Practitioners and researchers largely agree that value-based pricing leads to higher profits than cost- or competition-based pricing.[1] Yet,despitethe fundamental superiority of VBP, studies continually show that cost- and competition-based pricing remain widespread in practice.[2-4]

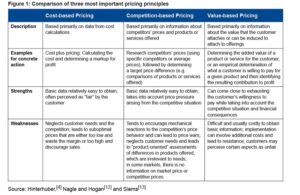

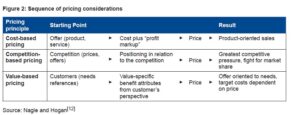

So why do managers gravitate to cost- or competition-based pricing when value-based pricing (VBP) has proven to be superior. (See Figure 1 for a comparison of the three types of pricing and Figure 2 for the sequence of pricing considerations.)

This apparent paradox likely results from the various obstacles managers face when implementing VBP. [4-11] These obstacles, which must be overcome, can be categorized as follows:

Implementation costs

- Investment required to differentiate the benefits of different product versions

- Risk of price erosion through arbitrage and the cost of mitigating the risk through fencing

- Cost of market research to assess differentiated customer value

- Cost and complexity of price setting and communication for thousands of stock keeping units (SKUs).

Implementation challenges

- Market segmentation and determining segment-specific prices

- Communicating differentiated customer value

- Customer resistance due to perceived unfairness.

Case: Pricing mistakes

For a business-to-business company with sales of US$2 billion, McKinsey estimated that the costs of correcting pricing mistakes were approximately $2 million plus $20 million in lost sales. And the cost of customer dissatisfaction is inestimable.

Implementation costs of VBP

Investment required to differentiate the benefits of different product versions

Differentiated prices are often recommended for fundamental services or core products with different key attributes. This can be illustrated with the following examples:

For a 15-centime premium (or 18% more than the B mail price), the Swiss post office promises next- day delivery within Switzerland for A mail, whereas B mail may take up to three days. Apple’s iPod is a product with various versions, ranging in price from CHF 119 to CHF 379. The price range for VW Golf IV models extends from CHF 22,900 to CHF 43,800.

Different product versions can help take full advantage of what customers are willing to pay, thereby increasing earnings. But it is important to note that there will come a point of diminishing returns, where the cost of additional versions may be higher than the additional earnings they generate. Companies must consider not only production costs, but also the administrative costs of a greater product range and the associated guarantee and service costs. Therefore, it is not surprising that in view of the cost of maintaining two independent logistic chains, dual product- management functions and two segments of higher administration, the Swiss post office is thinking of merging A and B mail. For electronic products or services though, differentiated offers are common because additional versions can be produced at low additional cost.[14]

Case: Behavioral segments at a Swiss bank

A pricing project for a Swiss financial service provider aimed to form different price segments. Historic transaction and stock data led to the determination of statistical clusters with different degrees of willingness to pay. However, the key account managers rejected this new segmentation, preferring their own segmentation scheme (diamond, platinum, gold and silver customers). The project implementation therefore included both segmentation schemes. But during specific sales talks with customers about the new price structure, the key account managers quickly realized that the new segmentation made it possible to tailor their arguments to each customer.

Risk of price erosion through arbitrage and the cost of mitigating the risk through fencing

VBP often results in a price structure where some customers pay higher prices, while others benefit from lower price. The danger is that you may unintentionally give unnecessary price reductions to customers who would be willing to pay more.

It is essential that steps be taken to ensure that customers who are willing to pay more are not offered prices meant for customers who are less willing. For example, students must show ID to take advantage of lower-priced tickets at movie theaters. This type of restriction is called “fencing.”[9] In such cases, a priori costs arise from enforcing the fence, rather than creating it, because rules must be entered into systems and employees must be trained to enforce them. This becomes particularly difficult when the company is engaged in multichannel marketing. In addition, post hoc costs arise when the fence is penetrated. Firms must work with customers, employees and trading partners to identify and eliminate price inconsistencies.

Cost of market research to assess differentiated customer value

The biggest obstacle to introducing VBP lies in assessing the differentiated customer value (i.e. the specific value that a product or service has for a customer) and the associated market research costs. According to Hinterhuber, this concern was noted by 79% of the managers questioned.[4]

Why is it so difficult to determine differentiated customer value? In business-to-business (B2B) situations, the initial difficulty lies in the complexity of the products and services. Customers must have a thorough understanding of processes to assess how much added value one solution can generate compared with the next-best alternative. In addition, more and more often the key account manager negotiates with procurement managers who are intent on extracting the lowest possible purchase price. For tactical reasons, procurement managers tend to deny that the offered product has any advantage over the competing product and they refuse to signal whether or not they are willing to pay more.

In business-to-consumer situations, the willingness to pay more can be determined quite reliably through conjoint analysis. However, the costs are significant because conjoint analysis requires expert knowledge if the firm wants to avoid worthless or possibly even counterproductive results. A good overview of this method appears on the website of the leading conjoint software supplier, Sawtooth.[15–16] While conjoint analysis can help managers learn about their customers’ willingness to pay, this information is not very helpful if the marginal costs of the different attributes are unknown. It is sometimes surprising to see how poorly equipped pricing managers are with reliable cost information.

Cost and complexity of price setting and communication for thousands of SKUs. Even medium-sized enterprises must set prices not for a single offering but for thousands, sometimes hundreds of thousands, of products and services.[5] A company with 1,000 SKUs that operates four channels and offers four discount levels must manage 16,000 individual prices. When regional promotions and bundling prices are added, the number of prices that need to be determined can be as high as 100,000. In such cases, pricing mistakes are likely to occur. The quantity problem increases significantly with VBP. An increase in the number of SKUs occurs when benefits are differentiated or different versions are added to increase customers’ willingness to pay.

Companies like Zilliant or PROS Revenue Management have geared their business models to such challenges and offer software solutions for automated price analysis, price setting and price monitoring. In the United States alone, providers in these markets have achieved sales of more than US$1 billion annually along with double-digit growth rates. However, these figures do not include the costs to the companies of setting up and integrating IT systems and databanks.

Implementation challenges of VBP

Market segmentation and determining segment- specific prices. VBP is based on the value of an offering to an individual customer. Theoretically, every customer receives a different price offer. In practice, this is rarely feasible. As in other marketing areas (e.g. product innovation, advertising, distribution), segmentation is the solution for determining prices for the mass market (low costs) and total individualization (high sales). Segment-specific prices should increase sales while ensuring that any additional costs do not cancel out increased earnings. For many companies, the traditional principles of segmentation are unsuitable for VBP, which requires a specific type of segmentation – pricesegmentation.[6] Price segmentation takes price interest, price knowledge and price intentions of the consumer into account and then segments customers by these characteristics.[17]

Case: Cutting costs for branding at Migros

In early 2009 the management of the major Swiss retailer Migros decided to cut its CHF 350 million marketing budget, much of which was being invested in marketing a constantly increasing number of Migros’s own brands. As part of its new communications strategy, it drastically reduced the number of brands it offered, devoted more of its budget to those brands remaining in its portfolio and invested more resources in the “Migros” umbrella brand. The cutbacks did not result in lower sales, which illustrates how Migros failed to communicate value through its multi-branding strategy, but was successful with communicating its umbrella brand.

Communicating differentiated customer value

After identifying price-specific segments, the company must communicate the differentiated customer value. First, it must assess and document the perceived customer value. This is particularly important in B2B markets where buyers are often not aware of the value of a certain offering and compare only prices. Value differences such as long-term cost savings or revenue enhancements are only credible if they are backed up with supporting data.

This communication often takes place through various marketing channels (the Internet is cheaper than a warehouse store and a warehouse store is cheaper than a specialized shop) or through a multi-brand strategy. The Swatch group is a good example of how to take full advantage of a customer’s willingness to pay for a product. Several price segments are served, starting with the CHF 60 Swatch and ranging through Tissot, Omega, Rado and Blancpain all the way up to the Breguet, which costs about CHF 250 million. However, the costs of a multi-brand strategy are substantial, as Migros discovered.

Customer resistance due to perceived unfairness. Since VBP sometimes means that customers pay different prices for the same or very similar products or services, this can lead to negative reactions among customers and the wider public if the price differentiation seems unfair in some way.[8] Customers form their opinions of fairness by comparing the price (and the underlying price system) against a reference price (or reference process).[11] On Amazon for example, most customers regard the price indicated on the website as the price that applies to all customers. The situation differs for airlines and hotels though because their customers are used to seeing substantial price differences depending on the dates of travel, date of reservation, sales channel and customer status.

Fundamentally, a differentiation in price should be communicated in such a way that it reinforces the highest price as the reference price and ensures that lower prices are linked to conditions that seem both understandable and fair.[18]

Case: Perceived Unfairness of VBP at Amazon

In September 2000, the online retailer Amazon. com began to adjust its book prices to purchasing behavior. A tremendous uproar resulted when a customer noticed that the price for a given book fell from $26.24 to $22.74 when he deactivated the cookie in his browser, then rose again to the higher price when he reactivated the cookie. Amazon.com received thousands of negative e-mails and suffered major damage to its image. Loyal customers felt betrayed, which resulted in lasting harm to their relationship with the firm. What is interesting here is not just the negative reaction but rather that customers willingly accept similar price differentiation from enterprises such as hotels, airlines or mobile phone providers – seemingly without question.

Conclusion

While VBP is superior to other pricing approaches in most situations and in respect to the goal of profit optimization, the majority of firms still use cost- based pricing as their dominant approach. This article helps to explain the reason for this paradox. While VBP sounds simple in theory, putting it into practice requires the execution skills to overcome the many hurdles of implementing VBP. Knowing those hurdles in advance helps managers to assess where and when to apply VBP and which execution strategies and tactics to use for pricing excellence.

References

[1] Kühn, R., and P. Pfäffli. “Wie Unternehmer die Preise erhöhen können.“ New Management, Vol.6, 2007: pp.

78–83.

[2] Avlonitis, G., and K.Indounas, K. “Pricing Practices of Service Organizations.” Journal of Service Marketing, Vol. 20, Iss. 5, 2006: pp. 346–356

[3] Cavusgil, S. T., K.Chan, and C. Zhang. “Strategic Orientations in Export Pricing: A Clustering Approach to Create Firm Taxonomies.” Journal of International Marketing, Vol. 11, Iss. 1, 2003: pp. 47–72

[4] Hinterhuber, A. “Customer Value-based Pricing Strategies: Why Companies Resist.” Journal of Business Strategy, Vol. 29, Iss. 5, 2008.

[5] Court, D., T.D. French, and T.R. Knudsen. “Confronting Proliferation: A Conversation with Four Senior Marketers.”

McKinsey Quarterly, Vol. 3, 2007: pp. 18–27

[6] Diller, H. Preispolitik, 4th ed. Stuttgart: Kohlhammer, 2008

[7] Hunt, J.M., and H. Forman. “The Role of Perceived Risk in Pricing Strategy for Industrial Products: A Point-of-

View Perspective.” Journal of Product & Brand Management, Vol. 16, Iss. 6, 2006: pp. 386–393

[8] Maxwell, S. The Price is Wrong: Understanding What Makes a Price Seem Fair and the True Cost of Unfair.

Hoboken, NJ: John Wiley & Sons, 2008

[9] Simon, H., and R.J. Dolan. Profit durch Power Pricing, Frankfurt: Campus Verlag, 1997

[10] Srinivasan, S., K. Pauwels, and V.Nijs. “Demand-Based Pricing Versus Past-Price Dependence: A Cost-Benefit

Analysis.” Journal of Marketing, Vol. 72, Iss. 2, S. 2008: pp. 15–27

[11] Xia, L., K.B. Monroe, and J.L. Cox. “The Price Is Unfair! A Conceptual Framework of Price Fairness Perceptions.” Journal of Marketing, Vol. 68, Iss. 4, 2004: pp. 1–15.

[12] Nagle, T.T., and J.E. Hogan. Strategie und Taktik in der Preispolitik, 4th Ed., Munich: Pearson Business, 2007 [13] Siems, F. Preismanagement: Konzepte, Strategien, Instrumente. Munich: Vahlen, 2009.

[14] Marn, M.V., E.V. Roegner, and C.C. Zawada. The Price Advantage. Upper Saddle River, NJ: Prentice Hall. 2005: p. 163.

[15] Johnson, R.M., and K.A. Olberts. “Using Conjoint Analysis in Pricing Studies: Is One Price Variable Enough?” Sawtooth Software Research Paper, 1996.

[16] Curry, J. “Understanding Conjoint Analysis in 15 Minutes.” Sawtooth Software Research Paper, 2001. [17] Diller, H. and H. Stamer. “Preissegmentierung in Konsumgütermärkten. Eine theoretische und empirische Analyse.” Arbeitspapier, Universität Er-langen, Nuremberg, 2003.

[18] Tversky, A., and D. Kahneman. “Loss Aversion and Riskless Choice: A Reference Dependent Model.” Quarterly Journal of Economics, Vol. 106, November, 1991: pp. 1039–1061.