How will currency fluctuations impact competitiveness?

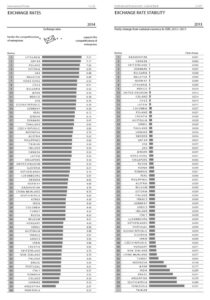

The latest currency fluctuation wave in Europe will indeed impact several competitiveness criteria. In terms of the World Competitiveness Yearbook hard statistics, such an impact will be felt in the long-term. Changes in exchange rates will resonate, for example, in indicators such as stock prices and export sales for 2016 (if not later).

Currency stability, however, is fundamental for the degree of confidence that economic actors have in a particular economy. In this sense, there are competitiveness indicators that will display the impact of fluctuations more substantially in the short-term. We expect therefore that data gathered through our 2015 Executive Opinion Survey will exhibit such an impact. For example, we largely expect survey participants residing in directly affected countries to conceive of exchange rates as a hindrance for the competitiveness of enterprises. In addition, opinions about the resilience of those economies to withstand economic cycles could become unfavourable.

The image abroad or branding of some countries may be affected negatively, which could eventually impact business development in those economies. Respondents may take an adverse stand in regards to the government. For example this could affect their impressions about the adaptability of government policy to changes in the economy, the effectiveness of the implementation of government decision and, in some cases, the likelihood of an increased risk of political instability.

Perceptions about credit availability and the financing of companies could also suffer. It could be the case that respondents find that credit is not easily available for businesses and that the levels of financing to companies are inadequate. In addition, opinions about the banking and financial services could shift. Respondents may perceive a decline in the support that these institutions provide to businesses. Undoubtedly, assessments of risk factors in the financial system will be affected as well as the relationship between the cost of capital and business development. Capital markets (foreign and domestic) could be found as inaccessible. At the same time, survey respondents may find that the investment environment in their respective countries lacks attractiveness for foreign investors.

To sustain competitiveness it is fundamental for countries to maintain the levels of confidence that their institutions enjoy which in turn depends on the perceptions of market agents. In this sense, our Executive Opinion Survey is an accurate tool to gauge and capture market sentiments about current economic events. Be ready then for a “reality check,” we compile the 2015 survey results by the end of May.

Research Information & Knowledge Hub for additional information on IMD publications

CFOs must drive a financially disciplined way to manage environmental and climate risk amid growing push back against sustainability efforts.

How a private equity-backed corporate carve-out created a successful, sustainable consulting powerhouse by Benoit Leleux

IMD produces a yearly Smart City Index offering a balanced focus on economic and technological aspects of smart cities on the one hand, and “humane dimensions” of smart cities (quality of life, environment, and inclusiveness) on the other. In this...

Stay ahead in a shifting global economy. Learn how to build resilient supply chains, manage currency risks, and adapt strategies for long-term business success.

Women’s realities are often overlooked, but lifepreneurs—entrepreneurs innovating from experience—are turning struggles into profit and systemic change.

Switzerland should assess the Credit Suisse collapse before adding more banking regulations, says UBS Group CEO in a talk on Europe's financial future.

CFOs can rethink underperforming AI adoption by focusing on business value, data readiness, and employee buy-in.

US President Donald Trump’s full embrace of digital assets has sent shock waves through the cryptocurrency market, driving a price surge while creating both new opportunities and heightened risks for investors and corporations. Last week, Mr Trump...

On 12 March 2025, new and expanded tariffs on aluminium, steel, and downstream “derivative” products come into force. This briefing shows that derivative products alone represented $151 billion of imports in 2024, with 27 foreign economies each ha...

Trade conflict is costly to all parties. Canadian and Mexican trade retaliation can deny tariff-related wins for American workers. Blunt retaliation could go so far as to eliminate all the take-home pay gains in 40 U.S. states and make whatever ga...

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

IMD World Competitiveness Center Report, 8 April 2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Global Trade Alert, Zeitgeist Series Briefing no. 57, 6 March 2025

Research Information & Knowledge Hub for additional information on IMD publications

3 March 2025, Global Trade Alert Report, cBrief 5: These Are Your People

Research Information & Knowledge Hub for additional information on IMD publications