IMD business school for management and leadership courses

Consumer Packaged Goods

Coca-Cola’s unexpected mix: One chart that unveils future readiness

Consumer Packaged Goods

Published on 25 May, 2023

Here’s what I found in a local grocery store in Manchester a few days ago:

I don’t really like whiskey, and I rarely drink soda. But when I saw the cans, I picked one up without hesitation.

It’s shocking to see Coca-Cola making an appearance in the alcohol section of the grocery aisles. For more than 100 years, it has stayed away from alcohol, never allowing an association with any booze. It’s been as much a branding choice as a decision for the sanity of its supply chain.

Making soda—adding sugar and bubbles to water—seems vastly different from fermenting whiskey and beer in barrels and tanks. And of course, these days, alcoholic seltzer with added flavor is all the rage. In the U.S. alone, off-premises dollar sales of hard seltzer increased from 3.83 billion U.S. dollars in 2020 to 4.63 billion U.S. dollars in 2021, a growth rate of 20.9%. The volume of hard seltzer in the U.S. is projected to grow from 1.3 billion liters in 2020 to 3.1 billion liters in 2025. We are likely to find ourselves at house parties seeing a bottle of Sauvignon Blanc from New Zealand sitting at the kitchen counter right next to a slim can of low-calorie Smirnoff (vodka) in black cherry flavor. Blending tastes with different mix formulations and making it look cool is exactly the kind of production and marketing approach that Coca-Cola knows well.

Still, the co-branding with Jack Daniel’s seems so far-fetched that it can’t be more than a niche product. In my mind, it can hardly become the next blockbuster like Coke Zero. Launching a niche product can be extremely costly. Imagine the nightmare if you run a factory of five products and suddenly you are told to increase to 50 different assortments. I bet you’ll find yourself quickly stuck with unsold inventory of some items while running out of others, leading to angry customers screaming on the phone.

How and why did Coca-Cola, for all its financial discipline, decide to plunge into what seems like a fool’s errand?

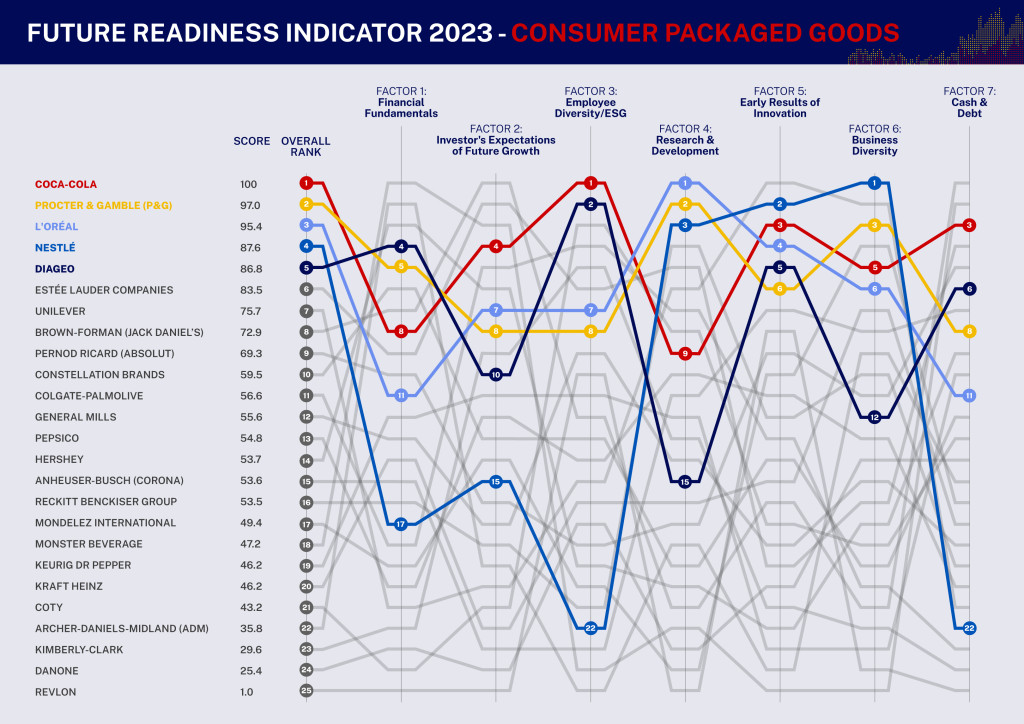

If you had asked me this question a few months ago, I wouldn’t have had an answer. But at IMD’s Center for Future Readiness, I have been ranking which companies have the capabilities to succeed, not only in the near term but also in the long run. We rank these companies based on a balanced scorecard approach, using a composite score. We gather all the publicly available information, relying solely on hard data. We consider everything from their financial growth to information on brand value and new product innovation. Below are the results in the Consumer Packaged Goods industry. You can also read about our methods here.

So, Coca-Cola is number one. What does that all mean?

If you are a food and beverage company, you need to ride the wave of the next big trend and serve what consumers think is cool. A recession is looming, and inflation is raging. What this means is the mass-market brands are getting squeezed. You need to either go upmarket, create something sexy, or go downmarket to compete with no-frills private labels at a discount based on cost. Unless you are an exclusive luxury brand like Louis Vuitton, you want to be able to do both, so that overall, you achieve both volume and margins at the same time.

To do all that in 2023, it’s not merely about studying consumers using focus groups or home visits. Those are still valid. But you need to also analyze social media using AI to spot patterns. Identify what’s likely to get popular and where. Then you combine such demand insights and use AI again to handle all the procurement and sourcing, packaging, and logistics.

Why all the AI stuff? Because decisions made by AI in real time can unearth patterns in the value chain that simply escape the purview of the human mind. How else can you manage to sell 500 soft drinks in 200 countries involving some 80,000 employees worldwide like Coca-Cola?

That’s how the company evaluates marketing campaigns across channels, platforms, formats, audiences, and messages. It measures their respective returns (ROI) in some 40 markets, identifies the top performers, and then allocates resources. All aim to optimize supply chain planning, inventory, production, and distribution. The result? A seamlessly efficient operation that runs like clockwork across channels, regions, and periods.

The goal here, of course, is not new. It’s just hard work every day. It’s damn hard to bring data across everything. Data that exist in purchase orders, accounts payable systems, contracts, spreadsheets, etc. Some data sources aren’t connected electronically. They might be stored obscurely somewhere in a local folder. Nor are they clearly laid out.

But what my research team has seen is every future-ready company has endured the pain of doing the hard stuff. These companies took their medicine at some point. That’s how L’Oréal, P&G, Nestle, and other high-ranking companies achieve scalable innovation that consumers find worth paying for.

In contrast, when a company gets stuck with a traditional, manual-based approach to running its business, complexity explodes. They can’t seem to launch the right thing. And any success always seems too small to justify an additional round of funding, since the cost of managing an additional variant in the company’s assortment is too high. In fact, without deploying AI and advanced analytics at scale, the cost of doing anything is painful. It’s like someone trying to manage a company’s budget using paper and pen with a team of accountants rather than sorting things out using an Excel spreadsheet.

So, if you are leading a department at your company, you can choose to become part of the solution. Coca-Cola has worked on its digital transformation for more than a decade and a half, and it’s still a work in progress. I am sure that within the company, some embrace the new tools with eagerness, and some resist, just as in your organization.

If you are just starting out, young and junior, and still early in your career, make sure you make your way into a future-ready company, not a laggard. Life is too short to spend time getting stuck.

I don’t like whiskey because I always find it too strong. But then I noticed in the fridge that the Jack Daniels mix is only 5% alcohol – far less than a Sauvignon Blanc. I am tempted. I think some AI knows that even in Europe, Jack and Coke—a drink popular in the American South—might just take off.

Don’t miss checking our latest readiness ranking in other industries including Automotive, Finance, and the rest of Consumer Packaged Goods.