IMD business school for management and leadership courses

Meta Pumped Cash Into A Future Vision, But Didn’t Prepare Well

This article was originally published on City A.M.

The challenge Meta faces is different from that of other companies like Google and Microsoft, because Mark Zuckerberg did nothing to future-proof his company in the event of a recession, writes Howard Yu

Meta suffered another blow last week, as the European Union ruled their ad practices in Ireland illegal. The decision resulted in a fine of €390m, which Meta is appealing, and shows yet another issue in the company’s business model and future-preparedness.

The technology sector has struggled over the past year, with the Nasdaq-100 technology sector index having fallen 38 per cent in 2022. However, there are big differences in how ready tech companies are to face the challenges confronting the industry.

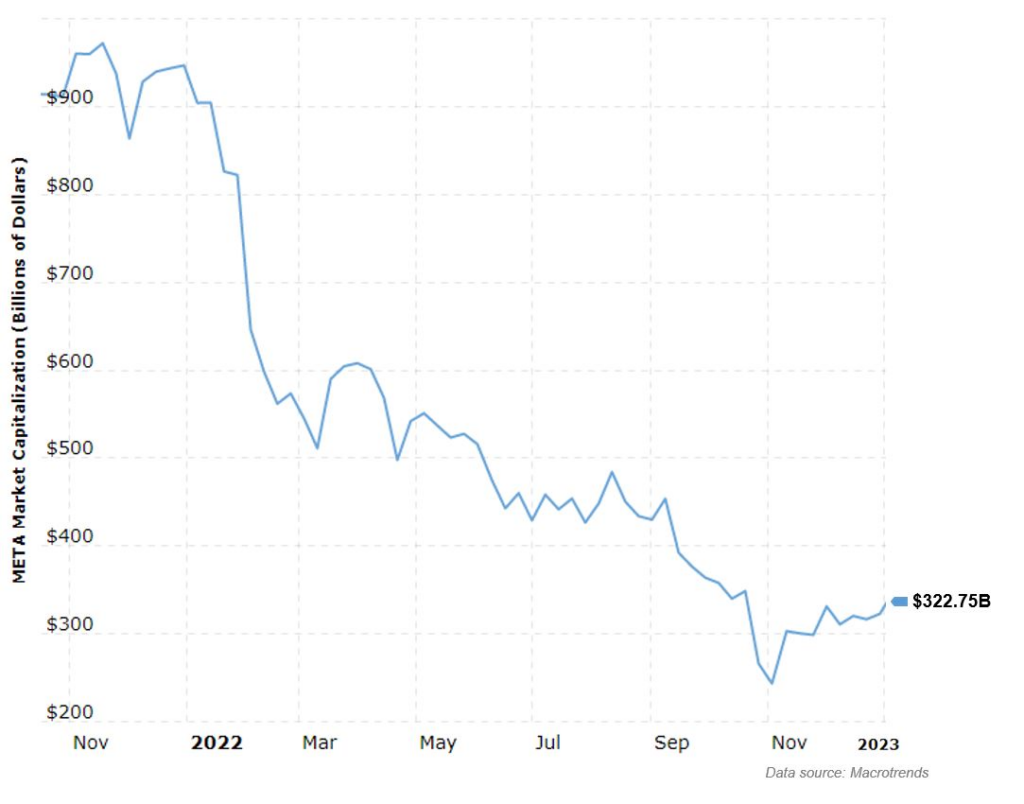

As Andy Grove, the former chief executive of Intel, once said “Bad companies are destroyed by crises. Good companies survive them. Great companies are improved by them.” The challenge Meta now faces is unlike that of companies such as Google and Microsoft, who have properly future-proofed their business models. Meta risks being destroyed by ongoing crises, having lost an astounding 60 per cent, or near $450bn. By the end of 2022, it had dropped to a total market capitalization worth only $320bn.

Crises often expose vulnerabilities, so businesses must cultivate a diversified offering to be ready for the future.

Microsoft has successfully done this, mitigating negative impacts of the looming recession. They have done so by offering broader product lines and ensuring diversified income streams. People may not be using PCs running Microsoft Windows, but even hardcore Apple fans will find themselves using LinkedIn, Xbox or Teams. The business has recently defended its $69bn acquisition of the gaming giant Activision, as well as taking a 4 per cent stake in the London Stock Exchange as part of a 10-year deal on its cloud computing business. Microsoft has successfully become inescapable to a tech user: that is the power of a diversified business portfolio. When I visited their offices at the end of last year, the mood seemed upbeat, confident in the strength of their business.

Meta, on the other hand, has exposed its vulnerabilities. Until 2022, it seemed unstoppable. No matter how many data scandals there were – most notably with Cambridge Analytica – Facebook’s share price did not stay down for long. But in 2021, Apple changed its privacy settings, impacting Meta’s almost single source of income – ad revenue. Suddenly, Facebook and Instagram could no longer follow users to websites other than their own. This move is expected to cost Facebook $14.5bn in lost ad sales for 2022.

Google wasn’t affected as much by Apple’s privacy changes because it operates Android. It also has access to user information through Google Maps, Search, YouTube, and Gmail. In contrast, Meta has been shown to be at the mercy of Apple. It is, in fact, the only tech giant that never goes deep like Alphabet or broad like Microsoft. Meta has been pursuing easy growth for too long.

Meanwhile, misinformation continues to fester on the Facebook platform. Mark Zuckerberg may support free speech, but the reality is that outrage generates more clicks than facts. And Facebook profits from posts that go viral. It forgot the younger users whom TikTok came scooping up.

This does not spell inevitable doom for Meta. Like the younger version of Facebook that acquired WhatsApp and Instagram, Meta could have started its virtual reality experiment earlier. Rather than focusing on providing expensive goggles for a fixed group of users, the company could have connected with younger generations by exploring where they spend their time online. It could partner or acquire someone like Roblox or Fortnite. But these moves require repeated experimentation. It targets future users that cannot be monetized right away; they look much less attractive on an Excel spreadsheet.

Meta’s mistakes serve as a lesson to businesses looking ahead to the challenges of 2023. New capabilities and markets must be consistently created and scaled up to maximise innovation. To ensure a business is futureproof, it must constantly experiment with new business models ahead of time. Most importantly, businesses should never lose sight of existing and future customers, as Zuckerberg has done with its Facebook platform.