Over 100 participants from all over the world gathered to hear Professors Michael Wade and Donald Marchand, along with their guest speakers, talk about “Digital Business Disruption: Creating Opportunities, Defending against Digital Disruption.”

There have always been market disruptions as new technologies emerge. How is “digital” different? Most importantly, what are the best strategies for businesses to adopt in order to successfully undergo digital transformation? These questions formed the central axis of the IMD Discovery Event hosted by Professors Michael Wade and Donald Marchand. Real-life examples provided by speakers from the Novartis e-Health in Africa non-profit initiative, from Six Payment Services and from Procter & Gamble offered insights into both the opportunities and the disruptive threats inherent in digital transformation.

Digital dodo or technology forerunner?

Many companies have gone the way of Blockbuster Video Entertainment because they were too slow to adapt to changing technologies and too risk averse to give up their profitable core business. For example, it is only in retrospect that the executives at Blockbuster – who passed up the chance to buy Netflix for $50 million – became fully aware of the missed opportunities that cost the company its leadership position and quickly led to its extinction.

However the pace of digital disruption is now so fast that even the disruptors need to quickly disrupt themselves in turn. This is a huge challenge for organizations, even the most nimble, because it involves replacing a successful formula with a risky bet. Netflix had to go through painful organizational change to implement its digital streaming strategy: Many within the company opposed this new direction. The cannibalization of its DVD business also put the company in a vulnerable state during the transition and caused the stock price to plummet in 2012. Self-disruption almost killed Netflix but was necessary for its ultimate success.

Athough many companies today accept, in theory, the need to invest in potentially disruptive innovation, the path to digital business transformation is often rocky. There is a gap between obtaining new technology and adopting it. In practice, the gap is caused by organizational behavior barriers – not simply because change is painful but also because companies struggle to implement digital technologies in a way that materially improves performance. Faced with bundles of new technologies such as Analytics, Mobile, Platforms and Social Media – or “AMPS” – many firms grapple with competing digital strategies. And even once a strategy has been chosen, there are risks of derailment. One way to derail is to talk about digital transformation but do nothing. Another is to deploy AMPS but fail to capture new value for the business.

Stairway to digitization

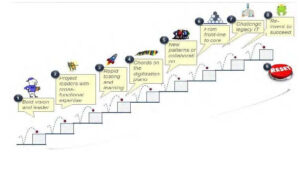

Given these challenges, an effective way of thinking about digital business transformation is to picture it as an eight-step journey as shown in Figure 1. First, choose a visionary leadership team and make sure they care about the outcome – their jobs should be on the line. Second, elect cross-functional AMPS experts to carry out the project. Third, carry out a “fail fast and learn fast” phase to experiment. Fourth, select the right mix of technologies – this step should resemble a jazz improvisation, in which individual musicians take turns improving their performance during solos, as opposed to an orchestra piece with a fixed score. Fifth, redefine the boundaries between functions and between local, regional and global collaboration (this involves healthy confrontation, which is uncomfortable but necessary in order to generate trust and sharing of knowledge later on). Sixth, foster innovation where it naturally occurs, at the customer interface. The digitization process often starts at the edge of the business, with support from top leaders, and must be protected as it moves up in the organization – middle managers are often most resistant to these innovations. Seventh, allow the innovation to challenge legacy IT. Eighth, redefine and “relabel” the digital transformation based on the new understanding of its value and meaning.

Figure 1: Eight key ingredients enable sustainable digital transformation journeys (Don Marchand)

An additional ninth step consists of “resetting” the whole process: Two to three years after deployment, the orientation of the digital strategy may have to be rethought at a high level. This last step is also when the firm can more confidently decide whether to roll out the innovations to other parts of the business.

Digital: The best ammunition we have to stay ahead of the game

Having been in business for over 170 years, Procter & Gamble takes a longterm perspective on technology adoption. As Filippo Passerini, CIO and Group VP of Global Business Services, highlighted during his presentation at IMD, technology is never the solution – it’s an enabler. The real innovation is in the business model. This is true for P&G, but also for other companies. A significant change brought by the iPod was to allow people to buy a single song at a time. In other words, new technologies should not make us lose sight of the end goal – to enjoy an experience. That being said, Passerini believes that digital technologies are “the best ammunition we have to stay ahead of the game.”

In response to a question about how his company’s big data investments were changing, Passerini noted that reporting has gone to the bottom of the list. In order to respond to a “VUCA world” (Volatile, Uncertain, Complex and Ambiguous), priorities have shifted toward predictive rather than descriptive analytics (see Figure 2). P&G is focusing on simulations and scenario planning: When a new product is launched, what will the competition do? How will the market react? Where will our competitors invest? The goal is to be “pre-ready” with the appropriate scenario. In a fast-paced world, speed is of the essence, but only speed with clear strategic intent.

New product development is another area in which speed is vital. Until recently, P&G built physical mock-ups of products and invited consumers to carry out several rounds of testing. This three- to four-month process has been sped up thanks to virtualization whereby the entire process, including the 3D prototype of a product as well as its packaging, artwork, distribution and layout on shop shelves, is visualized entirely on screens.

In closing, Passerini shared three pieces of advice for staying abreast of innovation. First, find a personal advisor who has gone through a similar process of technological transformation before and use this person as a sounding board. Second, spend time scouting new places, new technologies and new people. This allows you to make unconventional connections. Visiting Israel, for example, offered insights into the country’s terrific ability to “triangulate” government, industry and academia to achieve innovation breakthroughs. Third, look at other industries for ideas as disruptions often come from disruptive cross-fertilization.

Digital trendspotting

What will be the next disruption in the payments segment of the financial services industry? This is what Christian Bucheli, Head of Strategic Ventures at Six Group, must bring to light and also prepare his firm for. Six Payment Services is owned by banks doing business in Switzerland, and one of its key services is to issue cards on behalf of banks and handle card-based transactions.

A useful framework to think about the changes that will impact Six Group is known as “PEST,” the analysis of the key Political, Economic, Social and Technological trends. Political trends related to Six’s business include the E-Money Directive and the Data Protection Act. The recent macroeconomic trends are generally characterized by a fast pace of change and the decreasing level of security in Western markets, for example the euro crisis and possible Grexit, increasing unemployment, bank disintermediation and shorter economic cycles. Key trends driving consumer behavior and social trends include migration, mobility, social media and digital natives/Millennials. Lastly, the technology landscape is shifting rapidly. Areas such as contactless payments, digital currencies and “blockchain” technology like Bitcoin, as well as omni-channel banking and mobile apps, are likely to shape the way payments are made.

Which of these four “PESTs” should Six focus on to prepare itself for disruptive innovation? Participants voted that the technology trends would be most likely to cause upheaval in the payments industry and that the best response strategy for Six Group to implement – out of the seven strategies outlined by Professor Michael Wade – would be to “Invest in disruption,” followed by “Disrupt the current business” and, third, “Milk” the existing business model.

Six Group is indeed investing in new digital technologies such as a mobile pointof-sale (POS) solution and biometricsbased client authentication. To nurture innovation internally, Six Payment Services has also set up a program dubbed the “Innovation Legionnaires.” The program starts with intranet-based idea collection. Employees can then apply to join ad hoc teams to work on specific projects. These three-person teams conduct “innovation sprints” lasting three weeks to come up with prototypes. The output from the Legionnaires is then reviewed at the executive level and, lastly, the selected prototype is integrated as a new product or service in the company’s standard offering.

Six Group is aware of the threat posed by both incumbent and emerging competitors – including Alipay, Google Wallet and Dwolla – and knows that it must fight for a place in the emerging payments ecosystem. However Six is an 85-year-old company that has enjoyed a national monopoly for many years. Change does not come easily. In the eight-step journey to digitization pictured in Figure 1 above, the company has obtained perhaps five of the necessary ingredients. Therefore the Innovation Legionnaires must march on.

Digital transformation via e-Health in Africa

For companies, seeing their industry undergo digital transformation can be both an opportunity and a threat. However, from a public health perspective, digital transformation definitely falls in the “opportunity” category, especially in lowresource countries. For example, going from paper to digital offers a unique chance to improve health outcomes in African countries affected by stock-outs of essential medicines.

Malaria kills 1,500 people a day, and 85% of African fatalities are children under the age of five. Malaria can be treated very effectively if tablets are administered within 24 hours of the symptoms’ first appearance. However, supply chain problems make it difficult to get medicines to patients on time, especially in rural health clinics. Over the last five years, Jim Barrington, retired CIO of Novartis, has led a uniquely successful initiative to digitize dispensary stock levels. After months of field research, Barrington concluded that an SMS messaging solution would be effective for health facilities. “SMS for Life”2 was first launched in Tanzania by a public-private partnership. Thanks to its mobile solution (with related health-staff training), antimalarial medicine stock-outs fell from about 75% to 5%.

The success of the program led other African countries to request roll-out of “SMS for Life” as well. Then, Barrington was approached by Ghana to find a solution to coordinate blood bank levels. The next challenge was Nigeria, which had different priorities, such as HIV/AIDS. Creating solutions for these countries became the second wave of the e-Health in Africa initiative. The team used the same back-end system as “SMS for Life” but designed a new front-end (and made the system accessible from any device, including tablets).

Some of the key lessons that Barrington drew from the project were:

- The biggest value did not lie in the technology, it lay in designing a new process.

- Designing for scalability and flexibility from the start allowed the project to expand freely.

- The strength of the team, comprised of one fully-empowered (and skilled!) employee from each of the partners (Novartis, Google, Vodafone, etc.), lay largely in the new patterns of collaboration they established (move fast; no reporting; no invoicing; no budgeting; whatever each person does, their own company pays for it).

- Legacy everything must be challenged, not just legacy IT.

For each new e-Health challenge, the founding principles stayed the same: All the technology would be open source and none of the vendors could have a monopoly. The team also created a “how to” packet for any organization that would like to replicate the methods. This packet was, for example, picked up by another pharmaceutical company to create a tailored e-Health solution for a sub-Saharan country, and it also allowed commercial spin-offs for pharmacists and diabetes patients. In short, the e-Health for Africa initiative was an example of the creative and life-giving – rather than simply disruptive – potential of digital transformation.

Discovery Events are exclusively available to members of IMD’s Corporate Learning Network. To find out more, go to www.imd.org/cln

Related case study: SMS for life (A): A public-private collaboration to prevent stock-outs of life saving malaria drugs in Africa