The digital vortex is accelerating, but companies don’t have a clear plan how to move forward

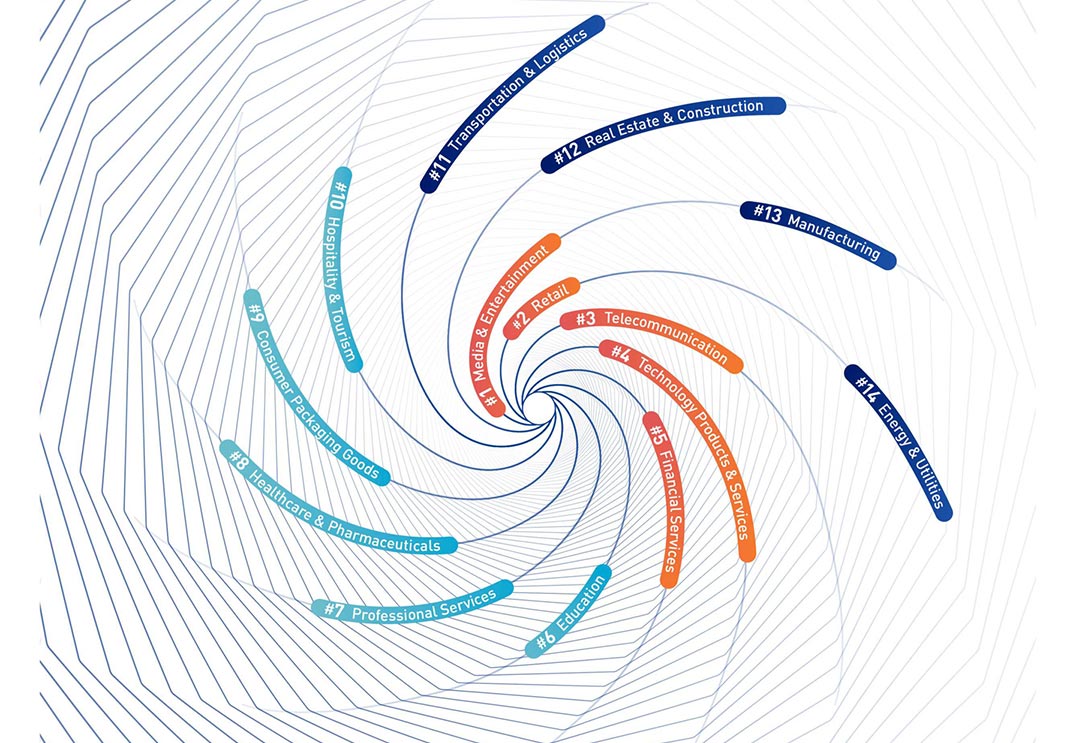

IMD’s 2021 Digital Vortex Report reveals that 90% of executives across 14 industries surveyed are moving closer to the center of the vortex, where the velocity and magnitude of change is the highest. The report shows that we have hit a saturation point where major or transformative digital disruption is impacting all sectors, irrespective of size or location.

But there is a growing gap between knowing and doing and among different echelons of executives. When the first Digital Vortex Report came out in 2015, executives were still debating whether they should move forward with digital transformation; today, this is no longer a question. The issue facing organizations is how should they move forward.

While it’s clear that companies have embraced digital strategies, the report shows that there is a big disconnect when it comes to formulating a cohesive, company-wide plan. More than 90% of respondents believed that digital disruption was a CxO-level concern, but 39% also stated that their organizations were not responding appropriately.

Furthermore, the percentage of respondents who reported having a fragmented digital strategy actually rose from 53% in 2019 to 61% in 2021. This is a strong indicator that while companies are pursuing digital projects, they are struggling with the execution, and they are most likely not getting all the benefits they hoped for from their digital investments.

The gap is also a problem within the structure of organizations

CxOs were more positive and optimistic about their digital strategy than lower-level executives. Higher level executives were much more likely to conclude that they were actively responding to digital disruption, while those lower down in the organization were more likely to say that the response was absent, inappropriate, or merely a copy of the competition. This perception gap widened between 2019 and 2021.

The 2021 Digital Vortex Report includes a special section on COVID-19 and its impact on digital transformation. Data collected specifically on activities related to the pandemic confirms that the global crisis was a catalyst for many companies to accelerate their digital transformations. In April 2020 roughly two thirds of organizations said their digital transformations had been accelerated. By June that number had risen to 75%, and by January 2021, 83% of companies said their transformation had picked up speed, indicating a big amplification effect of digital maturity.

There is also evidence that companies who began their transformation earlier have benefited financially during this past year. A strong positive link between digital spending and performance came through not only in the digital vortex data, but also in the second set of data that is included this year around the pandemic. Companies with a high level of digital maturity going into the pandemic actually had a higher business performance throughout the pandemic. Those that had a lower level of maturity going in had more trouble responding, so there is a sense that having already invested in digital tools and technology gave many companies a head start.

The five industries closest to the center of the digital vortex (media & entertainment, retail, telecommunications, technology products and services, and financial services) have remained the same since 2015. The big movers towards the center this year were healthcare & pharmaceuticals, education, and professional services.

Digital disruption itself no longer appears to be something organizations fear. Respondents from most sectors surveyed were more optimistic than concerned about their organization’s future ability to respond to digital disruption. Provided that organizations can successfully address the knowing-doing gap, the combination of projected increased digital spending with an optimistic outlook bodes well for a post-COVID business world.

Research Information & Knowledge Hub for additional information on IMD publications

The case explores TBC Bank Group’s remarkable journey from a small Georgian bank to a regional leader in digital financial services across Central Asia. Founded in 1992 with just US$500 in initial capital, TBC evolved into Georgia’s largest financ...

The case describes two transformation journeys for ABN AMRO bank. The first transformation is cultural and the second is digital. It explores the interplay between these two journeys from the perspective of the head of the Personal Banking. The ca...

As uncertainty grows, organizations must rethink how they navigate a volatile world. Rather than relying solely on scenario planning based on historical data, organizations could take a more proactive approach—imagining and shaping distant futures...

A great way for executives to hone their communication skills is by having a coach listen in on their conversations and provide feedback. But given the increasing capability of AI-based tools to have meaningful conversations with people, research...

The China Resources Beer (CR Beer) case study is a compelling narrative of the world’s largest beer producer by volume under the leadership of CEO Hou Xiaohai. In 2016 CR Beer embarked on a pivotal transformation journey. This case study offers cr...

Five friends created DIDA in 1983 and turned it into a global provider of IT infrastructure and services. Riding the wave of rapid growth of communication networks and increasingly global business relationships of corporations, DIDA established it...

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

The case describes two transformation journeys for ABN AMRO bank. The first transformation is cultural and the second is digital. It explores the interplay between these two journeys from the perspective of the head of the Personal Banking. The ca...

in Forbes.com 20 February 2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

NTT Corporation, Japan’s information and communication technologies (ICT) leader since 1953, was the first to commercialize internet usage on mobile phones in the 1990s, which resulted in NTT achieving much success in Japan. However, by the end of...

Building on NTT (A), the case starts with NTT’s CEO having narrowed down strategic growth options with the board to prepare NTT for the future. Past international investments in AT&T Wireless and KPN to tap into foreign markets had resulted in bil...

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD Brain Circuits 15 January 2025

Research Information & Knowledge Hub for additional information on IMD publications