IMD business school for management and leadership courses

The Concept of Leap

A crisis often accelerates existing trends. It reveals what the most urgent matters are. Despite a looming recession, there are secular trends that are neither seasonal nor cyclical; they are deep trends that keep a consistent pace of development over a long period time. They are evident to senior executives everywhere.

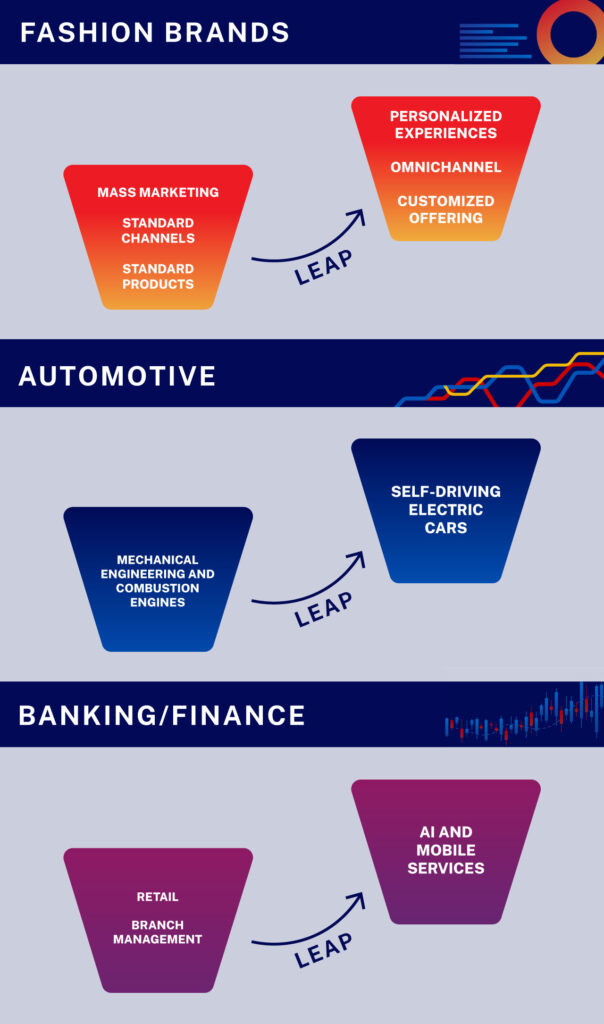

No carmaker, for instance, would speak to investors without mentioning “future mobility”. Among the traditional carmaker, there exists a profound de-emphasis of traditional know-how. Mechanical engineering done by combustion-engine experts are phasing out. In coming is the new knowledge surrounding electrical engineering and software programming. A self-driving electric vehicle would be supercomputers on wheels. They will be done by experts who build computers, mobile games, and handheld devices.

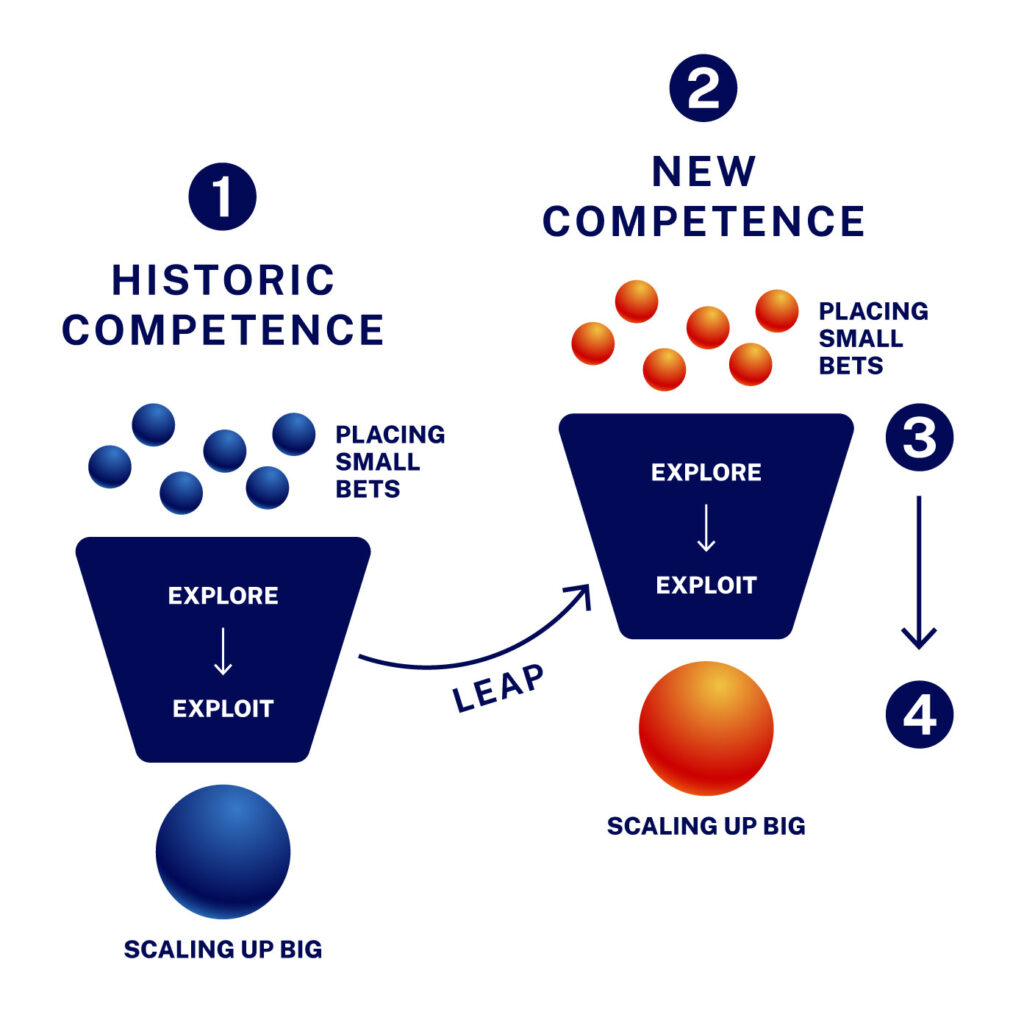

The shift of traditional knowledge to the new is what we call “leap.”

You can see leap everywhere. For consumer banking, there is a de-emphasis of operating retail branches. It was an old setting where knowledgeable staff members would give investment advice customers face-to-face. But for any fintech disruptors, opportunities lie in data analytics. They strive to interact with consumers the same way an e-commerce retailer would. For a consumer brand, the traditional know-how has been built around manufacturing a standard product at the lowest cost and push through retailers at high volume, while advertising at scale.

Then for a consumer brand, the traditional know-how has been built around manufacturing a standard product at the lowest cost. The brand would seek to push products through retailers at great volume, while advertising at scale. What’s changed today is the importance of blending online and offline activities. A brand must create personalized offerings and foster a direct-to-consumer relationship.

The importance of “leaping” toward a new knowledge discipline cannot be overstated. What we have observed is companies that have leaped early are the ones now becoming more resilient during crisis time. And the degree by which a firm has leaped ahead of time can be easily quantified.

This is why we’ve built the Future Readiness Indicator.

A ranking can measure incumbents in each sector on the degrees of progress they make toward what they have announced as intent in annual reports or letters to shareholders.

One can rely on hard market data – data that is publicly available with objective rules – rather than using soft data such as polls or the subjective judgments of raters. Read here for our methodologies.

Here is a warning. A peculiar form of the knowing-doing gap often persists among big companies. These are companies of all-knowing but few doings. They may have established corporate venture funds to invest in innovative startups. They practice open innovation, posting challenges online, and running tournaments with external inventors. They have organized “design thinking” workshops for employees to rethink customer solutions. And yet, their core business continues to be encroached disruptors. All the experimentation notwithstanding, nothing scales.

The reason is straightforward. These laggards are stuck in stage 3. When a company leaps, it must identify a new knowledge discipline to master as in stage 2. Then it needs to be agile to learn as quickly as it can as in stage 3. But based on evidence, it must commit to irreversible choices. There will be tough tradeoff to be made. There will be argument to be have. But unless a company move into stage 4, nothing is relevant.

This is why an accompanying analyses of our indicator is a computer-aided text analysis. Ranking is interesting. But what choices companies have made, and how they’ve come to make those is even more profound.

Learn more about this A.I. powered text analysis here.

Or start with a sector and dive right into the insights