Digital supply chains – Do you risk falling behind?

The second edition of the IMD Global Supply Chain Survey examines how organizations rate themselves on 20 important trends in supply chain management. It shows that experts from leading European companies, in a wide variety of industries, expect the focus of supply chain management over the next three to five years to remain on traditional topics, such as applying sales operations & planning (SO&P) throughout the chain and using specific key performance indicators (KPIs). Interestingly, the experts give less importance to key areas of digital transformation, such as digitalization of interactions with suppliers, channel partners and consumers, and the use of “Big Data”. New technological advances, such as robotics, the Internet of Things (IoT) and 3D printing, are seen as being of even less relevance in the period.

Is this a sign that – despite the feverish talk of disruption from digitalization and new business models – supply chain management is still about focusing on the basics of a physical world business? Or do some business leaders believe that the nature of their physical world products shelters them from rapid technological shifts? Are these organizations holding themselves back by not paying enough attention to new technology and processes? Are they at risk of missing out on the rapid development of “Supply Chain 4.0” or even “Value Chain 4.0”? As my colleague Carlos Cordon, Lego Professor of Strategy and Supply Chain Management, noted in a recent article, the supply chain function at many organizations is rapidly evolving to not only deliver value at the lowest cost but create customer value and translate it into higher sales.

The survey

More than 300 people across more than 30 industries participated in the survey, carried out between mid-September and mid-November 2016. Main industries represented included speciality chemicals, food & beverage, pharmaceuticals, industrial goods, fast-moving consumer goods (FMCG), oil & gas and mining & minerals. The study focused on identifying the gap between how important a key supply-chain topic is perceived to be for a company over the next three to five years and how well it is seen as being addressed in the organization. Respondents were also asked to name their top-of-mind, highest priority initiatives for advancing supply chain performance in their organization.

Key takeaways

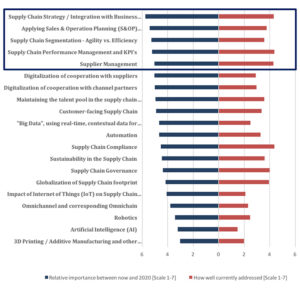

We selected 20 topics – some old, some new – that are significant drivers of supply chain performance. Although different industries give different weight to different drivers, the overall trend is clear. Respondents feel generally comfortable with the way their organizations address the basics, such as aligning supply-chain strategy with overall business strategy, supplier management, measuring supply-chain performance using a set of KPI’s and compliance and governance (see Figure 1).

Figure 1: The most important drivers of supply chain management and how well they are being addressed in organizations, average ratings

N=268 respondents, average ratings, only complete results are taken into consideration

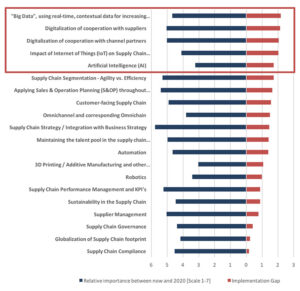

N=268 respondents, average ratings, only complete results are taken into considerationFew respondents see a high impact over the next three years from drivers such as the internet of things, automation or robotics. Nevertheless, digitalization seems to be a strong focus – in cooperation with suppliers and channel partners, for example, or using “Big Data” for forecasting and demand planning – with more than 33% rating it as important or very important for their organization. But the same percentage rated the degree to which the organization addresses the drivers as low or very low. Respondents were very clear that their organizations are not well prepared to address digitalization drivers showing the largest implementation gaps as of today (see Figure 2).

Figure 2: Key drivers rated according to the gap between importance to 2020 and how well addressed in respondents’ organizations

N=268 respondents, average ratings, only complete results are taken into consideration

N=268 respondents, average ratings, only complete results are taken into consideration

When it comes to key drivers, outside of the tried-and-tested supply chain management basics, differences are to be expected between industries. For example, only 9% of respondents from the mining & metals industry considered the use of “Big Data” for demand forecasting an important or very important driver. This figure rose to 60% for FMCG, freight & logistics and retail. A B2B industry will place much lower importance than a B2C industry on availability of integrated data across all channels and partners or a customer-facing supply chain. But it would be short-sighted to believe that a company and its supply chain leaders do not need to stay abreast of opportunities and trends – change might be driven by your channel partners, i.e. players further down the value chain. The question remains whether the low level of importance attributed by respondents to the internet of things, robotics, 3D printing and the like, points to a larger issue, namely that companies tend to plan for technological shifts only when that technology is ready to replace existing processes and methods. In our fast-moving and increasingly digital age, organizations may be waiting too long to prepare for disruption of their supply chain by digital and technology drivers. Conclusion Supply chain leaders must balance short-term benefits and the longer-term investments needed for an efficient and effective supply chain that is ready for the future. Based on our survey results, this involves the following three key activities:

1] Getting the basics right

– implementing supply chain best practices and improving supply chain performance using tried-and-tested methods

2] Having a strategy for an increasingly connected and digital world

– no revolution, but continuous evolution of a digital supply chain where greater transparency and analytics leads to improvements in delivery times, reduction of inventory, reduction of supply chain cost and risk, and increased ability to create value for customers and, therefore, sales

3] Being ready for big technology shifts

– involving robots and autonomous vehicles, 3D printing and connected products, and the internet of things, to improve product and service offerings and reduce costs Senior supply chain leaders should embrace a holistic approach that aligns people, processes and structures within the supply chain function to the challenges that a digital and increasingly automated world present to companies of all industries and in all stages of maturity. They should not focus only on implementing more and better technologies, but must inspire, manage complexity and develop distinct cultures conducive to success in rapidly changing environments.

Ralf Seifert is Professor of Operations Management at IMD. He directs IMD’s new Digital Supply Chain Management program, which addresses both traditional supply chain strategy and implementation issues as well as digitalization trends and new technologies.

Research Information & Knowledge Hub for additional information on IMD publications

Foxconn, a Fortune Global 500 giant and the world's largest electronics manufacturer, made headlines in 2023 by announcing a shift to a five-day, eight-hour workweek in its Chinese factories - a significant departure from its long history of exten...

Boards are playing an increasingly active part in shaping change efforts.

September 2024 marks a turning point in corporate management and a drama in the management world, which began with an essay by Paul Graham, patron of Silicon Valley's leading startup incubator, Y Combinator.Graham coins a new paradigm, the founder...

As businesses navigate market disruptions, technological innovations and an increasingly turbulent world, leaders will frequently find themselves taking control of a team in the aftermath of a crisis. Inheriting such a challenging environment ofte...

The supply chain risk management literature differentiates between disruption risk that arises from supply disruptions to normal activities and recurrent risk that arises from problems in coordinating supply and demand in the absence of disruption...

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in Production and Operations Management 16 November 2024, ePub before print, https://doi.org/10.1177/10591478241302735

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications