IMD business school for management and leadership courses

Future Readiness Indicator

Tesla’s crown is slipping: Mounting pressure in the shifting electric vehicle landscape

The era of Tesla’s uncontested dominance in the electric vehicle market has ended, but what does its future success depend on? And who is catching up?

- Chinese dominance: BYD surpassed Tesla in EV sales in Q4 2023 (though Tesla regained the lead in Q1 2024)

- Price pressure: Chinese EV makers hold a 30%+ price advantage over Western competitors

- Legacy giants accelerate: Traditional automakers are rapidly investing in and catching up on EV technology

- AI is key: Tesla’s advantage lies in software and AI, but the competition is intensifying on this front

- Market consolidation: The automotive industry is overcrowded; consolidation is inevitable as the EV market matures

So what’s new in 2024?

Tesla Inc., the once unchallenged king of the electric vehicle (EV) market, is facing rising competition that’s significantly altering the industry landscape. While recent analysis pointed towards a dangerous narrowing of the gap between Tesla and its rivals, new data shows one last commanding advantage of Elon Musk.

Almost all companies in the IMD Automotive Future Readiness Indicator showed an increase in their future-readiness score from 2023 to 2024. This indicates that industry followers are rapidly catching up to the industry leaders. The upward trajectory could be attributed to a number of factors, including increased investment in research and development, a growing focus on sustainability, and efforts to improve corporate governance.

The Chinese surge – a temporary setback?

Tesla maintains the top spot in the rankings with a score of 100.0 in both 2023 and 2024. However, BYD Co Ltd. shows significant improvement, increasing its score from 74.70 in 2023 to 78.20 in 2024.

BYD, the Chinese EV titan, surpassed Tesla in sales in Q4 of 2023, marking a historic milestone for the company and industry. However, Tesla appears to have bounced back in Q1 2024, retaking the top spot. Nevertheless, this highlights the rapid pace and dynamic nature of the burgeoning EV market.

Other Chinese automakers, including BYD, Geely, NIO, and Li Auto all command a significant price advantage over Western competitors. This cost competitiveness, coupled with aggressive innovation, indicates that Chinese manufacturers will own one-third of the global EV car market by 2030 – this is a major threat to the established European automakers.

The battery factor

One potential wild card in the EV game is the rapid advancement of battery technology. While lithium-ion batteries currently dominate, alternatives like sodium-ion or solid-state batteries have the potential to disrupt the market with improvements in cost, energy density, and safety. These advancements could reshape the competitive landscape.

The middle tier accelerates

It’s not just China shaking things up. Traditional giants such as Volkswagen, General Motors, Ford, and Kia are also pouring resources into EV development.

The data shows a tightening gap between the top and middle tiers of the leaderboard. Several companies experienced a significant increase in their scores. Ford Motor Company increased its score from 61.94 in 2023 to 70.32 in 2024. Hyundai Motor Company’s score jumped from 65.65 in 2023 to 72.32 in 2024, and Stellantis NV showed a marked increase of just over 24 points, from a score of 48.31 in 2023 to 72.37 in 2024. This trend suggests that these companies are implementing strategies that are bringing them closer to the leaders in the EV industry.

What’s most notable is that these legacy players have an advantage that Tesla lacks in that they can lean on the sales of their traditional gasoline and hybrid cars to fund their EV transition. This financial cushion provides them with breathing room as they scale up their EV market share.

While the majority of companies showed improvement in their scores, some companies towards the bottom of the table saw their scores decrease; for example, Renault fell from 30.48 in 2023 to 21.62.

Tesla’s strengths: AI and adaptability

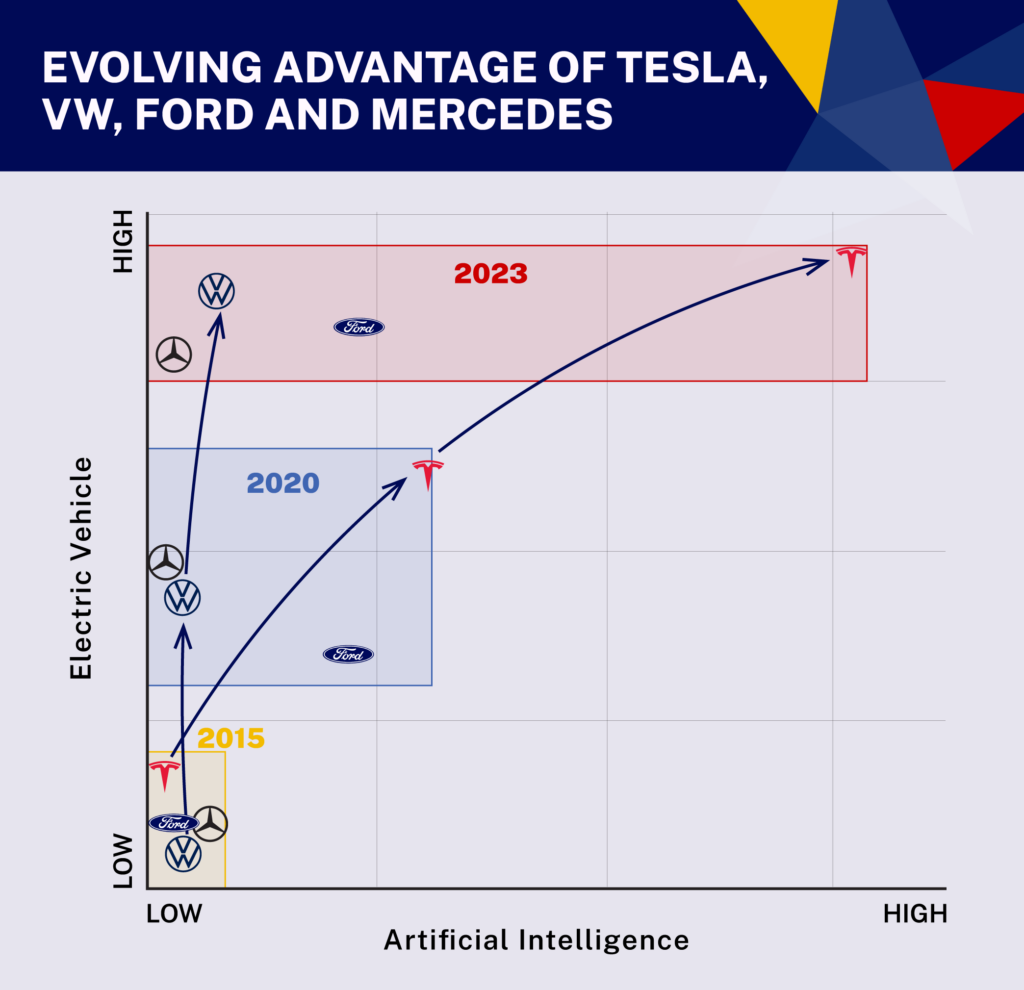

The ace in Tesla’s hand remains its software-centric approach and artificial intelligence (AI) expertise. This was evident during the semiconductor crisis, where it displayed flexibility by optimizing limited chip supplies – a feat competitors struggled with.

An emphasis on AI is key to Tesla’s overall strategy – as seen with its Full Self-Driving (FSD) software, which, while still requiring driver supervision, integrates neural networks for a more adaptable, less explicitly coded system. This also shows how Tesla is continuing to innovate. However, the company urgently needs to deliver on its promises to match the hype. It has long promised true self-driving capabilities, yet its system remains at SAE Level 2.

Some progress is becoming evident as Tesla is now making robotaxis a centerpiece of its long-term strategy, indicating that its robotaxi will be revealed in 2024. However, its final form and production timeline are yet to be confirmed. On the consumer EV front, to counterbalance aggressive Chinese pricing, Tesla has resorted to repeated price cuts, and new lower-cost car models are planned for a 2025 launch.

A key takeaway is that Tesla’s once uncontested leadership is being challenged on multiple fronts. Its future success therefore depends on maintaining a technological edge and finally delivering on its bold AI promises.

The defining battleground

What is becoming increasingly clear is that the real war isn’t being fought over sales figures alone. There is a battle for supremacy in AI, connected cars, and semiconductors. While Tesla retains an edge, traditional automakers, tech giants, and agile Chinese startups aren’t standing still. Tesla’s future remains viable but it desperately needs to maintain its technological lead – and finally deliver on its most audacious promises.

The last wild card will be on advancements in battery technology that could reshape the market. Sodium-ion batteries, which are cheaper and more abundant than lithium-ion, are starting to be put into production EVs by companies like CATL. Lithium-sulfur batteries that store more energy at lower cost are also on the horizon. Automakers like Toyota, Nissan, and BMW are investing heavily in solid-state battery development. These new battery technologies could significantly disrupt the EV landscape in the coming years.

Still, industry consolidation is inevitably coming, and some of the weaker players likely won’t survive. We won’t be seeing a Tesla collapse soon, but it’s undeniable that the era of Tesla’s uncontested dominance has ended.