IMD business school for management and leadership courses

Future Readiness Indicator

Two Charts That Show What a Future-Ready Financial Services Company Is

Click on the company’s name to see details of the score and drag slider to adjust year.

Our objective is to achieve a balanced viewpoint of a company’s future readiness. Obviously, you need to have a strong cash flow and healthy profit to invest in the future. But you also need to have a diverse team of board members to embrace change. After all, we are interested in the actual results of a company’s innovation. We therefore look at a company’s new products or services and see if they are scalable. When all things are on track, investors’ expectations will naturally rise. And that is reflected in a company’s share price performance. Here, you can learn more about our methodology in calculating the composite score. Below are the key takeaways that you need to know.

1. As COVID-19 recedes, mainstream banks can trump Fintech

Fintech is still in full swing. Funding for fintech startups soared to $131.5 billion in 2021 from $49 billion in 2020, according to CB Insights. But the craze over the pandemic meme stocks is coming to an end. Nasdaq and tech firms all tumbled. It’s in this context that we see an adjustment in the financial industry in 2022. That’s unlike last year’s ranking, during which we saw in 2021 that PayPal, Block (formerly Square), and Ant Group were all trending at the very top. This year, no longer.

Why the reversal of fortune? The key strength of fintech has always been its technological prowess. Fintech companies typically target younger generations with financial services at a lower or no fee. They rid themselves of any labor-intensive operations. In contrast to a traditional bank, fintech firms are far more aggressive in automation and replacing human interaction with digital interfaces. They are nimbler in changing product offerings. Most importantly, they provide offerings that are simple to understand and easy to use for consumers. In short, they are more convenient, according to a survey by McKinsey.

But these fintech advantages were made possible, in large part, because interest rates were near zero. That cheap funding is now drying up. It is getting harder to sustain any money-losing strategies to grab market share.

After all, funding costs reflect risks. As the global economy becomes cloudier, investors demand greater profitability in a riskier market. The financial services companies that can continue to grow are the ones that possess a strong balance sheet. The halo of a sleek mobile app no longer suffices.

2. But firms’ histories still loom large over their future outlooks

Of course, being future ready is as much about a company’s strategy as about its mindset. So, we went on to analyze companies’ outlooks, using a big data approach.

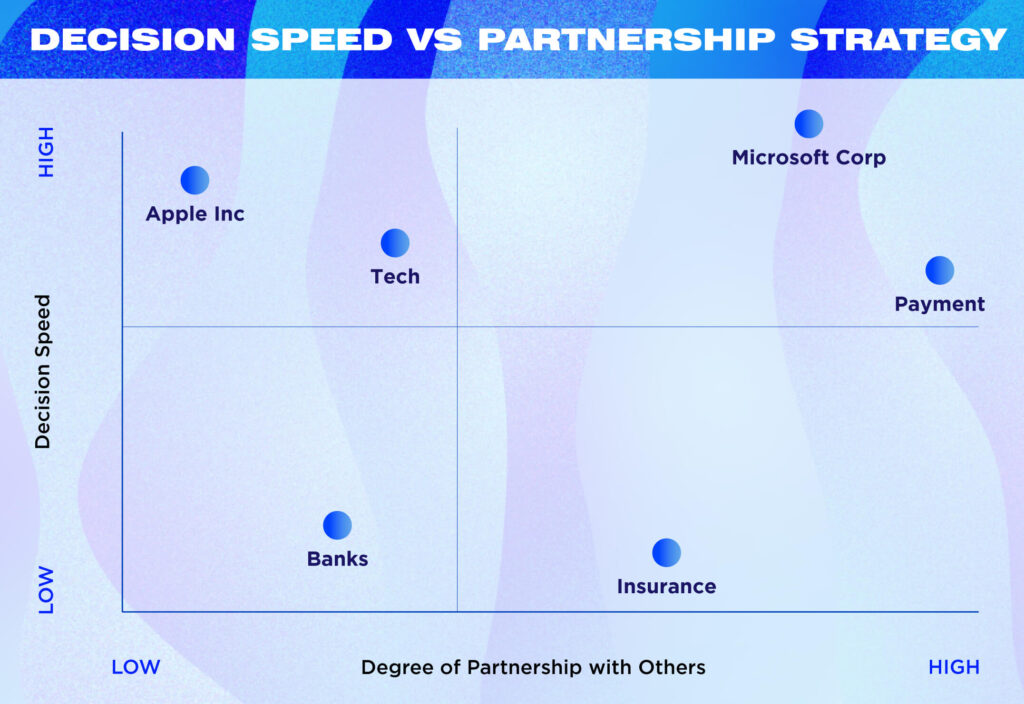

The Y-axis measures a company’s speed of decision-making. Are agility and nimbleness key features in the corporate decision-making? Or is it a company that requires long-term planning and detailed assessment?

The X-axis measures how likely a company is to form strategic partnerships with other companies. Is it likely to pursue a strategy of a closed-loop system, like that of Apple? Or it is more similar to Microsoft’s open approach?

We compare these outlooks between the technology industry and the financial industry. And among financial services companies, we further split them into three sub-groups. There are mainstream banks like Citigroup and HSBC. Then you have insurance companies like AXA and AIG. And finally, you have payment companies such as Mastercard and PayPal.

We drew up this chart in a big-data style, with a little help from artificial intelligence. We first downloaded every report published in the last 10 years by the standard-bearers of business news: The Wall Street Journal, CNBC, The Financial Times, and the like. We also included all the corporate press releases circulated during the same period. We fed 10 years of data into an algorithm. The algorithm then looked at what these companies really represent. To what extent has the business community come to understand these companies? Such “text analyses” may not be perfect, but they let us gauge how things are. You can read more about our method here.

What this chart shows is how a company’s history can weigh heavily on its future outlook. Top executives may proclaim a company is to embrace fast decision-making and agility. But if you are a mainstream bank, it’s hard to forget the last financial crisis in 2008. It’s harder still to free yourself from the internal regulations and complex compliance. But all these are excuses when you are competing for future growth against fintech disruptors.

3. That’s why future-ready companies are investing through tough times

Even when the going gets tough, curtailing investment is not an option. Not least forestalling the buildup of future capabilities. COVID has trained a generation of consumers with new behaviors. So antiquated now is the idea of visiting a retail branch or calling up a customer representative. The big no-go is asking your customers to sign a paper form that needs mailing back.

That’s why smart companies see competition as a non-zero-sum game. They see open collaboration not as an option but as a must. Whether it’s blockchain, artificial intelligence, robo-advisory, or digital payment, it must be implemented through the concept of open banking.

The reason is simple. Large players will always be too slow to spot the next disruption. Any game-changing offering will likely be started by a nimbler innovator. But what’s built as a front-end offering will require backend support. And in finance, it’s all about moving money around, or pooling risk, or lending money from one side of the market to the other. In other words, domain knowledge matter. The fundamental job is still the same. The trick is to repurpose your legacy infrastructure. So companies are investing aggressively in new interfaces and APIs. Make it so easy to use but also secure to adopt. That’s how relevance is not lost.

Is it any wonder why a top-ranking company like Mastercard makes sure consumers can use it to clear PayPal transactions? It also makes sure crypto giant Coinbase will use the Mastercard network for peer-to-peer exchange of digital goods minted as NFTs. Whether you are signing up for Apple Pay or Google Pay or Revolut, Mastercard is an easy option to pick, and third-party merchants are likely to accept it.

In a way, Mastercard and Visa don’t see themselves as credit card companies. They started off that way but that’s ancient history. They are instead technology firms that facilitate commercial activities. It doesn’t matter if you draw down your credit line, or use fiat money, or some cryptocurrencies. They are all there for you.

As the world steels itself against a recession in 2022, the COVID economy in 2020–2021 seems like an easy ride. Still, here is one thing we’ve learned. Future readiness is resilience. There’s no better time to be prepared than now.