IMD business school for management and leadership courses

What We Can Learn About Strategy from Xbox in the Gaming Industry

Even if you don’t play video games yourself, someone close to you probably does, considering the video game industry ($220 billion) generates far more revenue than the film industry ($100 billion). The lost years of the Covid pandemic drove growth, as did the many ways to play games these days—on consoles, PCs, mobile devices, streaming services, and online platforms.

Little wonder that Xbox’s owner, Microsoft, has been fighting in the courts, first in the US and now in the UK, to win final approval to acquire Activision Blizzard, publisher of Call of Duty and Candy Crush.

It’s a big purchase that amounts to $68.7 billion, but Microsoft is the world’s second most valuable company, surpassed only by Apple. Still, regulators don’t like the prospect of Microsoft buying Activision. If the acquisition goes ahead, it’s no stretch to imagine Xbox urging Activision to stop making its game available on consoles other than Xbox. Not on PlayStation. Not on PCs. Less stuff on streaming. A monopoly will protect its exclusive content and force everyone to buy another expensive console to play great games. This is the classic model of iPod+iTunes—tightly integrated inside a walled garden. Apple is a device+service company.

But that reading is wrong. And I think that’s why the US regulator has already approved Microsoft’s deal. It’s now up to the UK regulator to see if it recognizes the same logic.

Sony, owner of PlayStation, has already signed an agreement with Microsoft. Everything by Activision—from Call of Duty to Candy Crush, from Warcraft to Hearthstone—will be available on PlayStation for the next 10 years. We may think Microsoft is making a one-time concession to pacify regulators. But the reality is that Microsoft has been self-disrupting its traditional Xbox model for a decade.

Case in point: Xbox Game Pass already allows people to play over 400 games on PCs, cloud devices, on top of the Xbox console. Anyone can play Call of Duty these days by subscribing to Game Pass and streaming it through Xbox Cloud Gaming without downloading anything onto a PC or owning a console.

What that means is that Microsoft has become the master of self-disruption. It stays one inch ahead of everyone. It sells Activision games at their usual price of $60~$70 each. But it’s also making them available from day one to Xbox Game Pass subscribers, which is what the company did with the previously acquired ZeniMax.

Now, let’s the math. Spending $180/year on Xbox Game Pass is the same as buying three games individually. But with Game Pass, you can play all the Xbox games on a PC, the classic console, and even a mobile phone.

The question to ask is—why would Microsoft do all this?

I didn’t understand it either. That is, until I came across an excellent presentation by Microsoft CEO Satya Nadella described in the equally excellent analysis by Stratechery.

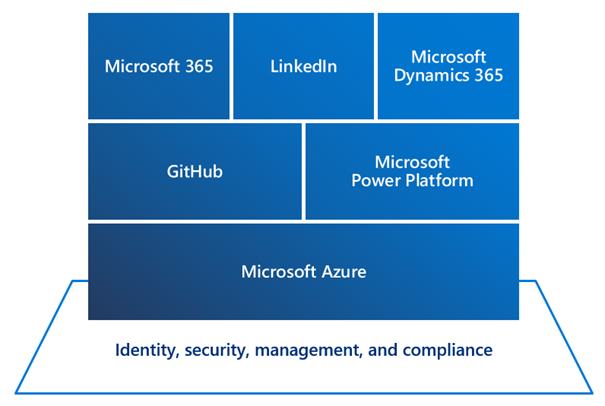

The Xbox business is obviously part of the Microsoft stack. Microsoft sees foundational technologies that it will control and expands on them to deep tech services like cloud computing. Where services like Microsoft 365 and LinkedIn sit is also where Xbox Game Pass resides. What it doesn’t mention in this presentation is devices—there’s no content about tablets, laptops, or the Xbox console. That’s because they are important only as a reference design, not as drivers for volume sales. It’s similar to how Dior competes in Milan fashion shows featuring its haute couture look, but makes its money on ready-to-wear items in the mass affluent boutiques.

For Xbox, it has moved away from the concept of device+service toward technology+content everywhere, in the context of Microsoft’s own evolution as well. So what’s the lesson to be drawn for all of us?

It’s this: Don’t wait until your old business model dies before you invent a new one. The traditional playbook of exclusive games still works fine for Sony. And the Xbox console remains a viable business. But Xbox is constantly edging in with its new model—trying it, timing it, refining it. Why? Because you should have the capabilities already developed. You wouldn’t necessarily scale the model big, but make sure you’re ready so that when the day comes, when the environment flips, you know how to capitalize on it.

Thank you for reading!