What is the competitiveness performance of the different regions in 2019?

On May 28, the IMD World Competitiveness Center launched the 2019 rankings. Singapore ranked as the world’s most competitive economy for the first time since 2010, Hong Kong remained in the second spot while the United States slipped from the top spot. The Press Release outlines the rankings for this year. In this edition of the Criterion of the month, we will sketch the performance of the regions.

Overall, while Eastern Asia tops the regional rankings, South America remains in the lowest position. Since 2016, Eastern Asian countries steadily improved from an average ranking position of 20 to about 17 in 2019. North America experienced a decline from an average position of 10 in 2015 to 22 in 2019. Western Europe remained stable (at about an average position of 21st) between 2017 and 2018, and it declined to about 23rd in 2019. The Southern Asia and the Pacific sub-region saw a decline in the 2017-2018 period but has increased from an average position of 29 in 2018 to about 25 in 2019. Western Asia and Africa experience the opposite trend increasing its average ranking (from about 34th to 33rd) from 2017 to 2018 and declining back to 34th in 2019. While Eastern Europe has steadily increased from 45th average position in 2017 to about 42nd in 2019, Ex-CIS and Central Asia economies declined from about 46th to 48th during the same period. The South American sub-region has steadily declined from 52nd in 2016 to an average ranking of 56th in 2019.

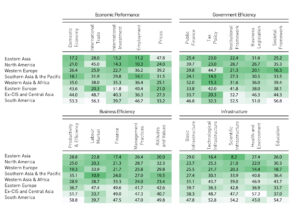

It is instructive to identify the performance of the sub-regions over the pillars of competitiveness. In fact, Table 1, provides the ranking position of all the sub-factor categories. The highest-ranking position in each sub-factor is denoted by the darkest green and the lowest position by lightest green.

Table 1. Sub-regional competitiveness average ranking positions, sub-factor level

The economic performance factor provides a macroeconomic evaluation of the domestic economy, employment trends and prices. Within this factor, Eastern Asia leads in the domestic economy sub-factor followed by Southern Asia and the Pacific, and North America. Eastern Europe tops the international trade sub-factor and Western Europe comes second. North America leads in the international investment and employment followed in both sub-factors by Eastern Asia. The prices sub-factor is led by Eastern Europe.

The government efficiency factor assesses the extent to which government policies are conducive to competitiveness. Southern Asia and the Pacific sub-region ranks at the top in public finance and tax policy with Eastern Asia in second in finance and, Western Asia and Africa second in tax policy. Western Europe tops the institutional and societal framework rankings followed by Eastern Asia in both sub-factors. Western Europe also leads in business legislation with North America coming in second and Southern Asia and the Pacific third.

In turn, the business efficiency factor quantifies the extent to which the national environment encourages enterprises to perform in an innovative, profitable and responsible manner. Western Europe ranks highest in productivity and efficiency, followed by North America and Eastern Asia. Southern Asia and the Pacific rank highest in the labour market, and Attitudes and values sub-factors. While in the former, North America comes second and Eastern Asia third; in the latter sub-factor, Eastern Asia comes second and Western Asia and Africa third. In the finance sub-factor, it is Eastern Asia that reaches the highest average position, followed by North America and Western Europe. Finally, Western Asia and Africa tops the management practices sub-factor, with Western Europe second and Eastern Asia third.

The fourth pillar of competitiveness relates to infrastructure and measures the extent to which basic, technological, scientific and human resources meet the needs of businesses. In this factor, North America is highest in the basic infrastructure sub-factor. Eastern Asia dominates the Technological and Scientific infrastructure sub-factors with Western Europe coming second and North America third in both sub-factors. Similarly, Western Europe leads the health and environment, and education sub-factors with North American second in the former, and Eastern Asia second in the latter sub-factor.

The highest sub-factor average position of the Ex-CIS and Central Asia sub-region is in tax policy, and the lowest in health and environment. South America reaches its highest position in the prices sub-factor and its lowest in the productivity and efficiency sub-factor.

This past year, global markets were characterized by high uncertainty because of changes in the international political landscape as well as trade relations. Countries chose different paths to address these challenges. Yet, from our research as well as the table above, the quality of institutions and the strength of societal values are ingredients that describe the competitive economies and portray the regions as well.

Research Information & Knowledge Hub for additional information on IMD publications

With stagnant import volumes since 2021, and import prices at levels below those suggested by fundamentals, foreign exporters face an uphill battle to convert access to the Chinese market into revenues. Notably, the volume stagnation predates the ...

It has become conventional wisdom to view Europe as an economic powerhouse past its prime, overshadowed by the steady advance of the US and meteoric rise of China. Critics cite Europe’s shrinking share of global GDP, excessive regulation, and slug...

The UAE has been making waves recently in the technology world. A $1.5 billion deal between American tech giant Microsoft and Abu Dhabi’s AI champion,G42, seems to mark a shift in global alliances. This deal is significant not just in terms of the...

Inflows of foreign direct investment into China shows worrying trends despite its massive economy. While total FDI appears substantial at $163B in 2023, most growth comes from existing foreign subsidiaries rather than new entrants. Foreign manufac...

Climate change, geopolitical frictions, and supply chain disruptions call for more sustainable trade practices that can withstand the pressures of volatility. But for trade to be sustainable, it must also be resilient. IMD World Competitiveness Ce...

The idea of an EU bond, a common safe asset, has been gaining attention lately, particularly following calls for its introduction this month by former Italian prime minister Mario Draghi.

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

IMD World Competitiveness Center Report, 14 November 2024, 8th edition

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications