Over the past several years, Consumer Packaged Goods (CPG) companies have looked more and more to third party logistics providers (3PLs) to manage their order fulfillment processes. The reasons and impacts of this trend may point to the future of distribution in the e-commerce age. CPG companies are considered among the leaders in supply chain trends in manufacturing. Names like Proctor & Gamble and Unilever are perennially atop the Gartner Top 25 Supply Chains, and represent 9 of the Top 25 in 2017. Looking to these companies can be very instructive for understanding the future directions of supply chain management for manufacturers.

Anecdotal exchanges with physical distribution leaders at CPG companies and major 3PLs point towards an ongoing trend of outsourcing order fulfillment execution to 3PLs, as manufacturers are rethinking what constitutes a core competency in supply chain. We spoke to some of the leaders of this transition at a major CPG manufacturer, a global 3PL and a major online retailer to understand the drivers of this trend and what it means for supply chains moving forward.

Why move to 3PLs?

The first keys takeaway from our conversation is that the primary motivation is not always cost. It’s not necessarily true that moving to a 3PL will be cheaper. This is especially the case for detail picking: the preparation of less-than-full-case orders. 3PLs are more price-competitive in simpler full-case or full-pallet orders. In fact, the most immediate benefit is flexibility.

A 3PL will have more ability to absorb volume increases or fluctuations in volume than an in-house operation. The ability to share facilities and labour allows a 3PL to move resources around and respond in ways the manufacturer cannot. This has strong appeal to CPG companies that have intense launch and promotional cycles that can create distortions in regular flows.

It is not only CPG companies that can benefit from the flexibility offered by working with 3PLs. Supply chain management at a major online retailer explained that even the global ecommerce giants have a growing 3PL activity. When the ecommerce company we talked to is looking to penetrate more deeply into a market, working with a 3PL is a flexible, agile way to establish a presence.

“Building an in-house facility can take 15 months, but starting up with a 3PL can be done in 3 months,” they explained. One might think a giant online retailer is present everywhere in Europe. This is largely true, but not every product category is available in each market, nor is every service offer, like same day shipping. For large, bulky items like major appliances, working with a 3PL makes sense for online retailers in these new markets. These items lend themselves poorly to the efficiencies of automation, and the volume is relatively low. This means that there is a limited cost impact to foregoing this industry’s well known efforts in warehouse automation and robotics.

There are challenges for online retailers to work with 3PLs, however: “It would be fair to say that most 3PLs do not live in the same IT world as us,” they confessed. This position is supported by some recent survey data that points to gaps between the customer expectation in digitalization and the ability of 3PLs to respond: only 35% of 3PL customers feel that their 3PL can support their Big Data initiatives, for example, and only 65% of 3PLs customers are satisfied with their 3PLs IT capabilities.

For the company to maintain its service standards, this places a strain on the interfaces between the online retailer and the 3PL. Detail picking for retail chains comes with classic, well-understood expectations of accuracy and reactivity. But e-commerce comes with its own set of unique challenges. In order to succeed at e-commerce fulfillment, there needs to be a seamless integration from the customer front-end to execution on the back-end. This requires live information on stock availability, order processing status and secure customer credit data. While this is a core activity for online retail, for CPG companies it is driving them to seek out the simplicity of working with 3PLs to manage their e-commerce activity.

A senior executive at a major global 3PL player we spoke with provided an interesting perspective on this expectation of simplicity. She observed that when CPG companies turn to 3PLs to manage an entire ecommerce operation, including front-end and payment processing, as well as classic retail fulfillment, the result is what she calls ‘extensive mediocrity’. The execution is mediocre across the board, neither excellent nor poor. This 3PL executive believes the optimal configuration is partnerships between traditional 3PLs and experts in ecommerce front end solutions. This would maintain the simplicity for the CPG manufacturer while allowing them to benefit from the expertise of each actor.

But this isn’t to say that order fulfillment has become purely a commodity, and that 3PLs do not offer expertise. Most big 3PL players have their own version of continuous excellence to push for cost and efficiency gains, but CPG manufacturers have demanding retail customers and consumers that they have to answer to. This means finding 3PL partners that can innovate in sustainability and service quality as well. This alignment along social values and sustainability has created a competitive space for 3PLs to distinguish themselves, by investing in carbon-neutral distribution facilities and strong labour standards, for example.

What it means for CPG companies

One potentially counter-intuitive consequence for the shift to outsourced order fulfilment has been improved business practices that impact the supply chain. When distribution is in-house, much commercial inefficiency that negatively impact logistics costs falls – fairly or not – on the shoulders of the supply chain managers, who are strongly encouraged to lower their per order and share of revenue costs. Yet often the drivers of the costs are behaviours that are outside the scope of a logistics manager. The nature of the order profile can strongly influence logistics cost. Order frequency, order minimums, preparations specifications and paperwork requirements are examples of how commercial teams can negotiate terms with a customer and have outsized impacts on fulfillment costs.

The transition to a 3PL exposes the different practices around order management, laying bare the real drivers of logistics inefficiencies. If this sounds familiar, it may be because this is the foundation of cost-to-serve, the method of looking at order treatment costs at the customer level, from order reception through fulfillment to returns and cash collection. The transparency of working with a 3PL is a vector for giving cost-to-serve a big boost.

In fact, because the 3PL works with other CPG companies, they may well be better in tune with the best practices in the market in logistics arrangements between CPG manufacturers and retailers, helping make the case and identify even more productivity opportunities. So, indirectly, there is indeed a cost opportunity of working with 3PLs, just in an unexpected, indirect way. The 3PLs understand this value that they add, and are increasing their analytics in order to gently push and challenge their CPG customers, in a way like a personal trainer helping a client who has shown they want to improve.

Returning to the 3PL executive, she believes that CPG companies may be falling into a trap of their own making: By considering fulfillment as a non-core competency and outsourcing it, the manufacturers are beginning to conflate fulfillment with a commodity, wherein the quality is constant across the spectrum of service providers. She has observed that many large players seem to ever more focused squarely on cost, and less on service differentiation.

What it means for 3PLs

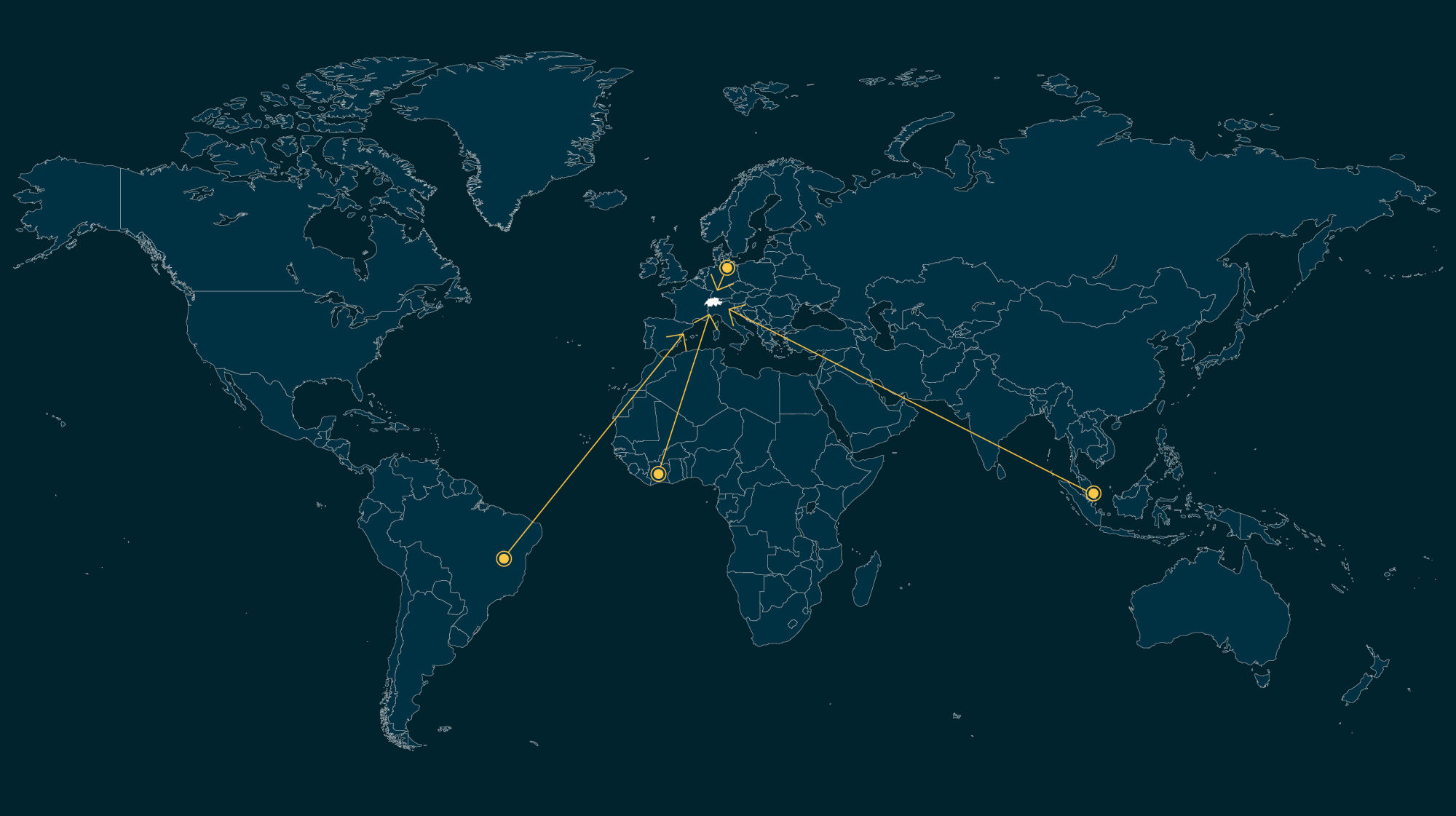

The 3PL space is not quite yet at the same level of maturity as their CPG manufacturer customer base. The market is still predominately made up of what can termed ‘local heroes’: 3PLs that are very strong in one particular market and have a deep connection to the retailers, transporters and regulatory bodies there. Even large 3PLs like DHL and Keuhne & Nagel have had challenges in standardizing the level of performance across markets, and it is still very much a function of the local personnel, perhaps even down to site level. This can be at odds with CPG manufacturers, who have a powerful brands and a global presence. They prefer to have a limited set of preferred partnerships, not a patchwork of contracts with local players.

3PLs will have to look to automation, robotics and learning algorithms to be even more efficient in their operations in order to justify their role. Indeed, the idea of warehousing on-demand could emerge as a real threat unless 3PLs continue to improve productivity and support cost-to-serve initiatives as added-value offering. It will be a challenge for 3PLs to avoid a race to the bottom when over three quarters of their customers consider cost the most important vendor selection criteria.

Takeaway

Most CPG companies started outsourcing logistics operations to 3PLs before supply chain digitalization with all its facets and opportunities took off, be it ecommerce, omni-channel or Big Data. Most don’t seem to have called this choice into question but consumer expectations seem to be evolving fast and 3PLs will need to upgrade their service offering in turn.

Should the trend towards outsourcing order fulfillment in CPG continue, it may fundamentally alter what is considered part of the supply chain core competency in operations. The emphasis may shift towards a deeper focus on business drivers of logistics costs. By carving out the logistics activities, this would be a support to the positioning of sales and operations planning by nudging supply chain into stronger inclusion as a core activity along with marketing, sales and finance.

Ralf Seifert is Professor of Operations Management at IMD. He directs IMD’s new Digital Supply Chain Management program, which addresses both traditional supply chain strategy and implementation issues as well as digitalization trends and new technologies.

Richard Markoff is a supply chain researcher, consultant, coach and lecturer. He has worked in supply chain for L’Oréal for 22 years, in Canada, the US and France, spanning the entire value chain from manufacturing to customer collaboration.