Have the perceptions on globalization changed?

Globalization enhances the level of economic integration among countries. The free flow of goods, services, talent, and ideas has economic implications as well as political ramifications. Globalization has been the driving force of value creation but also of inequality; it offers greater choices of goods and services but has also caused the disappearance of domestic companies that could not adapt to global competition. The latter may result in higher unemployment and, in some cases, deteriorating quality of life in the cities where these firms are located. In turn, the negative effects may contribute to the increasing nativist political parties observed in both developed and developing countries asking for a reduction of globalization.

As many other dimensions in our social and economic interactions evolve, so does globalization. In this edition of the Criterion of the Month we will explore the perceptions of mid- and upper-level managers around the world on globalization.

There are several variables that capture aspects of globalization in the Executive Opinion Survey. Let us concentrate on four economies to examine how these different criteria evolved during the last 15 years: China, which in the last twenty-five years has expanded its trade and investments with the rest of the world; Germany, which is the strongest economy of the European Union; and United Kingdom and the USA, two countries that in the last few years have been inward looking. Figure 1 captures the response to the statement “The national culture is open to foreign ideas” in three periods: 2002, 2008 and 2018.

Figure 1: Is the national culture open to foreign ideas?

Figure 1 reflects an interesting result. Apart from China, the executives in the other three economies feel that the national culture has become more inward looking between 2002 and 2018. For the UK and the USA, the economy seems less open to foreign ideas compared with the beginning of the global financial crisis in 2008.

Naturally this will have an effect to how these economies are perceived by the rest of the world. Figure 2 provides the perceptions of the executives to the statement “The image abroad of your country encourages business development.”

Figure 2: Does the image of your country abroad encourage business development?

Germany is the only economy among the four examined here where executives recognize a constant improvement in its image abroad. China is approximately in the same position in 2018 as it was in 2002, while the perceptions of the executives in the UK and the USA decreased in the period covered, with the latter declining by a third.

The last statement examined for these four economies is a direct question regarding globalization asking the executives to reflect whether “Attitudes towards globalization are positive in your society.” Figure 3 presents the responses.

Figure 3: Is the attitude towards globalization positive in your society?

Except for the USA, the other three economies have a more positive outlook for globalization in 2018 compared to 2002. The UK still has not reached the position it had at the beginning of the economic crisis. However, the USA has a much less positive view on globalization.

An important question is whether the USA belongs in the majority of the economies we study and Figure 4 allows us to reflect upon this.

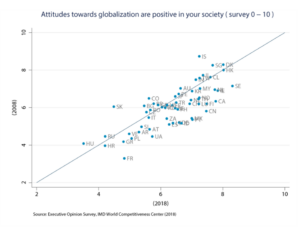

Figure 4 Changes in the perception towards globalization between 2008 and 2018

Figure 4 describes how the attitudes towards globalization have evolved between 2008 and 2018. The horizontal axis provides the ratio for the year 2018, and the vertical axis the ratio for 2008. Countries that are below the 45° red line have a more positive attitude towards globalization today compared to that of 2008. It is reassuring to note that the managers in the majority of countries have a more positive opinion about globalization. In fact, less than a third of the countries have a less positive view than a decade ago.

Still, this is not necessarily how the perceptions on globalization will evolve in ten years from now. It remains to be seen whether globalization will expand or contract.

Research Information & Knowledge Hub for additional information on IMD publications

China’s apparel sector in 2025 sees local brands rise and global players adapt amid digital, Research & Development, and innovation-led growth.

Explore how innovation, R&D, and policy reforms are reshaping China’s pharmaceutical sector amid rising healthcare demand and demographic shifts.

Stay ahead in a shifting global economy. Learn how to build resilient supply chains, manage currency risks, and adapt strategies for long-term business success.

On 12 March 2025, new and expanded tariffs on aluminium, steel, and downstream “derivative” products come into force. This briefing shows that derivative products alone represented $151 billion of imports in 2024, with 27 foreign economies each ha...

Trade conflict is costly to all parties. Canadian and Mexican trade retaliation can deny tariff-related wins for American workers. Blunt retaliation could go so far as to eliminate all the take-home pay gains in 40 U.S. states and make whatever ga...

This paper presents a compact and intuitive framework that consolidates, simplifies, and extends results on the links between technology, trade, and labour market outcomes. It makes three main contributions. First, it presents closed-form solution...

The board of Nestlé S.A. announced that Anna Mohl would become the CEO of Nestlé Health Science (NHSc) — a global leader in nutritional science — on 1 January 2024. She was delighted to hear about her new position but knew there was little time to...

Consumer-voters and the processing industry are the sure losers of the trade war against China that Trump will carry on with renewed energy.

Brookfield’s Catalytic Transition Fund is a case study in how the financial industry can spearhead sustainable development. Brookfield Asset Management announced an initial closing of $2.4 billion for the Catalytic Transition Fund, marking a signi...

BARCELONA, JANUARY 2023. What started in 2016 as a humble entrepreneurial attempt to contribute to a more sustainable future had turned into a solid eyewear brand present in major Western markets. François van den Abeele was even more excited by t...

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Global Trade Alert, Zeitgeist Series Briefing no. 57, 6 March 2025

Research Information & Knowledge Hub for additional information on IMD publications

3 March 2025, Global Trade Alert Report, cBrief 5: These Are Your People

Research Information & Knowledge Hub for additional information on IMD publications

in Journal of International Economics 23 February 2025, ePub before print, 104065, https://doi.org/10.1016/j.jinteco.2025.104065

Research Information & Knowledge Hub for additional information on IMD publications

Case reference: IMD-7-2636 ©2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications