Business efficiency and productivity (part II)

In this Criterion of the Month, we continue to explore the relationship between business efficiency and productivity, and the institutional framework. Evidence presented in our February 2017 Criterion showed that institutions consistently played a significant role in the efficiency and productivity of the private sector. At the time, we suggested that a competitiveness strategy focus on institutional stability and predictability was a fundamental driver of efficiency and productivity. Using the same stepwise regression tests we employed then, we now attempt to evaluate the role of the different components of the institutional framework.

The first set of tests thus take the efficiency of business factor as the outcome and the components of the institutional framework as the input.

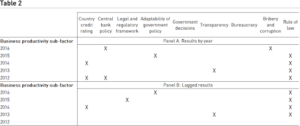

In the first step of the test, we assess the role of those components by year from 2012 to 2016. We find that the country credit rating and the limited impact of bureaucracy on business activities are consistently significant. The next step of test (lagging inputs by a year), supports the importance of the credit rating indicator for business efficiency, while the bureaucratic impact loses some significance. In the second set of tests (see Table 2) we replace business efficiency with business productivity as the output variable.

In this context, the importance of credit rating drops significantly and simultaneously that of the rule of law increases throughout the period of study. Lagging the input indicators by a year leads to similar results. Rule of law is the only input variable that is consistently significant for productivity.

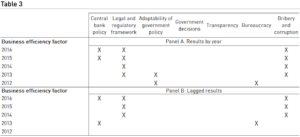

The lack of significance among the other components of institutional framework can be explained by considering that the country credit rating and the rule of law can absorb the significance of those components. This is because the efficiency of the government policy implementation and transparency, for example, could be encompassed by the credit rating and rule of law measures. We thus run an additional set of tests after dropping both indicators, credit rating and rule of law.

In the case of business efficiency (see Table 3), the results highlight that the quality of the legal and regulatory system, and the limiting of bribery and corruption are its main drivers in both, the by-year and lagged tests.

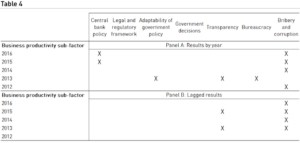

It is interesting to note that the transparency and the effectiveness of decisions indicators have no significance in both tests, although the government policies’ adaptability to changes in the economy is found to have been a driver of business efficiency in 2012 and 2013. For business productivity, the bribery and corruption indicator is of fundamental consequence (see Table 4).

It is important to indicate, in addition, that transparency becomes significant during some of the years considered. Interestingly, in the 2013 test, the only year in which bribery and corruption is not significant, the latter is replaced by the government policies’ adaptability to changes in the economy, the limited impact of the bureaucratic structure on business activities, and by increasing the transparency of government policy-making processes.

These results support some of our initial propositions. In this regard, it is important to highlight the significance of the quality of the legal and regulatory system, the upholding of the Rule of Law and the credit rating indicator which are all conducive towards an institutional framework that is stable and predictable, not to mention effective in achieving its objectives.

Research Information & Knowledge Hub for additional information on IMD publications

- Business efficiency and productivity (Part I)

- Business efficiency and productivity (Part II)

- Business efficiency and productivity (Part I)

- Business efficiency and productivity (Part II)

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

CFOs must drive a financially disciplined way to manage environmental and climate risk amid growing push back against sustainability efforts.

How a private equity-backed corporate carve-out created a successful, sustainable consulting powerhouse by Benoit Leleux

IMD produces a yearly Smart City Index offering a balanced focus on economic and technological aspects of smart cities on the one hand, and “humane dimensions” of smart cities (quality of life, environment, and inclusiveness) on the other. In this...

Stay ahead in a shifting global economy. Learn how to build resilient supply chains, manage currency risks, and adapt strategies for long-term business success.

Women’s realities are often overlooked, but lifepreneurs—entrepreneurs innovating from experience—are turning struggles into profit and systemic change.

Switzerland should assess the Credit Suisse collapse before adding more banking regulations, says UBS Group CEO in a talk on Europe's financial future.

CFOs can rethink underperforming AI adoption by focusing on business value, data readiness, and employee buy-in.

US President Donald Trump’s full embrace of digital assets has sent shock waves through the cryptocurrency market, driving a price surge while creating both new opportunities and heightened risks for investors and corporations. Last week, Mr Trump...

On 12 March 2025, new and expanded tariffs on aluminium, steel, and downstream “derivative” products come into force. This briefing shows that derivative products alone represented $151 billion of imports in 2024, with 27 foreign economies each ha...

Trade conflict is costly to all parties. Canadian and Mexican trade retaliation can deny tariff-related wins for American workers. Blunt retaliation could go so far as to eliminate all the take-home pay gains in 40 U.S. states and make whatever ga...

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

IMD World Competitiveness Center Report, 8 April 2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Global Trade Alert, Zeitgeist Series Briefing no. 57, 6 March 2025

Research Information & Knowledge Hub for additional information on IMD publications

3 March 2025, Global Trade Alert Report, cBrief 5: These Are Your People

Research Information & Knowledge Hub for additional information on IMD publications