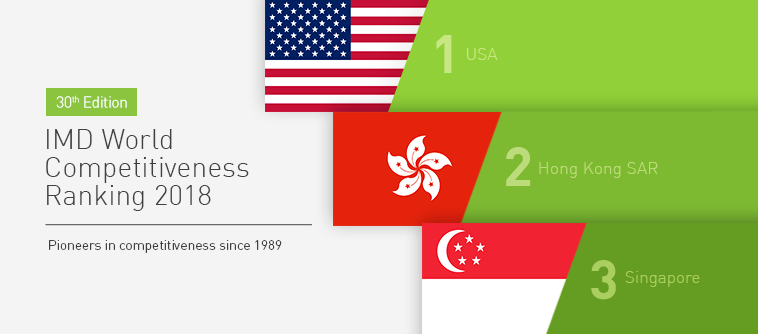

Marking its 30th edition this year, the IMD World Competitiveness Rankings emphasize a long-term trend highlighted in past editions – that the countries on the top of the list each have a unique approach to becoming competitive.

The top five most competitive economies in the world remain the same as in the previous year, but their order changes. The United States returns to the first spot, followed by Hong Kong, Singapore, the Netherlands and Switzerland. The United States improves three positions from last year while Hong Kong drops one spot and Singapore remains 3rd. The return of the United States to the top is driven by its strength in economic performance (1st) and infrastructure (1st). Hong Kong takes a somewhat different approach exploiting its government efficiency (1st) and business efficiency (1st).

The Netherlands moves one place to 4th, swapping with Switzerland which moves down to 5th. The Netherlands’ advancement shows a “balanced” path to competitiveness, ranking in the top 10 in economic performance, government and business efficiency. Switzerland declines mainly due to a slowdown in exports and, to a lesser extent, an increase in perceptions about threats of relocation of R&D facilities.

The remaining places in the top 10 are occupied largely by Nordic countries: Denmark, Norway and Sweden rank 6th, 8th and 9th respectively. These countries show strong performance in the overall productivity of the private sector and its management practices. The UAE (7th) and Canada (10th) close the top of the rankings.

Other high performing economies advanced even further this year. Notably, Austria (18th) and China (13th) considerably improve their positions by seven and five places respectively. Professor Arturo Bris, Director of the IMD World Competitiveness Center, says “economic growth, reduction of government debt and increased business productivity enable Austria to move up. In the case of China, investment in physical and intangible infrastructure as well as improvement on some institutional aspects such as the legal and regulatory framework boost its performance.”

Russia and Turkey go up one place respectively to 45th and 46th.

The bottom five economies show a slight change in their performance especially those countries that have experienced economic and political distress in the last few years. While Mongolia (62nd) and Venezuela (63rd) remain in the last positions, Ukraine (59th) and Brazil (60th) improve. Brazil’s improvement is the first since 2010 due to a positive shift in real GDP and employment. Ukraine increases because of its business efficiency. Their rise pushes Croatia down two places to 61st.

Arturo Bris notes that “this year’s results reinforce a crucial trait of the competitiveness landscape. Countries undertake different paths towards competitiveness transformation.” He adds “countries at the top of the rankings share an above the average performance across all competitiveness factors, but their competitiveness mix varies. One economy, for example, may build its competitiveness strategy around a particular aspect such as its tangible and intangible infrastructure; another may approach competitiveness through their governmental efficiency.”

The IMD World Competitiveness Center, a research group at IMD business school in Switzerland, has published the rankings every year since 1989. It compiles them using 258 indicators. ‘Hard’ data such as national employment and trade statistics are weighted twice as much as the ‘soft’ data from an Executive Opinion Survey that measures the business perception of issues such as corruption, environmental concerns and quality of life. This year 63 countries are ranked.

REGIONAL FOCUS

Asia

Asia shows mixed results. Hong Kong and Singapore lead the region. On the one hand, Japan (25th), Republic of Korea (27th), Malaysia (22nd) and India (44th) all see slight improvements. On the other, Taiwan (17th), Thailand (30th) and Indonesia (43rd) drop a few places. Australia (19th) improves its rank by two positions and New Zealand (23rd) drops 7 places. The Philippines experiences the most significant decline in the region, shifting nine places to 50th. The reasons for such a drop include a decline in tourism and employment, the worsening of public finances and a surge in concerns about the education system. Countries from the region that experience declines this year, with the exception of Taiwan, all show signs of a need to improve their tangible and scientific infrastructure.

Europe

In Eastern Europe, there are also mixed results, although the majority of its economies improve. In this group are Lithuania (32nd), Poland (34th), Slovenia (37th), Hungary (47th), Bulgaria (48th) and Romania (49th). Among these countries Poland, Slovenia and Hungary advance the most: four, six and five ranks respectively. Poland’s progress comes after GDP growth, a rise in the export of commercial services and an improvement in the management of government debt. Hungary boosts its competitiveness partly because of a reduction in corporate taxes and growth in overall productivity. Slovenia rises thanks to a remarkable positive shift in its domestic economy and the enhancement of public budget. The region’s declining economies include the Czech Republic (29th), Estonia (31st) and the Slovak Republic (55th). Latvia (40th) stays in the same position.

Western European economies follow an opposite pattern, with very few countries advancing in the rankings this year. Ireland (12th) and Luxemburg (11th) leave the top 10, dropping six and three places respectively. Germany (15th), Finland (16th), the United Kingdom (20th), Iceland (24th), Belgium (26th), Spain (36th) and Cyprus (41st) all experience a decline with respect to last year. With the exception of Cyprus and Spain, all countries experiencing a decline in the overall rankings show signs of a slowdown in economic performance to different degrees. For example, in economic performance Iceland drops 18 places and the United Kingdom 16 positions. Conversely, France, Portugal and Italy see an improvement in the overall rankings by three (28th), six (33rd) and two positions (42nd) respectively. Portugal’s upsurge is due to growth in economic activities paired with a positive turn in perceptions about institutional efficiency including greater governmental transparency. Only Greece remains in the same place (57th).

Middle East

In the Middle East, despite the increase of political tensions in the area, all the countries experience competitiveness improvements with the exception of Saudi Arabia which drops three places to 39th. The UAE (7th), Qatar (14th), Israel (21st) and Jordan (52nd) show progress in the rankings. The UAE and Qatar benefit from the strengthening of their international trade. Israel and Jordan boost their competitiveness through better government and business efficiency.

Latin America

Most Latin American countries in the sample improve: Argentina (56th), Brazil (60th) and Peru (54th) advance. In the case of Argentina and Peru their progress comes on the back of further business efficiency. Chile (35th) and Venezuela (63rd) remain at the same position. Mexico drops to 51st as a result of the worsening of perceptions about the quality of institutions and business legislation such as the ease of doing business, and some aspects of corporate governance. Similarly, Colombia declines to 58th due to an increase in bureaucratic procedures required for the creation of firms and negative perceptions about governance, combined with a raise in taxation.

South Africa

Overall South Africa remains stable at 53rd. Progress in institutional framework driven by exchange rate stability contributes to a slight increase in government efficiency. A minor reduction in crime and some measures on gender disparity also support that increase. Positive GDP growth and an improving current account deficit suggest that South Africa may be moving out of its transition period, while the continued broad range of export partners supports stability.