IMD business school for management and leadership courses

Does Tesla still have the magic?

Tesla’s stock is tanking, critics abound . . . but could artificial intelligence (AI) be its secret weapon?

The overall electric vehicle (EV) market is cooling down, yet competition from China is heating up.

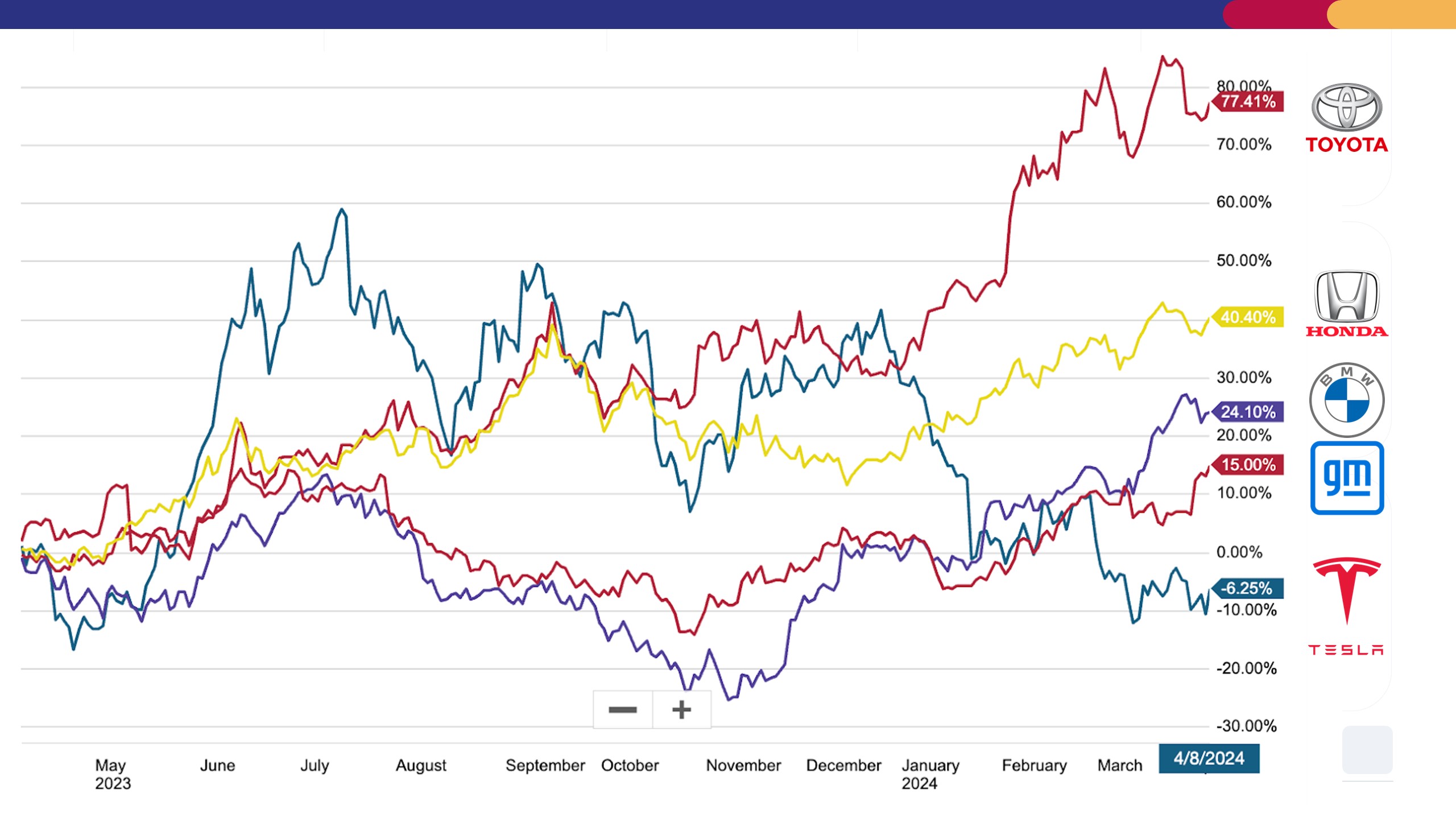

Tesla, the largest EV manufacturer in the world, missed its delivery and volume forecast last quarter as it marked its first year-on-year decline since 2020. The company’s share price dropped by 33% this year, making it one of the worst-performing stocks in the S&P 500 index.

So, is Tesla finally losing its magic?

As one former Tesla executive said, “Elon Musk isn’t a magician, even though he has seemed like that for the last fifteen years.”

Why are things so bad? It is clear that competitive rivalry is reshaping the global EV market.

China dominates the EV market

China is projected to generate the highest revenue in the EV market in 2024:

There are now more than 129 EV brands manufactured in China. The country has a vast number of suppliers servicing the market, from new battery brands such as CATL to the aluminum part manufacturer Wencan Group. It has a large talent pool to support the industry. The sector is highly innovative. Take, for example, Xiaomi, the third-largest mobile brand in China and globally, which unveiled the SU7, a $30K Porsche clone, which offers an astonishing 500-mile range.

The barriers to entry are collapsing

While no one is making enormous profits selling EVs yet, the barriers to entry are collapsing, and a century-old stable industry has now turned into a Wild West, its profit pool largely destroyed. This could potentially be seen as bad news for giants like BMW and Ford.

For the first time, it’s easy to build a car. EV’s, unlike internal combustion engine vehicles, come with simple product architecture and standard components. While they offer greater acceleration, they require no oil change.

Mass producing cars is an expensive business; unlike other luxury brands like Hermès, traditional carmakers must sell lots of cars to survive. In fact, General Motors’ (GM) annual capital expenditure is in the rough range of 10-15 times higher than Hermès’.

Using AI to fight back

If electric cars are all similar and prices keep dropping, what can set a carmaker apart within the market? How can they fight back?

Everything points toward artificial intelligence (AI). Interestingly, that might turn out to be Tesla’s biggest ray of light.

Telsa has had a hidden AI program since 2016. The AI program has been monitoring how drivers handle different situations, even when the autopilot function isn’t on. No matter what you think about Tesla’s not-quite-ready autopilot, the company made a major move when its latest and more advanced driver-assist system, which helps the driver with tasks like steering and braking, was launched in 2023. The AI is continuously learning, for example, when the AI guesses wrong about what the driver will do, it takes snapshots from the car’s cameras and sensors. This data is sent to Tesla, where their AI team analyzes it. They then use this data to teach the AI to act more like a human driver, which, given their focus on autonomous vehicles, is critical.

Although Tesla is not the only EV manufacturer using AI, it is doing so at a much larger scale.

Tesla monitors over two million cars. This massive amount of real-world data is a huge advantage for Tesla. By comparison, GM’s Cruise collects data from 100 vehicles and Waymo from 1,000 vehicles.

So, while some may say that Tesla might be losing its edge in electric cars, they’re playing a whole different game when it comes to AI and digital tech.

Tesla leading the AI charge

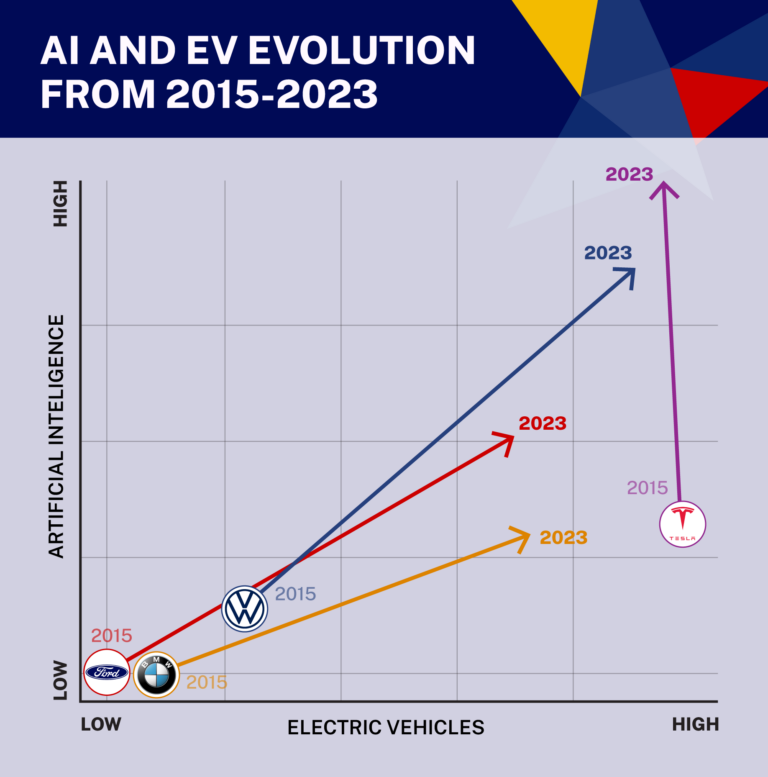

We recently embarked on an exercise to better understand how vehicle companies are embracing AI. Using an AI program, we analyzed what executives say about electric cars and AI. The graph below compares how four companies (BMW, Ford, Volkswagen, and Tesla) compare in terms of their AI capabilities and their focus on EVs.

Within the general category of how the company is embracing AI, we include information about self-driving cars or autonomous vehicles, AI/machine learning investments and applications, and overall strategy around AI. Within the EV category, we focused on the company’s current and planned fully electric vehicle offerings, battery technology development, charging infrastructure, and overall commitment to an electric future.

We downloaded all the quarterly earning calls where CEOs and CFOs were grilled by investor analysts from Wall Street, and then we deployed an AI program to score these dimensions. We scored those companies on a scale of 0-100, 0 being low on AI/EV and 100 being high on AI/EV.

This is what we discovered

This chart shows that while rivals are catching up with Tesla on electric cars, the company is still ahead when it comes to AI.

From 2015 to 2023, traditional car companies have closed in on EVs, which explains some of Tesla’s current woes. While rival vehicle manufacturers are catching up with Tesla on electric cars, Tesla is still leading the charge when it comes to AI. Up till most recently, most of these companies talked about their agency sales model, utilizing AI and web crawlers for pricing and demand forecasting, and applying AI across R&D, sales, production, and administration. In short, their use of AI centers around streamlining sales and predicting demand.

Not Tesla. AI permeated almost every topic discussed, from manufacturing technology to autonomous driving to their humanoid robot project. Massive investments in AI hardware, software, and training were a central theme. In Tesla’s earnings call, the conversation emphasized how Testa sees itself as an AI and robotics company that happens to make cars.

Musk’s AI advantage?

Given how quickly other car companies are closing in, why isn’t Elon Musk more nervous these days? He’s a guy who loves distraction and thrives on crisis. The current down market has probably ignited more energy in him than despair.

But, if AI is the next frontier, a frontier that can again pull Tesla ahead, not just of traditional carmakers but also ahead of all the Chinese EV makers, it should be no surprise that Elon Musk successfully raised $3 billion to fund a new AI-focused startup. In April 2024, he posted on X that Tesla’s autonomous vehicle, Robotaxi, will be launched in August 2024 – and that might be the magic that helps Tesla to once again pull ahead by the end of 2024.

Thanks for reading! If you’re attending either event, let’s connect there. I would love to hear your thoughts on the Tesla situation. I’ll be watching to see if Tesla’s AI gamble pays off!