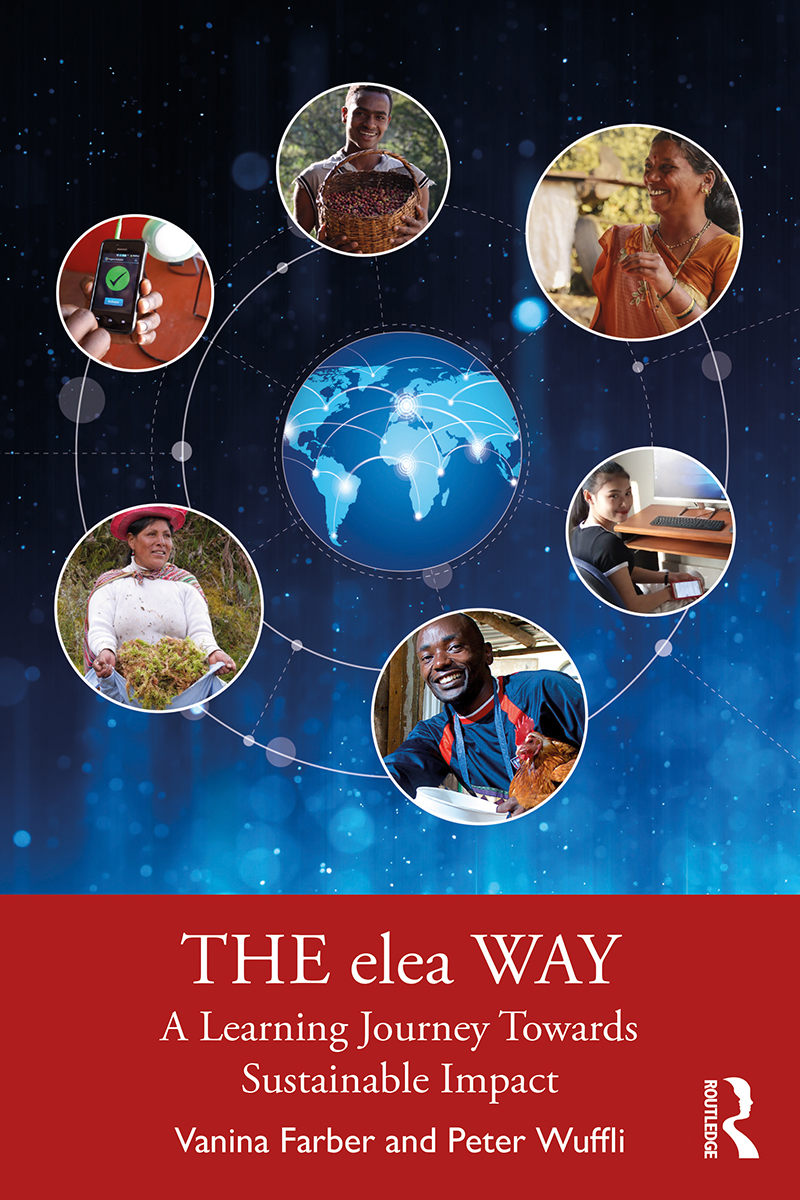

The elea Way

elea’s innovative approach reinforces convergence across corporations, investment organizations, and entrepreneurs toward social impact and meaningful purpose. Its lessons are valuable for corporate executives as they realize strategies that benefit societies.

The elea Way shows how to mobilize capital for social impact by reshaping market-based models. It contributes to harnessing the efforts of complementary actors, such as investors, entrepreneurs, response agencies, and governments, who have the people most affected by poverty and crisis in mind.

This book is a rare opportunity to gain insight into the mind of an experienced impact investor. elea’s connectedness with our team, which goes far beyond its contribution of financial capital, has been instrumental on our path as impact entrepreneurs, particularly when facing the Global Covid-19 Crisis.

elea’s pioneering combination of impact investing and philanthropy inspires both private and public-sector initiatives for economic development. Its ethical foundation in liberalism and its values of inclusive capitalism are hallmarks of Swiss identity

IMD is delighted to host the elea Center for Social Innovation. The elea Way will help in the development of thoughtful and ethical leaders broadening their horizons toward new forms of capitalism and deepening their understanding that they can do well by doing good.

Impact investing has become mainstream. The desire to link investments to social goals is no longer a buzzword for do-gooders, but a daily reality for industrial companies, international banks, insurers and fund managers.

Yet as globally active companies find themselves increasingly confronted by demands for greater probity and proof they are good corporate citizens, the requirements for valid environmental, social and governance (ESG) policies have spiralled.

In The elea Way: A Learning Journey Towards Sustainable Impact, Vanina Farber, Professor of Social Innovation at IMD, and Peter Wuffli, Honorary Chairman at IMD and Founder and Chairman of the elea Foundation, argue that, instead of a binary choice between Bad Business or Good Society, we need ‘inclusive capitalism’ – an impact-orientated capitalist philosophy that taps into growing international interest in social entrepreneurship and impact investing.

Offering pioneering insights, Farber and Wuffli acknowledge the role of corporations, but focus on what wealthy individuals can do, whether via their own philanthropy or though foundations.

The authors draw on the experience of the elea Foundation, a 20m CHF impact investment fund created in 2006, which has since expanded to encompass some 40 investments around the world. Elea’s 15-year track record of how private capital can help impact entrepreneurs realize their potential provides an essential guide in improving conditions for some of the world’s most disadvantaged people.

Farber is particularly interested in how asset owners include impact into their risk-adjusted returns financial decisions along the social capital spectrum. She stresses the important role that philanthropic impact investors have in bringing private capital to early stage social enterprises as a way to build the pipeline to bring social innovations to scale to the market.

Wuffli provides insights from the worlds of consultancy and international finance, along with hands-on organisational experience, as well as first-hand knowledge of motivating philanthropists and outside investors seeking worthwhile projects.

Such priorities have grown all the more urgent since Covid-19. The pandemic is having a devastating effect on world poverty, with few safety nets for people in the developing world. Rising poverty will reinforce challenges like swelling populations and climate change, making survival difficult for the world’s most vulnerable people.

Private sector capital has a decisive role to play in alleviating absolute poverty and answering to grand global challenges, the authors argue. Not necessarily through the traditional large scale industrial or infrastructural investment projects but via actively placing capital in impact enterprises that generate a measurable desired beneficial social and/or environmental outcomes that would not occur but for his/her investment, with expected financial returns ranging from the highly concessionary to above market. But while there is strong momentum to mobilize private capital for specialized impact funds, budding developing world entrepreneurs can find it hard to make good use of capital, while investors are challenged identifying suitable opportunities.

The elea Way provides practical advice on how such gaps can be bridged and how to integrate entrepreneurship and capital for impact and innovation by using elea’s philanthropic investing approach.

Using genuine examples, the book offers ideas on leading impact enterprises in fields like developing strategies, plans, and models; building effective teams and organizations; managing resources and handling crises. Crammed with practical and theoretical advice, the book offers a crucial, hands-on guide on how to fight absolute poverty with entrepreneurial means.

Research Information & Knowledge Hub for additional information on IMD publications

You can also buy the book on Barnes & Nobles, Book Depository, Orell Füssli and Routledge.

The case examines the entrepreneur-led carve out and buyout of dss+, DuPont’s safety and sustainability consulting division, by Gyrus Capital and dss+ management team. dss+ (formerly “DuPont Sustainable Solutions”) played a pivotal role in high-ri...

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Case reference: IMD-7-2639 ©2025

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD Brain Circuits 24 February 2025

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD Brain Circuits 17 February 2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications