IMD World Competitiveness Yearbook: The 30th Edition

In less than three weeks, the IMD World Competitiveness Center will launch the 2018 competitiveness rankings. Every year in May there is a lot of work and a tremendous effort to cope with deadlines, meticulous reporting and checking of the data. There is also excitement about the upcoming results. This year, the enthusiasm and anticipation are even higher because this year the Center will launch the 30th edition of the IMD World Competitiveness Yearbook!

The first issue was introduced in July of 1989. It studied 32 economies and regions and made a clear distinction between developed (all OECD economies) and newly industrialized countries. The three highest ranked economies were Japan, Switzerland and the USA.

For the sake of history, it would be interesting to identify the three highest ranked economies with respect to competitiveness in intervals of (almost) ten years. Figure 1 presents the list. In 1998 the three highest ranked countries with respect to competitiveness were the USA, Singapore and Luxemburg among 46 countries that the Center analyzed. Ten years later, in 2008, the first two positions remained unchanged: USA and Singapore, while the third place was captured by another highly competitive economy in South-East Asia: Hong Kong. This time, the center was analyzing 55 economies.

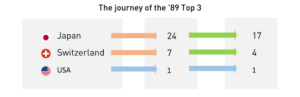

One notes that the USA remained among the top 3 during the specific years we present while Singapore was very competitive both in years 1998 and 2008. What about the other two countries of the 1989 top three economies?

Figure 2 presents the rankings of these three economies in the years under consideration. Japan dropped to the 24th place, while a decade later it had climbed back to the 17th position. The ranking positions reflect the stagnation and collapse of asset prices observed in Japan during the so-called “Lost Decade” period in the Japanese economy. Conversely, the innovative Swiss economy has always been ranked within the most competitive economies.

Figure 2. The journey of the ’89 Top 3

The three sample points taken into consideration traced the evolution of competitiveness in the three top ranking positions.

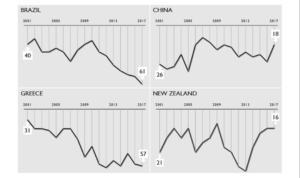

Alternatively, one may attempt to trace the overall competitiveness performance for a number of years. Graph 1 presents the competitiveness evolution for four countries. We begin at 2001, when the current methodology was introduced by the WCC.

For instance, Brazil is a country that attracted a lot of attention because of the size and potential of its economy. A member of the so-called BRICS countries, Brazil was ranked 40th in 2001. Because of both internal and global issues, this expectation never materialized. In 2017, Brazil had dropped to the 61st place out of 63 countries studied.

The same pattern is observed for the country of Greece. In 2001, a year after it was accepted into the Eurozone, Greece captured the 31st place in the ranking. Structural challenges along with excess government spending and tax evasion brought the country to the 57th position in 2017.

Graph 1. World Competitiveness trends around the world

The exact opposite trend is observed in the remaining two economies in Graph 1. China was ranked in the 26th position in 2001. The introduction of structural and institutional changes resulted in a fast growing economy that brought the country to the 18th position in 2017. Similarly, the economy of New Zealand held the 21st position in 2001. Managing not be highly affected by the global financial crisis and with the support of improving commodity prices, as well as attention to infrastructure, the economy of New Zealand captured the 16th place in 2017.

Figure 3. Who is going to lead the WCY ranking in 2018?

Figure 3 presents, the three highest ranked economies for 2017: Hong Kong, Switzerland and Singapore. Our intention was to whet your appetite by offering you the countries that captured the three top places in our ranking in the inaugural year as well as 1998 and 2008. Now, it is your turn: which economies do you think that will be in these three places in 2018?

Research Information & Knowledge Hub for additional information on IMD publications

Global market shifts and turbulence in 2025 mean Chief Financial Officers must take into account inflation, trade tensions and shifting regulations to ensure long-term growth

Asia's economic landscape 2024 and 2025. Three distinct approaches: Japan's technology-driven revival amid demographic challenges, China's deflation and growth concerns, and India's manufacturing ambitions through foreign investment and strategic ...

Companies don’t operate in a vacuum. Corporate leaders have to navigate political dynamics, and in Chapter 12 we discuss nonmarket strategies. But there’s a global dimension to sustainability that’s worth a separate discussion. Will rising geopoli...

With stagnant import volumes since 2021, and import prices at levels below those suggested by fundamentals, foreign exporters face an uphill battle to convert access to the Chinese market into revenues. Notably, the volume stagnation predates the ...

World exports of goods and services enjoyed boomtime growth in the 1990s and early 2000s. Since 2008, trade in goods – specifically manufactured goods – have plateaued; services exports have not. Services trade continues to ride the go-go growth p...

Early in his career, Dolf van den Brink, CEO of Heineken since 2020, did everything he could to project an image of authority – including wearing spectacles he didn't need. It wasn't until he learned to be comfortable in his skin that he began to ...

The trade policy stance of foreign governments to China’s goods exports is reviewed here. A balanced approach is taken— examining new import reforms facilitating sourcing from China as well as new import curbs. Further perspective is provided by c...

On the campaign trail, Mr. Trump slammed subsidy-driven approaches to attracting foreign investment in U.S. manufacturing. Putting tariffs on imported goods and saving subsidy outlays was his preference. Since 2017, the United States has seen two ...

With looming trade tensions and security uncertainties, the continent is at a crossroads. It is tasked with securing its future as a global economic power. Guest commentary by David Bach As the world prepares for Donald Trump's second term as US p...

Faced with looming trade tensions, security uncertainties and climate challenges, Europe is at a crossroads. It must seize the opportunity for bold reforms to secure its future as a global economic power. As the world prepares for Donald Trump's s...

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in Binder, Julia Katharina (Ed.); Haanaes, Knut Bjarne (Ed.) / Leading the sustainable business transformation: A playbook from IMD, pp. 47-57 / Hoboken: Wiley, 2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

The World Trade Organization Report / Trading with intelligence: How AI shapes and is shaped by international trade, p. 26 / 2024

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications