Business Efficiency and Productivity

The actions and policies of the government and their outcomes (e.g., infrastructure indicators) affect the efficiency and productivity of the private sector. In this Criterion of the Month, we assess some of the key indicators driving business efficiency and productivity.

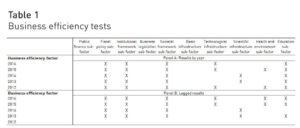

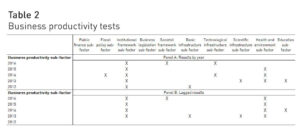

We use stepwise regressions to carry out two sets of tests to identify the competitiveness sub-factors that influence business efficiency and productivity. The first set of tests take the efficiency of business factor as the outcome and all sub-factors related to the government efficiency and infrastructure factors as the input. We ran these tests by year starting in 2012 up to 2016. That is to say, we take business efficiency 2014 as the outcome of all 2014 relevant sub-factors. The effect of our assumed inputs (e.g., policies), however, may be fully realized sometime after their implementation. For this reason, we lag the input indicators by one year in the second phase of the tests. For the 2016 business efficiency factor, for example, we take all input sub-factors from the previous year (i.e., 2015). The second set of tests, triangulates the results by substituting the business efficiency factor by the business productivity sub-factor and carry on the same two-steps (i.e., by year and one year lagged) analysis.

Results from the first round of tests show that there is a set of sub-factors that throughout the period of study are statistically significant in their impact on business efficiency. These key drivers (or inputs) are fiscal policy, institutional framework, societal framework and education.

Lagging the year of inputs leads to similar results with the exception that education becomes less significant (see Table 1).

In the second round of tests, which focus on business productivity, we find that the only sub-factor that is consistently significant throughout the 2012-2016 period is the institutional framework sub-factor. Lagging the input sub-factors for business productivity, only the institutional framework and the health and environment sub-factor are significant statistically throughout (see Table 2). These results indicate that “institutional competitiveness” plays an essential role in defining the efficiency and productivity of business.

What does institutional competitiveness mean? A peruse of the institutional framework components highlights the fundamental role of stability and predictability in this context. We thus propose that the quality of the legal and regulatory system is a key driver of efficiency and productivity. Similarly, the level of the government policies’ adaptability to changes in the economy is essential. We also propose that increasing the transparency of government policy-making and simultaneously limiting bribery and corruption drive business efficiency and productivity. We thus expect the Rule of Law and the country credit rating indicator, which evaluates the political, economic and financial risks that underline a particular country’s credit quality, to be of high significance.

The above propositions may seem self-evident to some observers but current political trends suggests that in some countries institutional competitiveness is somewhat in decline. It is thus necessary to revisit its fundamental role. We will tests the above propositions in a future Criterion of the Month.

Research Information & Knowledge Hub for additional information on IMD publications

- Business efficiency and productivity (Part I)

- Business efficiency and productivity (Part II)

- Business efficiency and productivity (Part I)

- Business efficiency and productivity (Part II)

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

IMD produces a yearly Smart City Index offering a balanced focus on economic and technological aspects of smart cities on the one hand, and “humane dimensions” of smart cities (quality of life, environment, and inclusiveness) on the other. In this...

This Technical Note explores the significant transition that leaders face when moving from functional to enterprise-level leadership roles. It introduces the "Seven Seismic Shifts" framework, which identifies the fundamental changes in mindset and...

This case study explores AstraPay’s journey to become a significant player, despite its latecomer status, in Indonesia’s burgeoning digital payments landscape. Launched in 2018, AstraPay had grown to serve over one million customers, but it faced ...

US President Donald Trump’s full embrace of digital assets has sent shock waves through the cryptocurrency market, driving a price surge while creating both new opportunities and heightened risks for investors and corporations. Last week, Mr Trump...

On 12 March 2025, new and expanded tariffs on aluminium, steel, and downstream “derivative” products come into force. This briefing shows that derivative products alone represented $151 billion of imports in 2024, with 27 foreign economies each ha...

Trade conflict is costly to all parties. Canadian and Mexican trade retaliation can deny tariff-related wins for American workers. Blunt retaliation could go so far as to eliminate all the take-home pay gains in 40 U.S. states and make whatever ga...

IMD World Competitiveness Center Report, 8 April 2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Case reference: IMD-2650 ©2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Global Trade Alert, Zeitgeist Series Briefing no. 57, 6 March 2025

Research Information & Knowledge Hub for additional information on IMD publications

3 March 2025, Global Trade Alert Report, cBrief 5: These Are Your People

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications