IMD business school for management and leadership courses

Easter Egg Hunt: How Trump’s Trade Policy Has Businesses Scrambling for Loopholes

Sky-High Tariffs, Shifting Rules, and a Hidden “Made in China” Shuffle—What You Need to Know

“You don’t exit China, you hide it—like colorful eggs.”

That’s what a top executive at a European multinational told me, just days after President Trump’s April 2025 bombshell: a new national economic emergency order that slapped a 10% tariff on all imports and a whopping 145% on Chinese goods.

We all have our fixations—that one thing keeping us up at night. Presidents are no exception; each has an obsession that shapes their era. Franklin D. Roosevelt tackled the Great Depression with the New Deal. Lyndon B. Johnson battled social injustices, pushing through landmark civil rights laws. Richard Nixon cracked open China’s door.

Trump? He’s fixated on the trade deficit.

That’s his yardstick for America’s global clout. After decades of railing against it, he finally dropped the hammer in 2025: a sweeping “baseline” tariff that hit allies and adversaries alike, shredding free-trade orthodoxy. With China, it’s even more pointed — he’s bent on decoupling the world’s two biggest economies.

On the surface, the goal seems simple: bring jobs back, punish unfair practices. But the unintended fallout? A global supply chain mess sapping energy from what counts: out-innovating Beijing.

The real strategic battleground isn’t trade balances. It’s tech.

My colleague, international economist Richard Baldwin at IMD, recently pointed out that only 13% of China’s exports go to the U.S. (You can check out his LinkedIn post with the slides.)

In other words, the trade deficit isn’t the real fight.

So what’s the point of onshoring if it just recreates low-tech sweatshops on U.S. soil? The real contest is for technological supremacy—particularly as a counter to China’s rapid ascent up the global value chain.

But to become a tech powerhouse today, we need a policy of precision and global cooperation that fosters American innovation—not isolationism.

When Policy Creates Chaos, Business Improvises

Companies aren’t stupid. They need access to the lucrative U.S. market, yes. But they also need global markets. Their tangled supply chains can’t flip overnight.

Remember, every factory dragged home skips product development cash. Every new plant means training U.S. workers—trickier than in China. Plus, American engineers? They are both scarcer and more expensive to recruit.

Policy twists and tariff threats — even when steady under Trump — still collide with the four-year political cycle. Meanwhile, as one exec pointed out to me, factories take 15 years or more to pay off. That means hiring, training, managing, and upskilling American workers; dealing with local unions; attracting partners (if they exist) to build an ecosystem; and ultimately, recreating from scratch what’s been running smoothly for years in Taiwan, the Philippines, South Korea, and across Asia.

It’s not hard to predict what business executives will do under great uncertainty.

They hedge. They delay. They protect what they’ve already built.

People improvise. Businesses draw up two plans: one for Washington’s pronouncements, and one for their shareholders.

We see it everywhere:

- The Rerouting Game: Companies scramble to move final assembly—slapping on a “Made in XXX” label while 80% of components still come from China—and even resort to emergency air freight.Apple reportedly flew planes full of iPhones out of India just before reciprocal tariffs kicked in. This is not reshoring. It’s tariff arbitrage.

- Creative Compliance: Faced with export controls on advanced chips, Nvidia created slightly less powerful versions for the Chinese market, skirting the rules until regulators caught up.

- The Grey Market Boom: Smuggling advanced semiconductors into China through third countries has become a fast-growing industry. DeepSeek and other stunning AI advances show progress continues despite the U.S. export controls.

- Strategic Workarounds: Dutch giant ASML, blocked from selling its most advanced chipmaking machines to China, plans to open a “reuse and repair” center in Beijing in 2025. They’ll service older machines and refurbish used equipment already in-country or imported under different rules – a clever way to maintain business without violating export bans.

Business leaders aren’t naive. And investment requires predictability. If government policy keeps flip-flopping, no one can justify long-term investment. Even what’s exempt seems to change on a daily basis. Which line from the president is a joke—and which is real?

That’s why companies build that token “resilient” factory in, say, Ohio—just enough to grab headlines—while quietly leasing warehouse space in Batam or rerouting supply chains through tariff-friendly zones. The showpiece gets the spotlight; the real action happens offstage.

The logic is brutal and simple: I’ll do what’s best for me and my shareholders, because Washington’s strategy is incoherent.

One shipping manager told me, “You think reshoring’s about factories? It’s paper shuffling. We’re whacking moles across 195 economies. I’ve never seen anything like this scramble in my 15 years in this industry.”

Is the U.S. Handing China a Strategic Advantage?

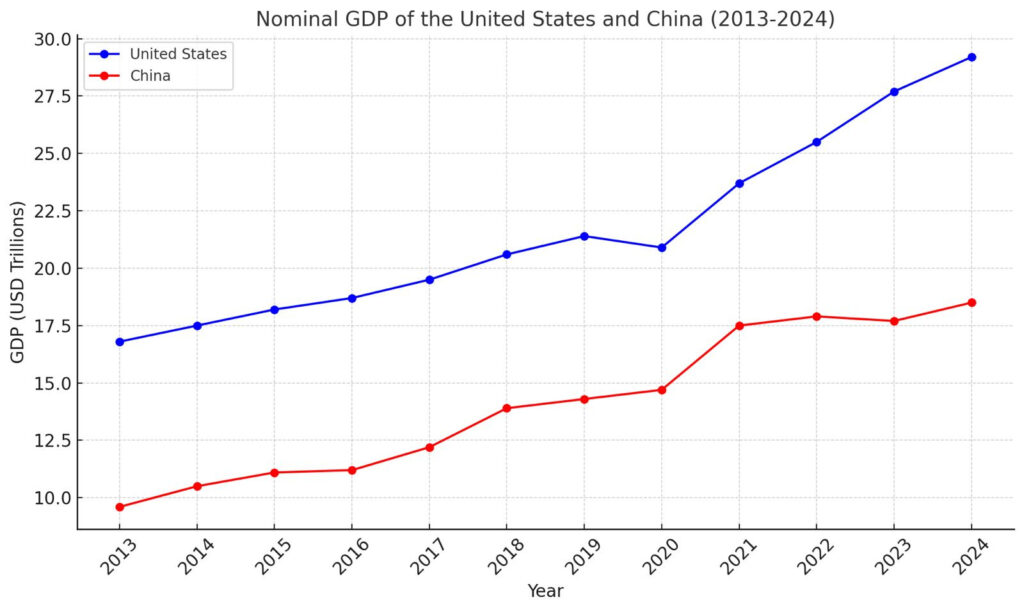

Let’s be clear about the U.S. economic heft. It still leads in nominal GDP ($27.4T) over China’s ($17.8T) in 2023. So one could look at these numbers and say: China is over. It has entered its “lost decades.” America can do what it wants.

And yet, the current chaos might be exactly what China’s tech strategists hope for. While Western companies burn resources on navigating tariffs, rerouting logistics, and designing policy workarounds, they’re not focusing all their energy on pure innovation. Every dollar spent on tariff consultants or emergency air freight is a dollar not spent on R&D. Suddenly, Western firms are not running as fast.

China, meanwhile, keeps building unabated. Beijing is playing a long game, focused on building the foundations of power: massive investment in manufacturing EVs, solar panels, semiconductors, supercomputers, high-speed rails, drones, and other key industries.

Here’s the twist: Much of that recent U.S. “growth” was inflated by higher domestic prices (yes, soaring egg prices technically boost nominal GDP). That’s why when measured by what the money actually buys (Purchasing Power Parity), China’s economy has been larger than the U.S. since around 2016, now roughly 1.27 times the size according to 2024 IMF figures.

China’s relative “weakness” in nominal terms is partly by design. Beijing intentionally keeps the yuan weaker, supporting its export-driven manufacturing strategy. A stronger currency would make exports more expensive and hamper growth.

And if China wanted to make headlines, it could just let the yuan appreciate. Nominal GDP would pop overnight. That’s what Japan did in the 1980s. The yen soared, Japanese GDP nearly caught up to the U.S., and Japanese firms went on a global real estate shopping spree. Remember when they bought Rockefeller Center?

Beijing doesn’t seem interested in that kind of “paper” growth.

Why look rich on paper only to grow poorer in real terms? If national wealth is meant to translate into health and longevity, the data draws a sharp and uncomfortable contrast between the two economies.

The Emerging Tech Landscape: Divided and Less Efficient

So where does this leave us? The messy, fragmented global landscape is heading towards:

- Bifurcated Ecosystems: Separate US-allied and China-allied tech spheres with duplicated efforts and higher costs.

- Regionalized Networks: Production hubs clustered geographically, potentially more resilient but less efficient.

- Strategic (and Messy) Interdependence: Continued reliance on global links for critical tech, or rare mineral inputs, managed through complex rules, loopholes, and constant policy adjustments.

Tellingly, the Trump administration’s own 2025 tariff list (Annex II) explicitly exempts semiconductor chipsets. Why? Because they know slapping tariffs on these critical components would instantly cripple U.S. industries like automotive and electronics, which depend heavily on global chip supplies. (Not that consistency is a given—Trump could reverse course by tomorrow morning, then deny he ever changed it a week later.)

For business leaders, the takeaway is straightforward:

The era of stable, predictable globalization is over. It’s being replaced by geopolitical whack-a-mole. Success requires agility, deep supply chain visibility, and a clear-eyed understanding that national policy goals and on-the-ground business realities are often wildly divergent.

So for companies built for lasting success in the coming years, here’s what they will excel at:

1. Instantaneous Indirect Trade Routes.

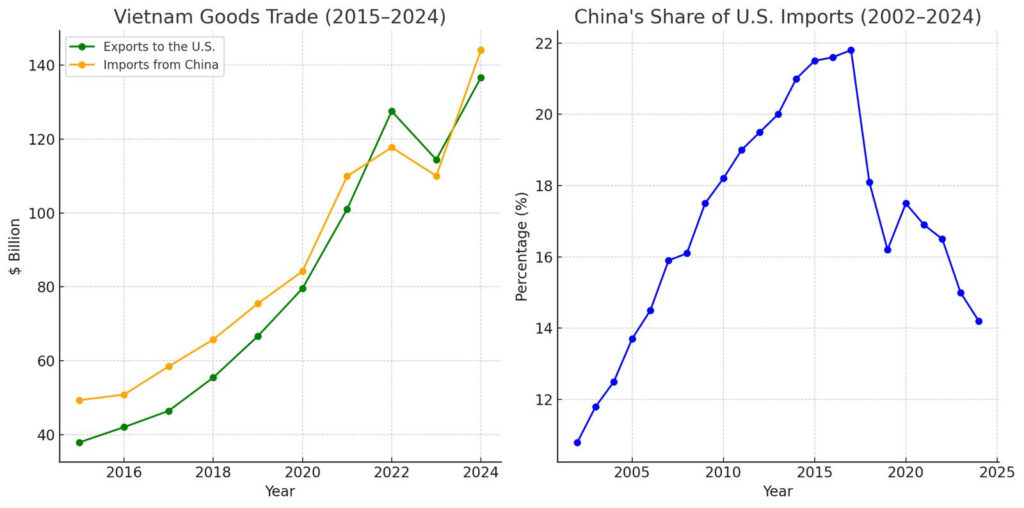

Third countries—think Singapore, Vietnam, the UAE—will increasingly serve as agile trade hubs, quietly channeling goods between China and restricted markets. Vietnam and Mexico are especially telling.

Just look at the data: Vietnam’s surge in exports to the U.S. in recent years almost perfectly mirrors its rising imports from China. In practice, Vietnam has become a transshipment and light-assembly node for Chinese-origin goods bound for the U.S.—a clever workaround hiding in plain sight.

Other Chinese manufacturers—especially in electronics and appliances—have taken a similar route, setting up shop in Mexico. Many of these facilities are operated by Chinese-owned firms, strategically positioned to finish products just enough to qualify for NAFTA/USMCA benefits.

The result? Goods flow into the U.S. with a “Made in Mexico” label, even if much of the value originated in China.

That’s why leading consumer packaged goods companies have turned to high-tech trade infrastructure to knit together their global operations.

P&G, for example, uses an AI-powered control tower that maintains a digital map of its entire supply, letting planners reroute shipments in real time. Similarly, Unilever runs on a cloud-based nerve center handling billions of transactions a week to ensure a hiccup in one region won’t stall the whole network.

2. Parallel Supply Chains to Win on Both Sides.

The smart money is on localization. Companies are increasingly building parallel supply chains—one for the West, one for China—to stay competitive no matter how geopolitics evolve.

Volkswagen, for example, is hedging its EV bets with major hubs on multiple continents: a €2.5 billion innovation center in China’s Anhui province, and a $2 billion Scout EV plant underway in South Carolina. No matter how the trade winds shift, VW is positioned to build locally.

BMW is taking a similar approach with its “local for local” strategy—sourcing and producing in-region, while launching closed-loop battery recycling systems in both China and Europe. That’s not just green—it’s strategic insulation from raw-material shocks.

3. Regional Realignment.

As formal trade channels tighten, companies are redrawing the map. Chinese firms, increasingly shut out of Western markets, are doubling down on the Global South. The result? A drift toward regionalized industries, with separate standards, supply chains, and product lines. Huawei is the poster child here—its 5G gear may be locked out of the West, but it’s thriving in non-aligned markets.

On the flip side, Western firms blocked from selling into China due to export controls are shifting their bets to India, Southeast Asia, and the Middle East. And then there are the grey markets: smuggling and workaround channels that quietly keep demand satisfied, sanctions or not.

Trump’s decade-long trade deficit fixation was meant to reshape America’s map. But by misjudging the core problem and wielding blunt tools, he’s turned global trade into a wild Easter egg hunt. Companies scramble for loopholes, trading innovation for survival.

The inherent contradiction is this: the U.S. needs global tech integration to function today, even as its policies push for immediate decoupling. All the policy chaos achieves one thing—it creates massive incentives for companies to game the system.

The question isn’t whether companies will find the loopholes—they always do. But while business leaders scurry to gather policy workarounds like Easter eggs, the real prize—technological leadership—may be quietly slipping into Beijing’s hands. That’s the cruelest surprise of all.

So I have to ask: what would a serious U.S. strategy for technological leadership look like—one that rewards innovation more than evasion and lip service to patriotism?