IMD business school for management and leadership courses

Future Readiness Indicator 2024

Future-ready companies are those that demonstrate cultural readiness, latest results show

IMD’s Center for Future Readiness today released the second part of its annual ranking of the world’s top companies, this time focused on the fashion, pharmaceutical, and technology industries. The IMD 2024 Future Readiness Indicator report ranks 93 of the world’s largest fashion, pharmaceutical, and technology companies in terms of their future readiness.

“The results reveal surprising shifts in what drives success. Market size is no longer enough, what is needed across all three sectors is cultural relevance.”

Howard Yu, Director of the IMD Center for Future Readiness

This is amidst a backdrop of geopolitical uncertainty, in which the threats of tariffs are looming large for companies across the board, with fashion being the most affected. “The ability to adapt quickly to changes as they happen, especially when it comes to being able to reorchestrate and reconfigure supply chains as required in the face of changing policies and a Chinese economic slowdown will become increasingly important in 2025.” Finally, integrating AI effectively into all aspects of business operations and putting sustainability at the forefront of business decision-making are no longer on the periphery but a business imperative.

- Hermès, LVMH, and Zara top this year’s indicator, by being deeply culturally relevant. Meanwhile, Nike slumped from first to fourth place, attributed to a loss of focus on its performance-focused brand identity and strained retail relationships, demonstrating how losing focus can be more dangerous than competition.

- In pharmaceuticals, Roche, Novo Nordisk, Eli Lilly, AstraZeneca, and Novartis top the list of companies that have harnessed AI adoption and delivered breakthrough therapies, notably GLP-1 medications, which have propelled Novo Nordisk and Eli Lilly into leadership positions. On the other hand, Pfizer saw a substantial drop from first to ninth position, highlighting the risk of over-promising on new technologies.

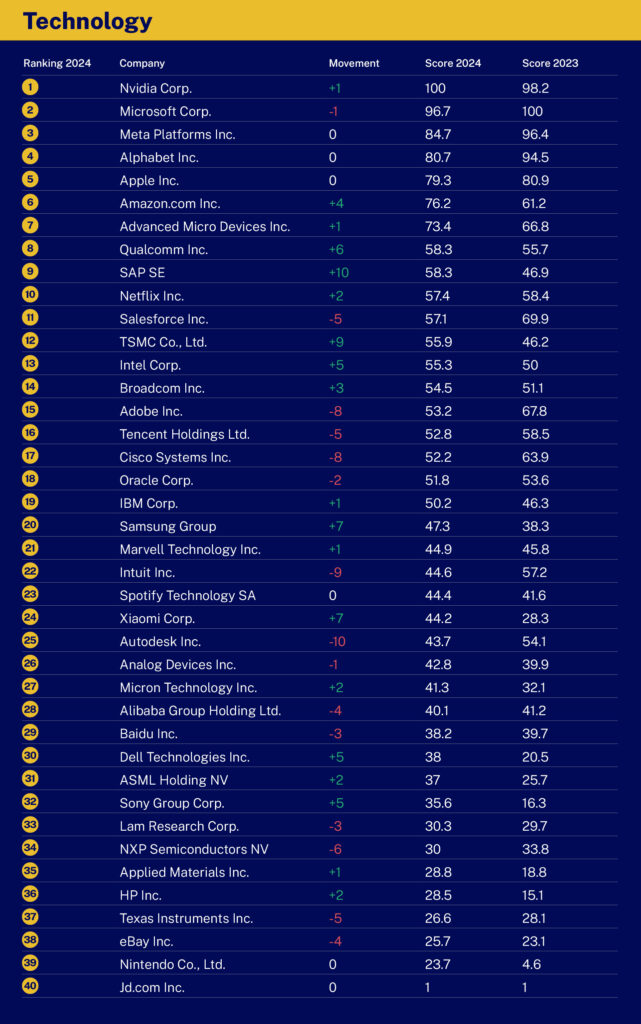

- Nvidia’s long-term investment in AI has paid off exceptionally well; it scored a perfect 100 in this year’s technology indicator. Meta Platforms’ aggressive investments in AI are also showing strong momentum, positively impacting almost all aspects of its operations.

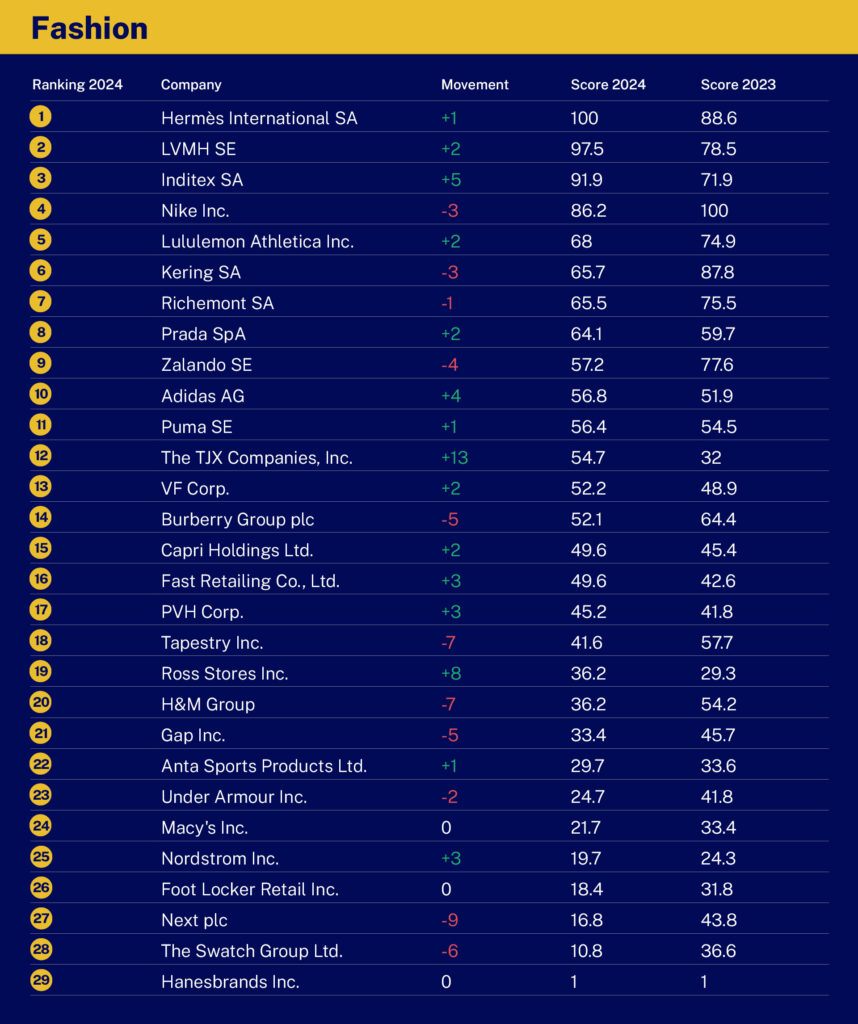

Fashion:

Fashion’s new playbook: Luxury leads, Nike stumbles

Luxury powerhouses Hermès and LVMH claimed top spots through “thoughtful expansion” rather than aggressive growth. Hermès achieved a perfect score of 100 on the Fashion Readiness Indicator, while LVMH followed at 97.5. Nike’s fall from #1 to #4, as a result of a shift away from its core performance-focused identity that left consumers confused and partners alienated, highlights how losing focus can be more dangerous than competition.

Zara has surged to #3 through a deft combination of cultural resonance and digital integration, proving fast fashion isn’t dead; it’s evolving. The company’s success comes against a backdrop of widespread criticism of the fast fashion industry, which saw H&M’s slide from #13 to #20.

Pharmaceutical:

Pharma’s AI revolution and the spectacular success of GLP-1 medications

In pharmaceuticals, clear winners are emerging through companies that have harnessed AI adoption and delivered breakthrough therapies. Roche leads with a perfect score of 100, followed by Novo Nordisk (98.7) and Eli Lilly (95.1). The spectacular success of GLP-1 (diabetes and weight-loss drug) medications has reshaped the industry landscape, propelling Novo Nordisk and Eli Lilly into leadership positions. However, this success brings its own challenges. Eli Lilly’s price-to-earnings ratio has surpassed major tech firms, creating pressure to deliver on sky-high expectations. The industry faces mounting pressure to balance profitability with drug accessibility, particularly as GLP-1 therapy costs draw regulatory attention. The mRNA vaccine experience, particularly with Pfizer, highlights the risks of over-promising new technologies, in this case the mRNA platform. The gap between scientific discovery and commercial viability often takes longer than anticipated, underscoring the need for realistic timelines and careful expectation management.

“Given the uncertainties of scientific discovery and what will be the next moonshot, means that for pharmaceutical companies, having a broader portfolio is more important than ever before to hedge risk,” observed Yu.

Technology:

Early AI investment pays off

The technology sector reveals a widening gap between leaders and laggards. Nvidia’s rise stands out particularly, with CEO Jensen Huang’s 30-year journey to AI leadership challenging the traditional Silicon Valley narrative of rapid scaling. The company’s early investment in CUDA and AI infrastructure has paid off spectacularly, positioning it at the center of the AI revolution.

Meta’s aggressive AI investments are also showing strong momentum, with its “AI Abundance” strategy driving improvements across advertising effectiveness and content feed performance. Despite heavy infrastructure costs, the company maintains a healthy 28% free cash flow to revenue ratio.

“When you do a broad-based assessment of Meta, the near-term revenue growth and profit growth, all the way to the long-term innovation pipeline, it’s clear why they are now in third position. A few years back they were not doing well. But Mark Zuckerberg’s persistence in investing in virtual reality has enabled the company to pivot at the right time,” explained Yu. “Its partnership with EssilorLuxottica, which delivered the Ray-Ban Meta smart glasses collection, was extremely exciting and proved to be a larger success than Meta expected. The Ray-Ban Meta smart glasses have become a significant driver of sales for the eyewear brand and Meta has expanded its partnership into the next decade.”

Trends that are shaping the future

What the latest Future Readiness Indicator shows is that AI integration is non-negotiable. “Across all three sectors, AI integration has become crucial for success,” said Yu. “Fashion leaders use it for personalization and supply chain optimization, pharma companies leverage it for drug discovery, and tech giants build entire ecosystems around it. Companies failing to effectively integrate AI risk falling behind rapidly.”

Furthermore, financial discipline alone no longer guarantees success. Top performers across industries have become culturally relevant through technology, local partnerships, and social media. This is particularly evident in fashion, where Hermès and LVMH have built genuine cultural movements that resonate globally.

Geopolitical tensions cannot be overlooked. Trump’s proposed economic policies, particularly aggressive tariffs, are forcing companies across sectors to rethink their strategies. Fashion brands face potential supply chain disruptions, while tech companies navigate US-China tensions, with Taiwan playing a crucial role through TSMC’s semiconductor leadership.

ESG is no longer a nice-to-have. Fashion companies are embracing circular economy principles, pharma companies are focusing on equitable healthcare outcomes, and tech firms are balancing innovation with social responsibility.

“The era of unlimited investor patience is over, with companies needing to demonstrate both innovation and financial sustainability,” concludes Yu. “Those that can master this balance while staying culturally relevant and technologically advanced are best positioned for success in the evolving global marketplace.”

Read more about the methodology here.