Around 70 executives attended an IMD Discovery Event hosted by the Global Center for Digital Business Transformation. The purpose was to shed light on strategic responses to digital disruption, including analyzing the three value drivers and how to create “combinatorial disruption.” In a dynamic exchange, all the presenters stimulated an interactive and energetic discussion of the opportunities and challenges of digital disruption to all businesses, not just “traditional” tech companies.

Few businesses today can refuse to “go digital” – the internet, social media, mobile solutions, big data and other innovation technologies have rapidly transformed entire industries and continue to do so. Digital, according to the Global Center for Digital Business Transformation (DBT Center), is the convergence of multiple technology innovations enabled by connectivity. And digital disruption refers to the effect of digital technologies and business models on a company’s current value proposition and its resulting market position. It not only affects start-ups but also has the potential to overturn incumbents and reshape markets faster than perhaps any force in history.

In a recent DBT Center survey of 941 business leaders in 12 industries around the world, respondents reckoned that an average of 3.7 of today’s top 10 incumbents in each industry by market share will be displaced by digital disruptors in the next five years. Nevertheless, in about 45% of the companies surveyed, digital disruption was not seen as worthy of board-level or CXO-level attention. Only 25% were actively responding by disrupting their own business in order to compete. The remainder either did not recognize or were responding inappropriately (43%), or taking a follower approach (32%). Event participants had rather more positive views.

Understanding the impact of digital disruption

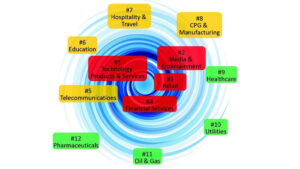

The Digital Vortex is a graphic way to show how digital disruption is redefining industries. An industry’s position relative to the center reflects the extent of potential competitive disruption that a firm in that industry will face within five years as a result of digital technologies (see Figure 1). Of the 12 industries surveyed, the number one spot is occupied by technology products and services. Industries on the periphery of the Digital Vortex are more asset-intensive, as opposed to the data-intensive industries close to the center, and are therefore likely to experience the most time before digitization becomes disruptive to their industry. But this does not mean that they are safe.

The automobile industry (No. 8) is an example from the periphery that will see unprecedented change in the next five years, with increasingly connected cars – including battery technology, connected tires, selfdriving cars, and the like. Already, major tech companies such as Google, Apple and Tesla are working hard to build driverless vehicles. And if this evolving technology is widely adopted, it is not only the auto industry that will be disrupted.Industries in the traditional automotive value chain, such as automobile manufacturing, auto repair and parts, public transportation and taxis, will obviously be affected. Some adjacent industries, such as package delivery, hotels, airlines and parking garages, will also feel the effects. Seemingly unrelated industries could also feel the pinch: insurance (with accidents projected to be down by 90%, demand may drop); retail (e-commerce will benefit from ease and low cost of delivery); energy; and media and entertainment (the driver no longer needs to pay attention to the road). Finally, unexpected industries may also be impacted, including real estate, healthcare, law enforcement and education. Selfdriving cars could trigger serious upheavals for many industries, which will have to shift strategy in order to compete.

Three categories of value drivers and combinatorial disruption

Digital disruptors create value for customers in at least one of three ways, and each of these has five different business models (see Figure 2). The three drivers are:

- Cost value – competing by offering the customer a lower cost or other economic gains

- Experience value – competing by offering the customer a superior experience

- Platform value – competing by creating network effects that benefit customers

The strongest digital disruptors – Amazon, Google, Uber and others – do not focus on just one type of value. They employ combinatorial disruption, which is so potent because the three values are mutually reinforcing. For example, Starbucks is not successful because it has better coffee – it is selling a superior experience, beyond the coffee. And now it is trying to provide platform value with its own pre-pay mobile app, which has $1.4 billion of coffee drinkers’ cash earning interest.

The DBT Center has identified two competitive realities facing firms today – the value vampire and the value vacancy.

Value vampires

A value vampire delivers value to customers but sucks the profit pool dry. It is a disruptive player whose competitive advantage shrinks the overall market size, leading to lower revenue and margins, or both. It always leads with extreme cost value, offering low cost or even free products or services. It combines this with a great experience and platform value, which provides exponential scale and rapid adoption. Incumbents’ offerings suddenly become uncompetitive and customers demand a “new paranormal” – there is no going back.

Amazon is a value vampire. It thinks of the digital value it wants to deliver to customers, not of the value chain. Take Amazon Prime – for $99, members obtain extreme cost value, including free two-day shipping, unlimited streaming of movies and TV shows, free e-books and so forth. Amazon is expanding into more areas to build experience and platform values. Amazon Echo, an internet-connected speaker that listens and talks, for instance, is useful and makes for interactive fun. Amazon is indeed building the casino you never want to leave. As a result, it is sapping the strength of Walmart, once a cost and supply chain champion, which is now closing hundreds of stores.

Value vacancies

Digital disruption is not always bad news for incumbents, however. A value vacancy is a market opportunity that can be profitably exploited via digital disruption. These market opportunities can be found in adjacent markets, in a digital enhancement (e.g., adding a sensor to a product) or in entirely new markets. Often they are short-lived because of the competitive dynamics of the digital vortex.

Incumbents need to focus on value vacancies because this is where the growth is. WeChat, owned by Tencent Holdings, is a messager app based in China with 600 million users. Sensing a value vacancy in the consumer financial services market, an entirely new market, WeChat launched a new service – Weilidai (“tiny loan” in English) – offering consumer loans of up to $30,000 via its app, with approval in minutes. The decision is based on analysis of personal information provided by the user, a credit check, plus WeChat’s own data. This new service fills a value vacancy by combining the three value drivers: first, it offers cost value by providing advantageous loan terms, such as not requiring collateral; second, it offers significant experience value, since customers can obtain a loan in minutes without going to a bank; and lastly, it offers platform value because users can easily access the service on the same app. In fact, WeChat has integrated many other types of functionality, including payments and food ordering, so users can benefit from a larger platform – a “one-stop shop.”

Digital response strategy playbook

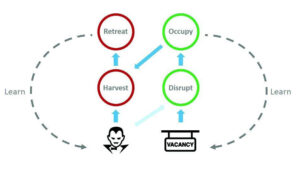

For incumbents, the question now is how to compete with digital disruptors. The DBT Center has developed a multi-step strategy playbook for managing amid digital disruption. The four competitive strategies encompass defensive strategies (red in Figure 3) and offensive strategies (green). Defensive strategies are used to fend off value vampires and modest disruptive threats, and to maximize the lifespan of businesses under attack. Offensive strategies are associated with the pursuit of a value vacancy. They all dictate how a firm creates new customer value through digital means and how it maximizes revenues and profits.

Figure 2: Digital response strategy playbook

Harvest

This is a defensive strategy aimed at blocking disruptive threats and optimizing the performance of threatened business segments. It is intended to make the best of a bad situation, optimizing the margin that can be extracted during the period of decline. Most would consider Netflix a digital disruptor, but before the company became a video streaming player, its main business was renting DVDs by mail subscription – and even today its DVD-bymail offering serves over 5 million members in the US, accounting for 23% of US profit in the latest fiscal quarter, although this is down from a peak of 20 million in 2010. As part of a harvest strategy, and to maximize DVD subscription revenue, Netflix optimized the business by streamlining and digitally automating the warehouse. Although Netflix has transformed itself into a global streaming service, it can still harvest its DVD operation – the question is, for how long?

Retreat

Aimed at strategic withdrawal from threatened business segments, this is a defensive strategy that should be adopted when the opportunity costs of maintaining a business exceed the benefits. Retreat mainly involves market exit, but possibly also targeting a market niche to serve a small subset of existing customers with unique needs. The vinyl record business is a good example of a niche with an appealing margin without major investment. Against the general trend, vinyl records have been enjoying positive sales growth in recent years. According to Nelsen Soundscan, 9.2 million vinyl albums were sold in 2014 in the US, a 52% jump on the previous year. Yet these sales accounted for only 6% of total album sales in 2014. It is still a niche market, as its main customers are DJs and audiophiles, but there is nevertheless a profit to be made.

Disrupt

This is an offensive strategy when a value vacancy is detected, aimed at disrupting one’s own core business or creating new markets. It focuses on creating any one of the value drivers or a combination of the three for customers using digital technologies and business models. Unlike Netflix, most incumbents are unwilling to disrupt themselves, especially if they are currently successful. This is probably one of the biggest roadblocks for incumbents in becoming disruptors.

Occupy

This offensive strategy aims to sustain the competitive gains associated with disruption. It focuses on maximizing the market opportunities and extending a company’s occupancy of the value vacancy. Often, a company differentiates its disruptive offering to extend the cost value, experience value and platform value it delivers for customers. Because this strategy requires incumbents to manage both declining and growing businesses simultaneously, it brings complexity challenges, such as operating outside the normal arena. Ultimately, most occupy plays evolve into harvest plays as the market continues to evolve.

Never-ending story

In the era of digital disruption, value vacancies do not endure and there is no lasting market supremacy. Start-ups and incumbents alike must constantly create innovations that blend cost value, experience value and platform value for customers. That is why we see Google, in addition to its core search business, investing heavily in self-driving cars; WeChat, apart from its disruption in communication, enhancing its financial presence; and Axel Springer, one of Europe’s biggest media companies, investing in digital companies such as AirBnB that leverage new technologies. These companies have successfully designed strategies that disrupt and occupy the value vacancy over and over again. Is your company ready to do the same?

Value Vampires and the Music Industry

In the late 1990s, the music industry was riding high, with global revenues reaching $28.6 billion. CDs cost $15 to $20, even though many felt this was overpriced. In 1999 Napster, a peer-to-peer file sharing service, was launched. Its original aim was to connect music fans so they could share and download music, but it quickly disrupted the whole industry for several reasons. First, the service was free, providing strong cost value for customers. Second, it delivered experience value by unbundling the song from the CD, so customers could download only the tracks they liked. Finally, it offered platform value by connecting fans with one another, and peer-to-peer sharing allowed it to quickly scale the number of songs and albums.

Most music retailers were afraid of Napster’s business model, but did not think of adapting their strategy. HMV sued Napster, which was ultimately blocked. The value vampire disappeared, but people still wanted digital music. HMV rested on its laurels, but other players such as Microsoft (Zune) tried to disrupt this market and occupy the value vacancy created by a disruptor that failed. iTunes finally won by combining cost value – $0.99 per song; experience value – well-designed devices; and platform value – as an all-content provider. HMV, reluctant to change its value chain, was finally forced to retreat to a niche in a declining market, focusing on vinyl and CDs.

iTunes was supremely disruptive, but occupancy of such a value vacancy does not last. New value vampires Spotify and Pandora are pushing iTunes to harvest. In response to the new digital disruptors, Apple launched the subscription service Apple Music to disrupt itself. Although it will be losing revenue, it sees this as a necessary step to try to occupy the value vacancy and build a new platform. Who will be the next winner?