5 new retail trends underway in China, that the rest of the world needs to know about

In 2020, China’s online sales amounted to RMB11.8 trillion (US$1.8 trillion). That’s more than the US and Europe’s combined, and a 10.8% increase over 2019.

The lens for consumer trends is hovering over China where previously it was over the US. Starbucks’ President and CEO Kevin Johnson said during a 2018 interview with CNBC that he wanted to apply what the company had learned in China to the US.

China’s online shopping platforms combine everything: e-commerce, social media, digital payments, community buying, gaming, short videos and live-stream selling. This integrated model provides the ultimate user experience, and it is the direction in which Amazon is also moving.

China: customer-led at the core

Back to the Chinese model and all functions are in one app. Successful Chinese retailers go to great lengths to remove any physical or indeed emotional barrier to online purchasing. This effortlessness translates into confidence in placing an order online and ultimately favors impulsive shopping.

Super apps combining multiple functions have been popping up for some years now in China. Meituan, a location-based platform founded in 2011 with a current market cap of US$276 billion provides all kinds of lifestyle services online. Pinduoduo, an e-commerce platform with a market cap of US$213 billion, accumulated over 700 million active users in five years by serving the consumers at the bottom of the pyramid.

Then there’s WeChat, the social-media platform under Tencent with a market cap of US$868 billion and Alipay with a market cap US$719 billion. Originally Alibaba’s and containing just a sole payment function, it later became a huge platform in itself…

On the surface of things, these new retail models seem to be innovating on the front end; they appear to be just new apps and digital channels to connect a broader base of products and consumers. However, the changes are deeper and wider as they imply the integration of the full value chain, from factories to end users.

Mark Schneider, CEO of Nestlé, said back in 2012 to The Economist, “If you want to see the future, look at China,” and his words have by no means lost relevance. Here are 5 new retail trends happening there right now, that should at very least be on the radar of the rest of the world:

1. The “sinking market” and its rising growth prospects

The typical characteristic of consumers in the sinking market (a Chinese concept denoting markets other than the first- and second-tier cities) is low income. After 20 years’ development of e-commerce, the competition for users in the first and second tiers has become fierce, and penetration has become saturated.

By contrast, there are more than one billion people living in third and below-tier cities who are untapped. No new retail player in China can afford to miss the sheer size of the sinking market, and super app PDD is experimenting with a new business model to serve this segment, and is having some initial success.

2. Local Chinese brands getting ahead of the pack in China

Ten years ago, many Chinese brands would try to look like they were a foreign product in order to attract local customers. Fast forward to today and these same brands are moulding themselves in Chinese traditions and styles.

The winner of the Tmall Golden Makeup Award for 2019 was the “Perfect Diary (完美日记)”, a Chinese cosmetics brand that was just two years old but which beat established brands L’Oréal and Estée Lauder into second and third place in China. New retail platforms, such as PDD, have also begun to collaborate with local manufacturers to improve the “made in China” branding.

3. Livestreaming 2.0 making millionaires out of artisan ‘stars’

The rise of social-media platforms such as Weibo and Xiaohongshu, and of short-video platforms as the likes of Kuiashou and Douyin (the Chinese version of TikTok), is providing opportunities for artisans like Li Ziqi.

The Chinese food blogger uses ingredients dug fresh out the ground, washes them in a mountain spring and cooks them on a log fire pit to form her videos. Rain falls on the roof, flowers blossom and roosters crow in the background. Li Ziqi’s videos have fulfilled people’s yearnings for their inner Shangri-la.

Despite having over 10 million followers on YouTube, Li does not represent any big brands aside from her own. Her store on Tmall (the Chinese business-to-consumer online retail site) opened in August 2018 and sells the 40-odd food products that appear in her videos.

The rough estimate of Li’s monthly income was over RMB100 million (US$14 million) in 2020. There are many talents like Li Ziqi yet to be discovered, and the development of social media and short video platforms are going to facilitate their rise.

4. Killer algorithms are the fuel to the fire of new retail

Big data, machine learning and sophisticated algorithms are pushing “relevant” news and short videos to unsuspected users, making them largely responsible for the success of Toutiao, PDD, Douyin and Kuaishou.

Recommendation algorithms help people make better decisions, minimizing the search time. With more data and more understanding of user preferences available, the recommendations employed are becoming more accurate.

5. Autonomous delivery goes hand in hand with various models of new retail

The COVID-19 pandemic in early 2020 has accelerated the development of autonomous delivery. Such vehicles, drones and robots have become solutions to the crying need for contactless delivery in Beijing, Wuhan, Changsha and Sichuan.

Alibaba, JD, SF Express and Meituan are all deploying autonomous delivery vehicles to solve last-mile delivery issues.

When a driverless vehicle sets out to make a delivery, a message is sent to the consignee who then receives a message when the driver is at the end location. By entering the order number on the vehicle screen, the recipient can take their order from behind the opening door. And on goes the vehicle to its next stop.

Research Information & Knowledge Hub for additional information on IMD publications

China’s apparel sector in 2025 sees local brands rise and global players adapt amid digital, Research & Development, and innovation-led growth.

Explore how innovation, R&D, and policy reforms are reshaping China’s pharmaceutical sector amid rising healthcare demand and demographic shifts.

It's a reversal of the situation: Chinese automaker BYD is offering to collaborate with former electric car pioneer Tesla. From drones to livestream trading to artificial intelligence: China is often ahead of the West.

Haier's CEO Zhou Yunjie explains how the company's innovative RenDanHeYi model empowers employees, drives global growth, and adapts to market changes.

The Trump administration’s recent tariff threats have increased uncertainty over the business model of Temu and other large ecommerce groups. The White House reversed its initial closure in 2025 of a loophole that allowed low-value parcels shipped...

The China Resources Beer (CR Beer) case study is a compelling narrative of the world’s largest beer producer by volume under the leadership of CEO Hou Xiaohai. In 2016 CR Beer embarked on a pivotal transformation journey. This case study offers cr...

Honda and Nissan's $58bn merger aims to compete with China's EV dominance, but risks include cultural clashes, overlapping markets, and uncertain innovation outcomes.

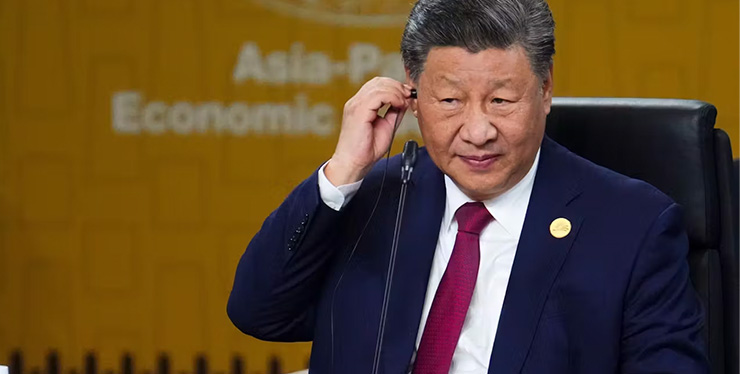

Within days of Donald Trump’s election win in November 2024, China’s president Xi Jinping was at a ceremony opening a deep-water port in Peru as part of a “diplomatic blitz” through Latin America. Xi’s presence was a symbol of China’s rising influ...

Global market shifts and turbulence in 2025 mean Chief Financial Officers must take into account inflation, trade tensions and shifting regulations to ensure long-term growth

What a difference twelve months make. A year ago, there were only faint signals of a potential luxury slowdown. However, since spring, the downturn has sharply intensified across luxury goods sectors, including fashion, accessories, watches, cars ...

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in The Conversation 9 January 2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications