IMD business school for management and leadership courses

Future Readiness Indicator

Future-ready travel companies balance tech with touch

Future-ready companies are distinguishing themselves by strategically balancing technological advancement with authentic human connection.

- The travel industry in 2025 is shaped by key trends including AI technology, personalized experiences, responsible tourism, and ‘bleisure’ – the blending of business with leisure. Companies must adapt by adopting eco-friendly practices, deploying AI at scale for personalization, offering unique experiences, providing wellness services, and catering to solo travelers.

- Future-ready companies include Booking.com, Delta Air Lines, and Marriott, based on their robust performance in relevant metrics.

- AI agents, like OpenAI’s Operator and China’s Manu, are revolutionizing travel booking, potentially disrupting traditional travel agencies by enabling autonomous trip planning.

1) Executive summary

From AI-powered bookings to strategic technology investments, discover how top companies fuse AI with authentic experiences—and why loyalty is your ultimate defense against disruption.

From AI-powered bookings to strategic technology investments, discover how top companies fuse AI with authentic experiences—and why loyalty is your ultimate defense against disruption.

The travel industry stands at a strategic crossroads in 2025, facing an AI-driven revolution alongside four transformative forces: personalization and digital transformation, sustainability demands, the blending of business and leisure travel (‘bleisure’), and a business’s financial resilience through diversification.

State of play – AI is the game-changer

Generative AI (GenAI) stands out as the most disruptive wildcard in the travel landscape. For years, consumers have comfortably navigated self- service travel planning; browsing aggregator sites, comparing flights, and scrutinizing user reviews. This tedious “click fatigue” is now primed for reinvention by autonomous booking agents such as ChatGPT’s Operator or China’s Manus. Instead of manually searching through dozens of options, travelers may soon simply instruct AI assistants to book complete itineraries in seconds.

This technological shift amplifies existing industry trends. Research shows that nearly half (46%) of organizations risk missing their interim energy transition goals, highlighting the industry-wide sustainability challenge. Meanwhile, almost three- quarters (72%) of corporate travelers extended business trips for leisure in 2023, confirming the ‘bleisure’ trend’s significant momentum.

How can travel companies stay ahead?

IMD’s Travel Future Readiness Indicator 2025 identifies Booking Holdings (the parent company of travel brands like Booking.com, Kayak, and Priceline), Airbnb, Delta Air Lines, and Marriott International as industry frontrunners. These companies demonstrate the importance of strong cash flow providing the critical foundation for sustainable innovation, enabling them to invest in technologies that have matured beyond initial hype to deliver tangible competitive advantages.

Future-ready companies also distinguish themselves by strategically combining technology that drives an efficient process, with exceptional personal service during the entire guest or traveler experience, whether hotel stay, flight, or cruise. These leaders use AI and data analytics as invisible enablers that enhance rather than replace the human interaction, creating more meaningful personalized experiences.

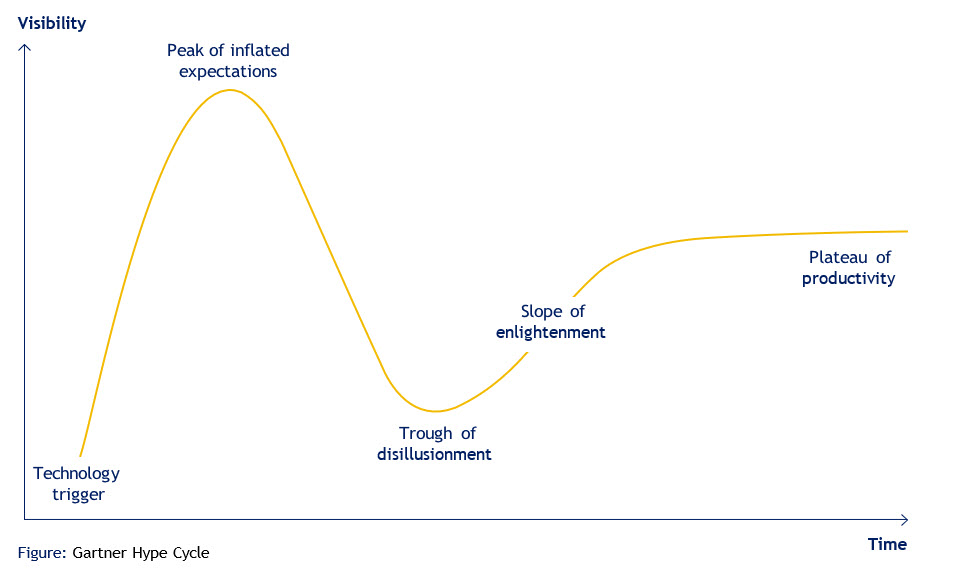

Our research also reveals that hype doesn’t equal to actual technology adoption, but those organizations that do are poised to benefit the most. These organizations strategically identify innovations where they can effectively pioneer applications into their products and offerings, highlighting their persistent efforts. As illustrated on page 34, the transition from enlightenment to productivity is fraught with trial and error.

Which businesses will thrive? Which are at risk?

Companies with strong direct customer relationships and robust digital footprints stand to benefit the most. Those with “sticky” brand loyalty (like Airbnb, which generates 90% of its traffic directly with travelers, or Marriott’s Bonvoy loyalty program) face less risk from AI intermediaries, as travelers will likely instruct their AI assistants to ‘check Marriott and Airbnb first’ rather than allowing completely autonomous decision-making.

Conversely, those companies that are dependent on search engine visibility or aggregator listings face greater vulnerability. When AI agents handle the comparison process, traditional discovery channels may be circumvented entirely. Small Online Travel Agencies (OTAs) that over-invest in traditional advertising and fail to pivot to AI-based distribution models are particularly at risk, as are small hotels and tour operators that lack the digital footprints to appear in AI-curated searches.

The “stickiness” factor represents not merely a current competitive advantage but potentially a crucial shield against AI-driven disruption. Companies with strong customer loyalty and direct engagement will be more likely to maintain their customer relationships even as AI booking agents become prevalent. When travelers feel connected to a brand, they’ll specifically instruct their AI assistants to check that brand first, rather than letting AI make fully autonomous decisions.

The winners will be those who recognize they’re competing for visibility – not just in the physical world but in the digital realm, where AI agents scan for recommendations.

Urgent but not overnight – building sustainable future readiness

Despite the dramatic potential of GenAI, it’s important to recognize that this transformation, while urgent, will not happen overnight. The companies best positioned to navigate this transition are those with strong financial fundamentals who can aggressively invest in fewer, more strategic technological initiatives rather than chasing every innovation. This measured approach is precisely what our Future Readiness Indicator captures – a balanced assessment of which organizations are performing exceptionally today while simultaneously making bold, focused investments in tomorrow’s capabilities.

Our analysis isn’t merely a forecast of future trends, but rather a comprehensive evaluation of which companies are successfully confronting inevitable changes, implementing practical solutions, and building the operational excellence necessary to thrive in an AI-transformed landscape.

2) Four major forces transforming travel in 2025

The business of travel is undergoing a profound transformation, driven by four distinct yet interconnected forces: digital personalization, sustainability demands, the blending of business with leisure (‘bleisure)’, and financial resilience strategies. While health-focused travel and solo journeys are emerging as notable sub-trends, these four primary drivers are fundamentally altering how companies compete and serve travelers.

Each trend presents both challenges and opportunities. Digital personalization requires sophisticated data capabilities while maintaining human connection. Sustainability demands authentic commitment beyond mere marketing. The ‘bleisure’ combination necessitates flexible offerings that accommodate work and play. Meanwhile, financial resilience has become non-negotiable following recent global disruptions.

For travel companies, the path forward requires strategic adaptation across operations, technology investments, and customer engagement models. Those who successfully navigate these shifts will emerge not just as survivors but as industry leaders, capturing market share through innovation that genuinely anticipates and meets evolving traveler expectations and behaviors.

Personalization & digital transformation

Travelers now expect real-time updates, seamless mobile apps, and curated itineraries built on robust data and AI engines. In one 2024 survey, a whopping 90% of travelers said they value personalization when planning a trip.

We have come a long way from the one-size-fits-all tour package; now every flyer and guest wants to feel like they’re the only one. Whether it is flight or hotel suggestions, loyalty program perks, or intuitive booking apps, personalization has become the norm. Marriott and Delta, for instance, have turned to artificial intelligence to curate options based on individual preferences, from recommending thatperfect room to doling out loyalty perks just when you need them.

If that sounds like a lofty promise, it is – but it’s also what customers increasingly expect as the baseline.

What sets truly exceptional hospitality providers apart is their commitment to enhancing the human experience through thoughtful digital integration. The most successful luxury brands recognize that technology must serve to elevate the personalized, attentive service that discerning guests expect – never replacing it.

These companies develop sophisticated digital backbones that power their operations while ensuring the technology remains largely invisible to guests, creating seamless experiences where human connection remains paramount. The most sophisticated implementations occur when companies allow technology to handle operational complexities behind the scenes, freeing staff to focus entirely on creating memorable, human-centered experiences.

By focusing on applications that enhance rather than disrupt the guest journey, they leverage data analytics and AI to anticipate needs and deliver increasingly personalized service while maintaining the warm, attentive human interactions that define luxury hospitality. This balance – invisibly leveraging technology while maintaining authentic human touchpoints – represents the pinnacle of hospitality innovation.

It’s like the proverbial swan – with AI and digital working below the surface, the smooth delivery of assured and exclusive service is very much face-to- face and personal.

How companies can prepare

- Data utilization: Invest in data analytics and AI to leverage customer data for personalized travel.

- Channel enhancement: Augment digital channels with user-friendly mobile apps, chatbots, and integrated payment gateways.

- Consistent experience: Ensure omnichannel consistency across websites, apps, call centers, and offline locations.

- Human connection: Create digital ecosystems where technology enhances the guest experience without becoming the experience itself, preserving the irreplaceable value of human connection.

Sustainability and ‘eco-friendliness’

Despite recent political or media rhetoric on sustainability or diversity, responsible tourism remains a priority for an increasing share of travelers. A recent study found that 78% of luxury travelers favor companies with strong sustainability policies – proof that caring for the planet isn’t just a niche preference but mainstream, even among high-end jet-setters.

Although there’s a clear gap between consumers’ stated environmental values and their actual spending, there is evidence of a willingness to pay a sustainability premium (often around 5-10%). Companies that fulfill the green mandate cost- effectively can therefore gain a decisive edge. This is yet another strategic advantage alongside digital transformation or consumer loyalty programs.

Marriott and KLM Airlines (part of Air France- KLM) have publicly set ambitious green goals. Meanwhile, Hilton’s global Travel with Purpose program, for example, pledges to cut the hotel chain’s environmental footprint in half by 2030.

It’s worth noting that consumers are skeptical of greenwashing and vague promises and are growing more focused on whether companies actually ‘walk the talk’ on sustainability. (How many hotels have asked us to reuse towels “to save the planet” while ignoring their operation’s jumbo-jet-sized carbon footprint?) There’s a demand for substance over style: real emissions cuts, support for local communities, and honest reporting on progress.

As one industry report highlighted, 32% of travel of supposedly “sustainable” travel options – a warning to any brand thinking a leaf icon on their website is enough. – a warning to any brand thinking that a leaf icon on their website is enough.

‘Bleisure’ travel

Although the future of remote and hybrid work arrangements is in flux as some major employers dictate a return to the office, business trips can increasingly morph into leisure excursions. Ever tacked a weekend of fun onto a Thursday-Friday conference? Congrats – you’re part of the ‘bleisure’ boom.

But how prevalent is this blending of work and play? When two-thirds of corporate travelers say they extended a business trip for leisure in 2023, roughly 70% of remote workers report having worked while traveling in 2024, and an estimated 35–40 million people worldwide now identify as digital nomads, these aren’t outliers – this is the new normal. In the US, another survey found that 84% of business travelers want to add vacation time to their next work trip and already have done so in the past year.

The implications are wide-ranging. Corporate travelers are increasingly venturing beyond the boardroom and generic conference center hotel, seeking out local restaurants, hidden gem neighborhoods, and authentic experiences after the Zoom calls are done.

A decade ago, a road warrior’s routine might’ve been to fly in, taxi to hotel, meeting, room service, fly home. Now that same traveler might schedule an extra day to hike a local trail or explore a museum, often with the blessing of an employer who knows that an employee who feels valued – especially one who’s been on the road during unsocial hours or at the weekend – is a more productive one.

Skift Research noted a 72% year-over-year increase in these blended travelers – a surge that Accor and others are capitalizing on by marketing hotels as not just a place to sleep but a place to get stuff done while enjoying what the locality has to offer.

How companies can prepare

- Greening operations: Adopt carbon reduction initiatives, such as fuel-efficient fleets for airlines and green properties for hotels. (According to the 2023 Global Sustainable Tourism Report, hotels implementing sustainable practices have reported a 12% increase in overall revenue compared to their traditional counterparts.)

- Clear commitments: Publish transparent targets, and monitor and report progress on carbon neutrality, waste reduction, and community impact. (A Deloitte analysis found that “a 10-point higher ESG score is associated with an approximate 1.2x higher EV/EBITDA multiple”. Another study analyzing 150 S&P 500 companies from 2017- 2020 found that “companies with superior ESG performance perform better financially and are valued higher in the market compared to their industry peers”.)

- Employees are your brand: Implement policies to improve employee well-being and enhance brand image. (The McKinsey Health Institute/World Economic Forum 2025 report Thriving Workplaces: How Employers Can Improve Productivity and Change Lives emphasizes investing in employee health could generate $11.7tn in global economic value.)

- Flexible booking options: Combining business and leisure packages and offering easier rebooking or extension policies caters to the evolving needs of the ‘bleisure’ traveler.

- Local partnerships: Collaborations with local restaurants, tour operators, and cultural institutions provide access to authentic experiences, differentiating a company’s offerings from the generic.

- Workspace offerings: Hotels and resorts can adapt by creating co-working spaces, ensuring fast, reliable Wi-Fi connectivity, and providing meeting-friendly environments to cater to the needs of travelers and remote workers.

Financial resilience and diversification

The travel industry has learned some hard lessons in resilience over the past few years. After the gut punch of pandemic lockdowns in 2020 – which, according to the World Travel & Tourism Council (WTTC), led to an almost $4.5tn loss in global travel and tourism GDP – as well as ongoing geopolitical jolts, airlines and hotel companies are determined to never be caught off-guard again.

Travel operators have learned the value of cash reserves and reduced debt burdens. The result is a strategic focus on fortifying balance sheets and diversifying revenue streams. The era of “growth at any cost” has shifted to “build a buffer for when things go wrong.” In practice, this means maintaining higher liquidity (cash reserves or credit lines) as a cushion, cutting operational fat for efficiency, and seeking new income sources beyond the core business of selling flights or room nights.

One clear sign of this trend is airlines ramping up their ancillary revenues – all those extras beyond the airfare that pad the bottom line. In 2022, airlines globally earned over $102bn from ancillary revenues, which accounted for about a 15% share of total airline revenue – a record-high. Everything is being monetized, from checked bags to seat selection to onboard Wi-Fi. Carriers are becoming retail enterprises in the sky, offering bundles, subscriptions (think paid annual passes for frequent flyers to get lounge access or free bags), and even vacation packages or hotel bookings as part of their portfolio.

Financial resilience isn’t just about revenue, of course – it’s also about cost control and agility. The pandemic forced companies to slim down and automate. Those habits are sticking.

Carriers automated more of their operations and customer service (fewer agents, more apps), and hotels found tech-based efficiencies – like on- demand housekeeping and contactless check-ins – that reduce front desk staffing needs. The aim is to build leaner, more flexible operations that can scale down – or up – quickly. Part of risk mitigation is scenario planning: many travel CEOs now routinely plan for worst-case “what if” downturn scenarios.

Importance of strong cash flow and pioneering winning technologies

The foundation that enables companies to be resilient and innovative is robust financial health.

Strong cash flow provides the necessary resources for companies to invest in technological experimentation and implementation with strategic patience. While many competitors might overinvest in unproven trends or lack the resources to adopt mature solutions, future-ready organizations maintain the financial flexibility to make measured investments at opportune moments.

While organizations need not develop proprietary technologies from scratch, they require sufficient financial bandwidth to thoroughly evaluate, adapt, and creatively apply emerging solutions within their specific business models. This patient approach allows hospitality companies to thoroughly assess which technologies align with their service philosophy before committing significant resources.

This financial discipline enables future-ready hospitality companies to become pioneering appliers of technology rather than followers – a critical distinction in an increasingly competitive marketplace where personalized luxury experiences continue to command premium value. By approaching technology adoption with both innovation and financial prudence, these companies maximize return on their investments while enhancing the guest experiences that remain at the heart of their business.

How companies can prepare

- Liquidity is king: Companies must prioritize maintaining sufficient cash reserves to withstand unforeseen downturns.

- Expand ancillary revenues: Airlines can explore cargo services, loyalty program enhancements, and subscription models. Hotels can venture into branded residences or co-working spaces.

- Operational efficiency: Automating back-end processes reduces overhead costs and mitigates risk, creating a leaner, more agile organization.

- Strategic technology investment: Allocate resources to technologies that have moved beyond the ‘Peak of Inflated Expectations’ toward the ‘Plateau of Productivity’, according to the Gartner Hype Cycle (more on this below).

- Technology alignment: Evaluate and adopt only those technologies that enhance core service philosophy and customer experience.

- Balanced innovation: Create frameworks for testing emerging technologies at small scale before large-scale implementation.

AI technology underpins these four trends

What is important to note is that underpinning these four trends is a resurgent focus on AI technology, especially Gen AI. While it forms a category in its own right – and we’ll discuss it in the final section of this report in more detail – it also amplifies the trends detailed above: personalization at scale, automated sustainability tracking, digital ‘bleisure’ platforms, and operational efficiencies.

In 1996, the internet was a fledgling technology barely out of its infancy, but it gave birth to a curious experiment: Microsoft’s Expedia. This unassuming website, a digital travel agent for the dial-up era, offered a then-radical proposition – the ability for any individual with a modem to bypass traditional travel agencies and book their own vacations. It was a quaint notion, almost charming in its simplicity, and a harbinger of things to come.

Fast forward nearly three decades and the travel industry finds itself on the brink of another, far more profound revolution. This time, the disruption isn’t driven by human interaction with drop-down menus, but by the cold, calculating efficiency of algorithms – algorithms capable of orchestrating a complex Parisian layover itinerary before you even finish your morning coffee.

This is the realm of GenAI agents, exemplified by OpenAI’s Operator, or China’s general AI agent, Manus. These emerging systems don’t merely offer suggestions; they execute. Imagine a scenario: you desire a trip to Rome. The Operator, with its digital ‘eyes’ (screenshots) and ‘hands’ (browser interactions), might seamlessly scour flight options from Delta, Lufthansa, or Turkish Airlines, identifying optimal fares and schedules. It then proceeds to secure your seat reservation – no tedious clicking, no juggling of multiple browser tabs. Craving a specific cuisine during your Roman sojourn? The Operator, with equal aplomb, consults OpenTable or the airline’s curated recommendations, and voilà, a reservation is confirmed.

The argument, elegantly simple, is that a well- designed AI interface can, within seconds, conjure precisely what the traveler desires, simply by having access to the vast expanse of the web. Yet this isn’t just about speed; it’s about a fundamental shift in power, from human curation to algorithmic precision.

3) Actionable industry insights: Connecting travel trends to company success

Travel industry executives are always on the lookout for actionable intelligence about what successful companies are doing and how sector peers adapt to changing conditions and want to discover practical strategies for future-proofing their operations. In the following industry and sector rankings, we reinforce our review of industry themes with a comprehensive analysis of travel companies, offering concrete insights and proof points that travel leaders can immediately apply to their strategic planning.

As we shift our focus from broad industry trends to concrete performance metrics, business leaders can connect these transformative forces to real-world examples of market leadership and competitive advantage.

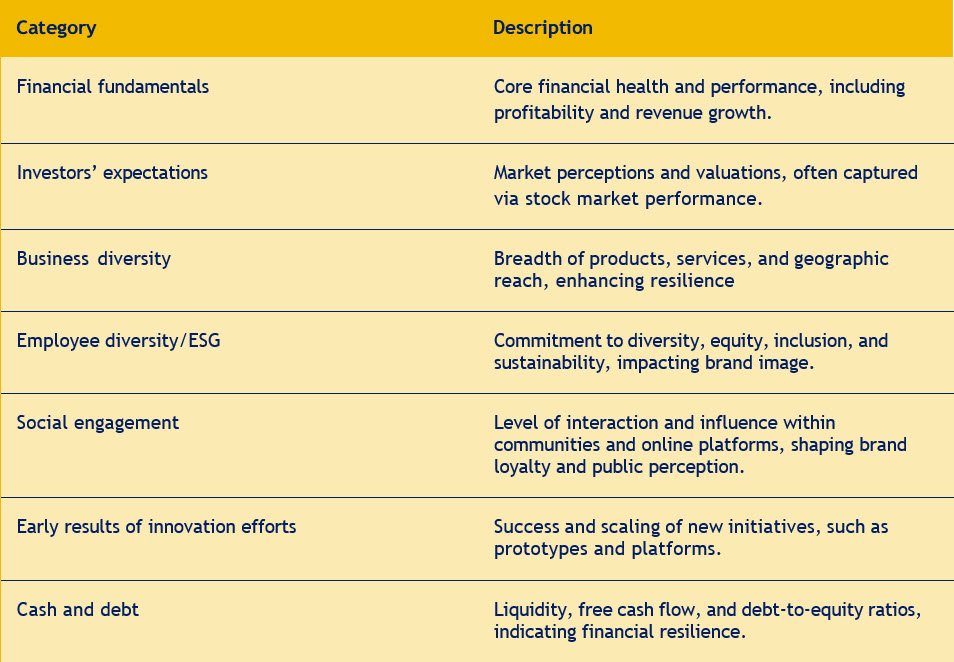

Measuring future readiness: the seven core factors

Future readiness refers to a company’s ability to anticipate and adapt to external changes. This is achieved through strategic foresight and tactical adaptability. As the world grows more ambiguous, however, companies must scale up new capabilities to maintain a competitive edge.

By focusing on long-term innovation and short- term adaptability (and noting that it is not an either-or choice, but both), companies can then not only survive but also thrive in extremely dynamic business environments. This proactive approach is key to success and resilience in an ever-changing global economy.

This Future Readiness Indicator goes beyond pure financial performance. It rewards companies that show diversification, invest in innovation, uphold sustainability, and manage healthy cash flows – all critical to adapting to the ever-changing travel sector.

Each of these dimensions comprises a combination of publicly available hard data – annual reports, press releases, corporate social responsibilityand sustainability reports, third-party databases (e.g., Crunchbase for investments/acquisitions, Sustainalytics for ESG ratings, Factiva for press coverage), and specialized tools.

To gauge which companies stand poised to prosper in 2025 and beyond, we gather, consolidate, analyze and interpret data in multiple raw variables (42 in total) and assess their future readiness by analyzing the data across seven factors (detailed in the table below).

This approach enables researchers to look beyond quarterly profits and capture how well an organization can adapt to – and invest in – the future. Our goal is to give both industry insiders and broader stakeholders an evidence-based snapshot of the extent to which firms are positioned to stay ahead.

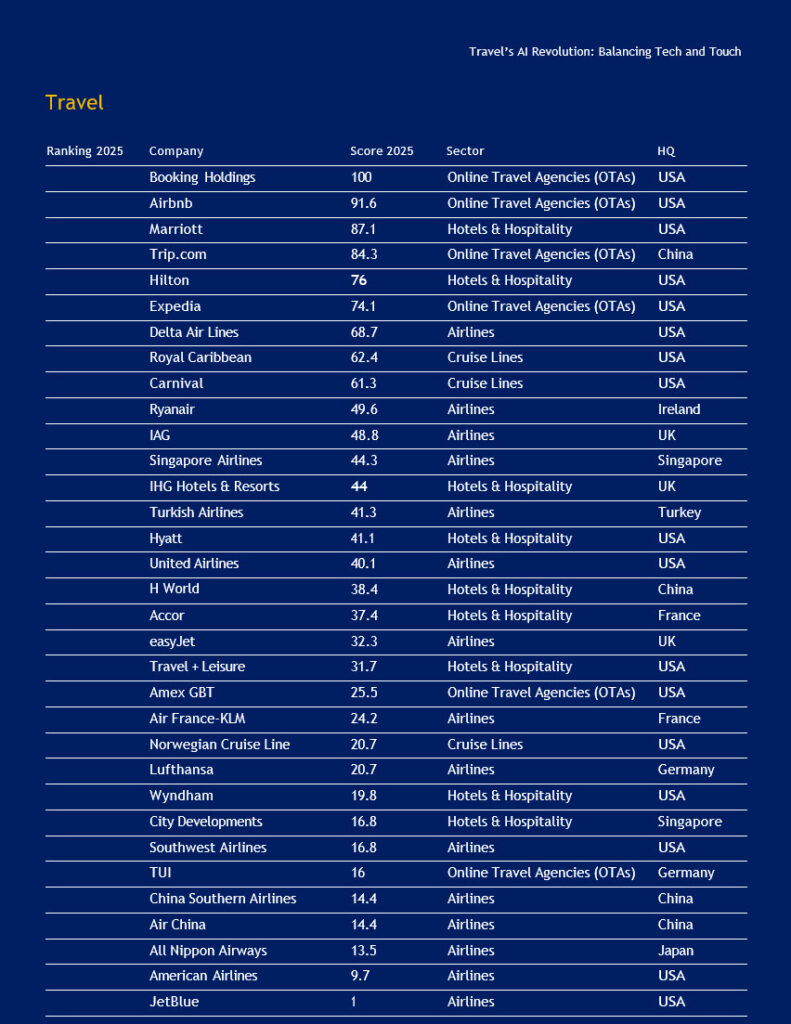

The Travel Industry Future Readiness Indicator 2025

The Travel Industry Future Readiness Indicator 2025 shows clear trends across sectors. Our researchers analyzed 33 companies across global travel, tourism, and hospitality using the criteria detailed above and ranked them accordingly.

Digital travel platforms hold the leading positions, with Booking Holdings, Airbnb, and Trip.com securing spots among the top four. This indicates online platforms continue to excel in adaptation and innovation, using technology and analytics to stay ahead of competitors.

The airlines have more mixed results as a sector, with Delta Air Lines achieving the highest ranking at seventh, while United Airlines, Lufthansa, and American Airlines place considerably lower – the last seven places in the indicator are all occupied by airlines. This variability suggests leading airlines are putting a real focus on cash generation and innovation, while others face challenges, potentially from operational complexities, financial constraints, or technological hesitancy. Interestingly, budget airlines like Ryanair and easyJet score better than many traditional carriers, demonstrating their flexibility in responding to market shifts.

Hotel chains also show a range of performance scores with Marriott and Hilton scoring well but Hyatt, IHG, and Accor ranking lower. While major international brands are combining the benefits of digital efficiencies in the back office as they maintain exceptional personal service, some other players may struggle with innovation, guest experience, or sustainability actions and positioning. The appearance of cruise companies such as Royal Caribbean and Carnival in the top 10 demonstrates that exceptional customer experiences drive financial performance through repeat bookings, higher onboard spending, and positive word-of-mouth references backed up by a strong omnichannel experience from booking to disembarking.

Elements that underpin the high and low scores

When assessing the companies, the following key drivers impact their ranking. Treat these as a measurement of objective outcomes. These are balanced assessments to evaluate if a company can win today while winning tomorrow.

Financial and stock market performance

The ‘financial performance’ and ‘stock market performance’ columns often correlate with the overall score. Top performers usually show stronger or fewer negative numbers here, reflecting profitability, investor confidence, or resilience.

Innovation and diversification

The ‘early results of innovation’ and ‘business diversity’ columns can lift scores. Companies investing in new revenue streams (e.g., digital platforms, loyalty programs, or technology solutions) tend to rank higher.

Sustainability and social engagement

Poor marks in ‘sustainability efforts’ or ‘social engagement’ can drag a company’s score down. A strong brand reputation and proactive environmental or community-focused initiatives can boost perception and long-term performance.

Balance sheet health (cash and debt)

High debt or limited cash reserves make a company more vulnerable, especially in travel/ hospitality, where shocks (pandemics, economic downturns) are common. Those with healthier balance sheets scored better overall.

In summary, the top-performing companies generally stand out for demonstrating:

- Solid or improving financial/stock performances

- Evidence of innovation and diversification

- Reasonable sustainability and community profiles

- Manageable debt levels

Meanwhile, the bottom tier often displays:

- More negative stock/financial metrics

- Weaker or inconsistent innovation and sustainability signals

- Higher debt burdens

- Lower brand momentum or social engagement

4) Future readiness by sector

A review of performance across and within the three sectors reveals distinct patterns. Digital booking platforms consistently demonstrate the highest readiness scores, excelling in innovation, financial performance, and technological advancement.

The airline sector shows significant variability, with top performers leveraging AI-driven personalization, sustainability initiatives, and operational automation, while lower-ranked carriers struggle with debt management and insufficient sustainability commitments.

In hospitality, leading hotel groups benefit from strong market performance, innovative loyalty programs, and recognized sustainability efforts. Mid-tier hospitality companies show moderate success in brand expansion but often lack social engagement or diversification.

Across all sectors, future readiness correlates strongly with technological innovation, financial resilience, and a commitment to sustainability.

Airlines

Among the 15 major airlines assessed, plus TUI, which we classify elsewhere due to its hybrid business model, five rise to the top, five occupy the middle, and five find themselves in the bottom tier.

Top performers

Delta Air Lines (Rank 7, Score = 68.7)

Ryanair (10, = 49.6)

IAG (11, = 48.8)

Singapore Airlines (12, = 44.3)

Turkish Airlines (14, = 41.3)

United Airlines (16, = 40.1)

Delta, for instance, demonstrates positive signals across social engagement (100), early innovation (85), and healthy financial/ stock performance relative to many peers.

Middle performers

easyJet (Rank 19, = 32.3)

Air France-KLM (22, = 24.2)

Lufthansa (24, = 20.7)

Southwest Airlines (26, = 16.8)

These carriers show mixed outcomes. Some excel in innovation or social metrics but trail in debt or profitability – others manage finances better but struggle with ESG or brand engagement.

Bottom performers

China Southern Airlines (Rank 29, = 14.4)

Air China (30, = 14.4)

All Nippon Airways (31, = 13.5)

American Airlines (32, = 9.7)

JetBlue (33, = 1)

Weaknesses here range from heavy debt loads to subpar stock performance, to insufficient ESG commitments.

Most future-ready airline: Delta

When it comes to harnessing trends and ensuring resilience, Delta Air Lines (Delta) stands out as a prime case of future readiness (Rank 7, Score = 68.7). A key differentiator lies in its commitment to AI-driven personalization. Delta’s much- touted Delta Concierge, a digital assistant that integrates real-time data from flight operations, weather forecasts, and traveler preferences, exemplifies the company’s focus on seamless, adaptive customer service. As noted earlier,

Delta’s vision is to anticipate passenger needs – such as suggesting rebooking options during delays – before the traveler even asks for help.

Beyond tech, Delta leads in sustainability with biofuels and bold carbon reduction goals. By combining these initiatives with a strong social engagement score (100) and methodical investments in automation – visible in areas like baggage handling and dynamic crew scheduling – Delta is combining improved customer experience and operational efficiency into a powerful mix. As the CEO puts it, these efforts aren’t just hype – they’re part of a holistic strategy to transform travel, focusing on hyper- personalization, sustainability, and resilience.

Online Travel Agencies (OTAs)

Six prominent booking platforms and tour operators dominate this category, with four placed in the top six overall best performers:

Top performers

Booking Holdings (Rank 1, Score = 100)

Airbnb (2, = 91.6)

Both enjoy stellar financial metrics, high innovation scores, and well-known brands. Booking Holdings’ extensive portfolio and Airbnb’s strong and ‘sticky’ direct-traffic ecosystem put them in rarified air.

Upper-mid performers

Trip.com (Rank 4, = 84.3)

Expedia (6, = 74.1)

Solid showings across most metrics. They occasionally stumble with debt or partial ESG data reporting but remain robust overall.

Lower performers

American Express GBT (Rank 21, = 25.5)

TUI AG (28, = 16)

Challenges in debt management, social engagement, or limited innovation weigh on their composite scores.

Most future-ready platform: Booking Holdings

Booking Holdings (Rank 1, Score = 100) exemplifies a future-ready platform. Its diversified portfolio (Booking.com, Priceline, Kayak) creates multiple revenue streams, mirroring the industry’s financial resilience focus.

The company excels in digital transformation and AI-driven personalization, offering customized recommendations based on user behavior, aligning with the demand for hyper-personalized itineraries. Investments in mobile apps and payment integrations ensure a seamless user experience. Booking Holdings is also addressing sustainability by promoting eco-friendly options and catering to responsible travel preferences.

Strong brand awareness and strategic acquisitions and partnerships, e.g., flight metasearch, further strengthen its market position, creating a comprehensive travel ecosystem, and enabling it to remain agile.

Hotels, hospitality and cruise lines

Ten major hospitality groups were evaluated:

Top performers

Marriott (Rank 3, Score = 87.1)

Hilton (5, = 76)

Each benefits from a strong stock market performance, innovative loyalty programs, and recognized ESG efforts.

Middle performers

InterContinental (Rank 13, = 44)

Hyatt (15, = 41.1)

H World (17, = 38.4)

Accor (18, = 37.4),

Moderately successful across finances and brand expansions, though occasionally lacking in social engagement or diversification.

Bottom performers

Wyndham (Rank 25, = 19.8)

City Developments (27, = 16.8)

Inconsistent or negative stock performance, higher debt burdens, and limited ESG or diversity initiatives pull them down.

The future-ready hotel: Marriott

Marriott (Rank 3, Score = 87.1) stands out as a future-ready leader in hospitality with a well-rounded strategy. Its expansive global portfolio – spanning budget-friendly Courtyard to ultra-luxury Ritz-Carlton properties – ensures resilience by catering to diverse traveler segments and mitigating regional market risks.

The ‘Serve 360’ initiative drives sustainability, targeting a significant reduction in environmental impact by 2030, including impressive strides in cutting carbon emissions, while prioritizing team member well-being to attract eco-minded travelers.

The Marriott Bonvoy loyalty program exemplifies tech-driven personalization, leveraging AI to tailor room recommendations, loyalty rewards, and seamless experiences like mobile check-ins and digital keys. By integrating advanced analytics behind the scenes, Marriott frees staff to focus on crafting memorable human interactions – where technology operates invisibly to elevate service.

By balancing short-term profitability with long-term sustainability through employee empowerment and environmental responsibility, Marriott cements its position as a sector frontrunner.

5) AI’s transformative impact: Reshaping competitive dynamics in the travel landscape

While the sector rankings show the relative positions of companies across the travel and hospitality industry, there are cross-sector factors influencing the current scores and prospects of all companies in the indicator. Notable among these is AI and the threats and opportunities it generates – from automated booking agents that could bypass traditional platforms to new pathways for customer engagement. The disruptive potential of GenAI is reshaping how travelers discover, compare, and purchase experiences.

Companies with strong direct relationships and digital footprints stand poised to benefit, while those relying heavily on intermediaries face potential disintermediation. This technology shift fundamentally alters the competitive landscape by emphasizing customer stickiness as a critical defense against AI-driven disruption. The ability to create ‘stickiness’ that keeps travelers returning directly to a brand may determine which companies thrive in an automated booking environment.

As we explore the emerging blueprint for success, it becomes clear that winning organizations will be those that understand both the technology adoption curve and how to maintain relevance in an increasingly AI-curated travel ecosystem. The following sections examine these transformative forces in detail.

The disruptive potential of AI: from click fatigue to autopilot

The sector faces multiple challenges, from geopolitical uncertainty, with evolving consumer preferences to the need to generate cash, GenAI stands out as the most disruptive wild card.

For years, consumers have been comfortable with self-service travel planning: browsing aggregator sites, comparing flights, fiddling with filter options, and scrutinizing user reviews. This tedious “click fatigue” is now primed for reinvention by autonomous booking agents such as ChatGPT’s Operator.

Instead of manually sifting through 50 hotel listings, travelers may soon ask a chatbot to book a Marriott room in seconds, redeeming loyalty points, and remembering dietary preferences for dinner reservations. It is an alluring prospect: a well-designed AI interface that can “see” and “click” across the web.

Future readiness and pioneering technology applications

Against this backdrop of identifying and putting the money on the ‘right tech bet’, the most successful organizations distinguish themselves not merely by adopting new technologies, but by understanding where innovations fall on the technology adoption curve. Future-ready companies in the luxury hospitality sector will have internalized awareness of the Gartner Hype Cycle – recognizing when technology is experiencing inflated expectations versus when it will genuinely contribute to productivity. Remember blockchain? A few years back, we were told it would displace real-world money – Bitcoin was going to be king – but it didn’t happen, at least not yet. Virtual reality and the metaverse? We were promised a digital utopia where we’d all be living by now. Nope. Gene therapy was going to end cancer, and electric vehicles were supposed to kill gas cars by… well, yesterday. AI is no different.

Rather than chasing every emerging trend at its height of visibility, they strategically identify which innovations offer substantive value.

We saw future-ready organizations demonstrate a remarkable ability to absorb emerging technologies – whether it’s artificial intelligence or robotics – and implement them in ways that truly enhance their value proposition. Instead of following the crowd toward the ‘Peak of Inflated Expectations’, they patiently evaluate multiple technologies, often engaging more meaningfully as innovations progress through the ‘Slope of Enlightenment’ toward the ‘Plateau of Productivity’ where practical applications become clear.

Such a pioneering approach demands leadership teams with diverse perspectives that can challenge conventional thinking and identify novel applications that competitors might overlook. By fostering cultures that encourage thoughtful experimentation rather than trend-chasing, these organizations develop and implement distinctive technological solutions that create genuine competitive advantage in the travel and hospitality sector.

The fate of OTAs

Online Travel Agencies (OTAs) – Booking.com, Expedia, and others – have traditionally thrived by gathering everything from flights to vacation packages under one digital umbrella. They dedicate billions to marketing, often outstripping the total budget a space agency would devote to planetary exploration – Booking Holdings alone spent $7.3bn in 2024 – up 7.5% from the previous year. This huge investment has enabled them to fine-tune user interfaces into frictionless funnels, replete with persuasive ‘only one room left!’ cues.

However, if an autonomous AI agent bypasses the OTA website to make bookings on a user’s behalf, the significance of those design features and marketing dollars could diminish drastically. OTAs, which often charge 15–30% commission, risk disintermediation if hotels or airlines seize the opportunity to encourage direct bookings – and if AI helps customers see the direct channel’s cost savings in real time. However, it is premature to pronounce OTAs ‘dead’. Armed with massive user bases, sophisticated data analytics, and longstanding partnerships, they can reinvent themselves as ‘app stores’ for specialized AI agents. In such a model, you might select from an array of specialized AI: one keyed to bargain hunts, another tailored for luxury experiences, and a third dedicated to wellness getaways. OTAs could curate and distribute these AI tools, preserving their dominance by becoming indispensable platforms for travelers seeking advanced personalization.

Indeed, they are hedging. Expedia, for example, processes over 800 billion AI predictions annually, fueling everything from fraud detection to dynamic trip recommendations. Booking Holdings, meanwhile, integrates AI trip-planning features across its portfolio. The question is whether travelers will prefer an “Expedia Agent” or a more generalized chatbot. It’s the same debate we’ve seen before: a walled garden like the iPhone versus the open ecosystem of Android.

Airline consolidation, loyalty, and direct channels

For airlines, the value proposition centers less on distribution disruption – since many already aim to lure customers to book directly – and more on how AI might reshape loyalty.

An autonomous agent analyzing a traveler’s frequent-flyer status could seamlessly select the best flight deals and seat upgrades on United or Singapore Airlines. Business travelers in particular might welcome a frictionless AI that adheres to corporate travel policies.

Yet the threat to carriers remains: if an AI decides a $200 fare saving is worth more than 5,000 loyalty miles, passengers might well forsake brand loyalty for cost efficiency.

Low-cost carriers such as Ryanair and easyJet may find their labyrinthine fees exposed. An AI that flags mandatory charges for seat selection and priority boarding can erode the appeal of headline “€9.99 fares.” These airlines’ profits currently depend on the continued friction that drives ancillary revenue. Which is potentially a practice that AI might systematically neutralize.

Hotels and the power of a ‘digital trail’

Hotel chains such as Marriott, Hilton, InterContinental, and others competing in an AI- driven environment will benefit from proliferating a user-generated digital presence. Reviews, social media buzz, and other organic content must be comprehensive and compelling, or risk rendering even a well-known property invisible to the algorithm.

This phenomenon also extends to cruise lines, such as Royal Caribbean and Carnival, which often rely on third parties to sell their trips. Viral campaigns like Royal Caribbean’s 274-day Ultimate World Cruise– demonstrate how shareable “wow” moments can reverberate online, fueling brand recognition.

The power of customer ‘stickiness’ across all travel sectors

The importance of customer engagement reveals a critical insight into the investor mindset.

While Booking Holdings maintains an impressive market position, investors consistently assign higher growth potential to Airbnb, reflected in its premium PE ratio. This valuation disparity

stems from a fundamental difference in customer acquisition strategy: Airbnb enjoys direct consumer engagement, while Booking.com depends heavily on Google ad placements to drive traffic.

The concept of ‘stickiness’ emerges as a key competitive differentiator. Airbnb has cultivated an experience akin to a “treasure hunt,” where users willingly return to the platform to discover unique stays and local experiences. This creates a self- reinforcing ecosystem of direct traffic – the holy grail of digital business models. In stark contrast, Booking. com’s more transactional model primarily attracts users searching for the cheapest accommodations

in specific locations, creating a more ephemeral ‘hit-and-run’ relationship that requires continuous advertising reinvestment to maintain. This distinction transcends mere business metrics; it reflects two fundamentally different approaches to the digital travel marketplace

As AI booking agents become mainstream, travel companies with strong direct customer relationships will likely hold a significant advantage. This simple truth has profound implications. Companies whose customers habitually visit their websites or apps out of brand loyalty or genuine enjoyment face less risk from AI intermediaries. These travelers will likely instruct their AI assistants to ‘check Airbnb first’ or ‘book with Delta’ rather than allowing completely autonomous, automated decision-making.

Conversely, companies that depend on search engine visibility or aggregator listings face greater vulnerability – when AI agents handle the comparison process, these traditional discovery channels may be circumvented entirely.

The ‘stickiness’ factor thus represents not merely a current competitive advantage, but potentially a crucial shield against AI- driven disruption, determining which brands maintain direct customer relationships in an increasingly automated booking landscape.

Who will emerge victorious in the long run?

The winners will be those who recognize they’re competing for visibility – not just in the physical world – but in the digital realm that AI agents scan for recommendations. Simply put: if you’re invisible to the algorithms, you’re invisible to tomorrow’s travelers.

The new blueprint: from aggregation to curation

At its core, GenAI shifts the travel model from human-led aggregation to AI-powered curation. The new environment empowers travelers with a personalized assistant that diligently compares flights, hotels, and even wellness or solo-travel options – all under the hood and without the traveler manually browsing dozens of sites.

For industry incumbents, the lesson is stark. Organizations with desirable physical assets (from global airline networks to distinctive hotel experiences) and invest in strong data- driven marketing stand to flourish.

There’s an irony here: GenAI demands both hyper- personalization and industrial-scale data. That artisanal chocolate on your pillow at the Mandarin Oriental only becomes algorithmic ‘fuel’ if thousands of guests post about it, so if you do not have a robust digital presence – reviews, user stories, social media traction – then AI might well overlook you.

Who will be the future winners and losers?

The winners:

- Airlines that are adept at frictionless direct bookings, linking compelling loyalty programs and transparent data.

- Hotel giants that deliver a steady stream of shareable, well-documented ‘wow’ factors and – through digital ecosystems where technology enhances the guest experience without becoming the experience itself – offer the best face-to-face experience.

- Cruise operators with consistent online marketing and content that resonates with next-generation travelers.

The losers:

- Small OTAs that over-invest in traditional advertising and fail to pivot to AI-based distribution models.

- Small hotels or tour operators that lack the digital footprints to appear in AI-curated searches.

For all the hype, ChatGPT’s Operator isn’t just another shiny toy. Autonomous AI agents will be a whole new blueprint for how we explore the planet.

If the 1996 experiment of online booking felt revolutionary, the next leap – autonomous AI curation – could be exponentially more disruptive. The most future-ready travel companies will be those that engineer memorable experiences that generate captivating stories that a machine can translate into new, unforgettable journeys.

And from here on, the eyes that matter most may not be human at all.

Conclusion

The travel industry’s ability to compete and grow represents an existential challenge for every business across the sector. As is evident through our Future Readiness Indicator, the gap between leaders and laggards is widening, with clear implications for survival in this increasingly competitive landscape.

For travel executives, the message is unambiguous: operational excellence and financial resilience create the foundation for strategic innovation. The companies ranking highest in our analysis aren’t succeeding through luck but through deliberate cultivation of both strong cash positions and forward- looking investments in mature technologies. This twin focus enables them to weather disruptions while simultaneously enhancing customer experiences.

The rise of GenAI represents perhaps the most profound shift in how travelers discover and book experiences since the original internet revolution of the 1990s. For travel businesses, this highlights three immediate priorities:

First, foster customer “stickiness” as your primary shield against algorithm-driven disruption. Companies like Airbnb demonstrate that creating habitual, direct engagement with travelers – whether through distinctive experiences, loyalty programs, or memorable service moments – establishes relationships that even powerful AI agents cannot easily disintermediate.

Second, recognize that your digital footprint is becoming as valuable as your physical assets. In an Second, recongize AI-curated world, your visibility to algorithms depends on a comprehensive, authentic, and positive digital presence. This means investing in technologies that create seamless experiences while maintaining the human connections that make travel meaningful.

Third, balance technological advancement with close and exclusive proximity to the customer, passenger, or guest. Most future-ready companies understand that technology should enhance rather than replace personal service, with AI and automation deployed strategically behind the scenes to lay the ground for those authentic human touchpoints along the customer journey.

The blueprint for success is evolving from pure aggregation toward thoughtful curation. This paradigm shift rewards businesses delivering unique value that can be discovered, recognized, and recommended by intelligent systems. The ability of hotels, airlines, cruise lines, or tour services to translate memorable in-person experiences into discoverable digital assets will increasingly determine your competitive position.

As our analysis shows, the companies best positioned for the future are not necessarily those first movers making the most extravagant AI investments. These leaders understand how to evaluate multiple technologies, and when to adopt proven solutions that deliver genuine customer benefits and competitive advantage.

Future readiness, therefore, comes not from chasing every new trend, but from the steady improvements that come from the ability to consistently anticipate and prioritize what travelers want and need.

For now, the travel industry stands at a defining moment as those organizations that fuse technology and personal service, diversify offerings without losing their core strengths, and balance short-term gains with long-term reinvestment prepare to shape the next era of travel.

White paper: Learn what industry leaders are doing to come out on top

Sectors covered include airlines, online travel agencies, hotels, hospitality, and cruise lines.