A thriving onboarding process is built on a clear definition of what constitute an “ideal” board to the firm and the establishment of the desired profile of new directors. Both of these elements need to be aligned with the company’s long-term strategy and set within a sound governance culture. Onboarding is supported by a comprehensive strategy that focuses on facilitating the fit between the company and new directors to ensure their successful incorporation into the organization. In doing so, it facilitates the smooth operation of the board and its evolution. The process is highly interactive and it helps prevent and diminish ineffective patterns of behaviors in the early stages of the new director’s appointment. Onboarding is a long-term process that extends beyond orientation and it could last several months. During that time, it provides a support framework and a welcoming environment that encourages newcomers to contribute rapidly and fully to firm performance. In what follows, we discuss some practices that define a successful onboarding process (see Appendix 1 for an onboarding checklist).

Board Culture and Integration

A successful onboarding begins with a sound strategy for integrating new directors into the board culture. A first step is to clearly define the board culture by setting the values in which that culture is embedded. Traditional values include responsibility, accountability and independence. Responsibility in this context refers to the board members’ duty to act in a manner which pre-empts, for example, any risks of conflict of interests. Board members have also the duty to prepare for and to fully participate in board meetings. They are accountable to the board and to each other. The independence of board members provides context for critical judgment leading to the “one voice” based on constructive disagreement and mutual respect. Onboarding aims, to put shortly, at ensuring that new directors gradually adopt the values of the prevailing board culture and related practices, customs and attitudes.

Integration seems paradoxical as new directors are required to progressively improve and adjust their practices and behaviours; yet, at the same time, they need to adapt quickly to their new surroundings in order to be productive in their new positions. The key is to base integration on the personality assessment of new directors and to make it parallel to the incorporation of their expertise into board activities. In this sense, integration allows new members to flourish in their roles because it enables them to gain a strong understanding of board practices and the operation of the organization in general. To this end, corporations contribute to the effectiveness of the process by providing new directors with an internal and an external mentor to elaborate a 100-day transition plan; at the same time, these companies guarantee the continuous support of new directors throughout the process.

Another element of this phase is the dissemination of information regarding ethical behavior standards. The chairman needs to emphasize the centrality of integrity and to make sure that newcomers fully understand what is expected of them in this regard. New directors are provided with a directors’ manual upon appointment and informed about their responsibilities, the nature of the firms’ businesses and about directors’ liabilities.

Integration affords new directors a forum to ask questions, access needed information and build relationships with peers. The latter strengthens a board’s culture of knowledge sharing, open debate and equal participation in discussions – a sign of a strong governance culture. At some firms, over a period of six to nine months, new directors participate in scheduled meetings with division heads and other senior leaders. They are also given detailed contact information of senior management. The objective is to give new board members access to management so they are able to ask any questions that they may have.

Goals and Objectives

Setting clear performance objectives for new directors facilitate the successful achievement of performance goals. In doing so, this practice increases not only the productive participation of new directors from the early stages but also the understanding of their roles. New directors who have a clear understanding of what is expected from their position are able to identify available alternatives to begin making meaningful contributions to board activities and to the company in general.

Goals and objectives need to be realistic, in the sense that they take into account the business knowledge and client understanding of new directors. In addition, defining clear goals and objectives helps new directors clarify problems and issues and identify opportunities to maximize their impact on board practices. Well-articulated objectives also stimulate innovation by allowing new directors’ creativity to be aligned with the organization’s practices. To support such practices, corporations, from the early stages of the appointment of new directors, develop and apply performance appraisal tools that enable new directors to align their individual performance with the company’s objectives.

Continuous Engagement

Onboarding promotes newcomers’ engagement with peers and stakeholders. The rapid integration of new members greatly depends on their fit within the team. For this reason, a strong onboarding process frames interactions between new directors and the CEO and chairman with the aim of generating robust board dynamics. Interactions lead to an all-inclusive board culture wherein new directors feel welcomed. In addition, understanding the internal dynamics of the board gives new directors the space to identify where their knowledge and expertise can be applied to maximize their contributions to the achievement of the company’s vision and objectives. Interactions also contribute to quickly deepening the newcomers’ involvement in board activities, making them feel valued by their peers. The latter grants new directors focus and dedication to board activities. In some companies, newcomers spend a day at corporate headquarters within the first three months of their appointment. This activity aims to provide new directors with a personal briefing by senior management on the company’s strategic plans, its financial statements and its key policies and practices. Similarly, from the early stages of their board members’ appointments, other firms ensure that plans are put in place for interactions between the newcomers and senior management.

Mentoring by established members of the board affords new directors with insights into board culture. Similarly, mentors from the senior executive team can offer guidance on what makes the firm “tick” and how the organization’s structure functions. Mentoring with a key member of the senior executive team, however, needs to be structured and formal to avoid undermining the role of the CEO. Multiple pairing mentorships provide newcomers with a wider network that expedites their effective performance by providing the organizational knowledge necessary for having a high-quality impact on the firm’s practices. The process can take advantage of available technology to facilitate such wide mentoring network. E-mentoring provides the opportunity for pairing established board members with newcomers via online processes. Email or chat “meetings”, for example, can be arranged to seek advice or to discuss reactions to board meetings and clarify issues that may have arisen. In short, increasing peer interactions by all means available accelerates the integration of new directors and contributes to stronger board relationships, which ultimately can maximize good governance practices.

New directors are encouraged to interact with the different echelons of the company and its stakeholders. External scans to learn about and interact with costumers, competitors and workers’ union leaders allow new directors to acquire a substantial understanding of the firm’s business and meet key clients. Corporations, for example, have introduced a process wherein they identify key colleagues and stakeholders with whom new directors need to immediately interact. Thus, firms furnish new directors with tools and opportunities to build relationships. As part of its basic orientation process, other companies include a plan for organized meetings with members of the management team and site visits. Similarly, other firms encourage directors to broaden their knowledge of the organization’s business and to remain abreast of developments affecting the business by setting a program of visits to offices in different locations.

Performance Evaluation

Establishing effective feedback mechanisms to maintain newcomers’ awareness of their performance contributes to the success of onboarding strategies. Evaluations focus on the frequency and quality of new directors’ contributions and aim to support them in the areas most critical for successful performance. New directors face great performance expectations to demonstrate their competence and feedback gives them a channel to reflect on their contributions to board operations. Early evaluation permits new directors to identify inefficient practices and inadequate behaviors so that they can quickly implement corrective actions. Otherwise, such practices and behaviors can become the norm and eventually could lead to failing performance. Early evaluation also allows the board to identify possible competency-development needs that can have a great impact on board effectiveness. But if neglected, those needs could have a negative effect on the newcomers’ morale and dedication. To avoid such situations, companies strive to monitor the progress of new directors during the first year of their appointment. With the same aim, other firms employ a questionnaire to be completed by new directors in their first 90 days. One of the objectives is to identify their contribution to the company; in doing so, newcomers embark on a self-evaluation exercise that can only increase the success of the process. To this end, corporations employ a comprehensive strategy, whereby they develop self-evaluation surveys to determine the training needs of new directors and to facilitate the necessary support for achieving their effective performance.

Another benefit of an effective evaluation process is that it increases the interactions between established members and newcomers thus contributing to building the necessary relationships for their roles. In addition to expediting the integration of new directors into the board culture, early evaluation can form a solid platform to enhance channels of intra-board communication. Evaluation enables new directors to improve performance and contributes to the alignment of their expertise and knowledge with the board’s objectives.

<h2″>Realistic Expectations

There is no set process for individuals to establish their expectations for whatever undertaking they are pursuing. Some may set their expectations extremely low in an attempt to avoid disillusionment. Others may be inclined to set unrealistic expectations that may lead to frustration and discouragement thus resulting in ineffective performance. It is for this reason that successful onboarding lead newcomers to begin their participation in the organization based on realistic expectations that will demand adequate efforts to achieve their objectives. An effective way of helping new directors set their expectations is to inform them fully about what is expected of them. Several firms employ such a strategy. They ensure that new directors understand what is expected of them by delivering a detailed letter outlining the key terms and conditions of the new directors’ appointment and providing a written description of the position.

Ideally, effective onboarding avoids focusing on performance outcomes in the early stages. It is only after early evaluation and feedback that realistic performance outcomes can be set. In this regard, the most successful onboarding processes employ the proactive participation of the chairman in guiding new directors to manage expectations. With input from the chairman, new directors can narrow the scale of what is expected and they can strive for the higher points on that scale. Thus, onboarding enables newcomers to anchor their expectations realistically and strive for tangible achievements. To assist in the management of their expectations, companies elaborate individual development plans for new directors based on data collected during the recruitment process and the aspiration of new directors.

External Support

The onboarding needs of new directors vary, for example, according to their status in relation to the company. New directors can be considered “internal” if they are promoted from within the firm or “external” if they come from outside the firm. The onboarding process for internal directors need not be overly focused on facilitating knowledge about the firm; instead, it emphasizes the development of relevant skills for the new director. Conversely, external directors may lag in terms of knowledge about the firm. In both cases, an effective onboarding process provides new directors with external support. To this end, customized coaching programs can be developed aimed at strengthening a new director’s specific board competencies, such as corporate strategy, governance, finance and corporate affairs. Corporations through external consulting firms have introduced development programs for new directors that include sessions on corporate governance and leadership. Such programs, which are tailor-made and could last a year, pay particular attention to the individual director’s expertise. At other companies, new directors are granted access to outside education programs with a particular focus on directors’ responsibilities.

Skill-Development Programs

An effective onboarding process maps the new directors’ skills and abilities in order to determine the specific requirements for their further development. The aim is to balance the skills, capacities and expertise of board members to fine-tune the board composition. In doing so, development programs strengthen the onboarding process by expediting the newcomers’ impact on and contributions to board performance. Table 1 offers an example of a learning portfolio.

Table 1. Development Program Portfolio (an example)

| LEARNING PORTFOLIO |

| Corporate governance best practices |

| Board roles, responsibilities and liabilities |

| Board culture and dynamics |

| Corporate strategy and performance |

| Finances |

| Executive compensation |

| Risk oversight and mitigation |

| Leadership |

| Succession planning |

| Crisis management |

| Regulation and compliance |

| Industry trends |

Available technology provides several innovative tools to deliver skill-development programs. For example, webinar educational programs can be employed to deliver lectures or conduct workshops when an interactive online context is necessary. Conversely, a webcast provides a one-way delivery of program materials but offers the advantage that learning takes place at the participant’s own-pace. In short, encouraging e-learning facilitates new directors’ independent, distance and flexible learning, which can only contribute to their performance.

Process Improvement

A sound onboarding process is underlined by the ability of the board and specifically of the chairman, to continuously identify and assess the strengths and weaknesses of the process to determine where necessary improvements are required. In this regard, companies seek feedback on the onboarding process from new directors after their first six months. The objective is to determine any issues that might have emerged during the process in order to implement the necessary adjustments to improve the process.

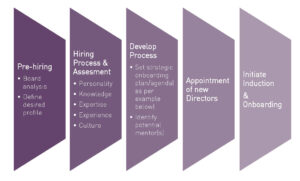

Figure 1: The Five Stages of the Hiring Process

The onboarding process is continuous and it requires the chairman’s attention to ensure that new directors are finding their “place” within the board and that potential problems are dealt with pre-emptively. High-performing organizations design onboarding plans that maximize directors’ prompt contributions in order to optimize board effectiveness. An additional benefit of an effective onboarding strategy is that it affords the company a sustained pool of quality talent. Furthermore, it gives the board the necessary continuity for the consistency of board practices, particularly those related to good governance. The onboarding process enhances new directors’ early performance and contributions to the organization. In turn, it builds a board culture based on cooperation and teamwork, which ultimately cements strong governance practices. It also facilitates the company’s growth and transformation of its practices by bringing in a diversity of views that, if well managed, can provide innovation to corporate strategy.

The practices discussed herein need to be strategically well integrated and systematically implemented for the process to be effective. The onboarding process needs to be reviewed periodically to ensure it meets the needs and objectives of the board and the organization in general. The areas to consider during a review include the experience of the organization in integrating new directors by facilitating constant interactions with peers and the use of early performance evaluation to set goals and objectives and to assist newcomers in setting realistic expectations. The review, in other words, needs to be designed in way that feeds back into the effectiveness of board practices.

Didier Cossin is Professor of Governance and Finance at IMD and founder and director of the IMD Global Board Center. He directs High Performance Boards, a program for supervisory board members and chairpersons.