Dhabi’s AI champion,G42, seems to mark a shift in global alliances. This deal is significant not just in terms of the...

Inflows of foreign direct investment into China shows worrying trends despite its massive economy. While total FDI appears substantial at $163B in 2023, most growth comes from existing foreign subsidiaries rather than new entrants. Foreign manufac...

Climate change, geopolitical frictions, and supply chain disruptions call for more sustainable trade practices that can withstand the pressures of volatility. But for trade to be sustainable, it must also be resilient. IMD World Competitiveness Ce...

The idea of an EU bond, a common safe asset, has been gaining attention lately, particularly following calls for its introduction this month by former Italian prime minister Mario Draghi.

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

IMD World Competitiveness Center Report, 14 November 2024, 8th edition

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications