The red envelope war in 2018

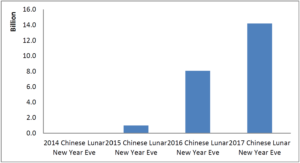

In a tradition spanning more than 500 years, Chinese people have been giving each other money in red envelopes, called hongbao, as part of the annual Lunar New Year celebrations. These hongbao have now become the latest battleground between China’s two digital behemoths, Alibaba and Tencent.It all started in 2014 when Tencent introduced a way for users to send a digital version of red envelopes to friends and family via WeChat, its blockbuster messaging platform. By the following year, Tencent had partnered with China Central Television (CCTV) as the official red envelope distributor during the five-hour New Year TV gala show, the largest entertainment show in the world with more than 700 million viewers. The move proved to be a great success. The WeChat digital red envelope quickly gained popularity and, as a result, millions of users tied their bank cards to a WeChat account.Since then, the digital red envelope has become a new tradition. According to Tencent, WeChat users sent 47 billion red envelopes to one another in the 6 days around New Year in 2017. A total of 14.2 billion red envelopes were exchanged on New Year’s Eve alone, a year-on-year increase of more than 75% (refer to Figure 1).

Figure 1, Number of digital red envelopes exchanged on WeChat

Data source: WeChat

Alibaba, China’s largest ecommerce player and owner of Alipay, the country’s dominant payment platform, was caught off guard by Tencent’s hongbao move. The company’s founder and Chairman Jack Ma described it as ‘a Pearl Harbor attack-like attack’. However, the company quickly went on the offensive. In 2016, Alibaba spent US$41 million to outbid Tencent and become the exclusive interactive partner for CCTV’s New Year TV show.

Moreover, in direct response to WeChat’s digital red envelope, Alipay introduced the “Lucky Card Collection” game in 2015, allowing users to collect and exchange cards with friends. Users who collected all five virtual lucky cards were eligible to participate in a draw for a large cash prize (in 2018, the prize will be US$79 million). The results were encouraging: 1.1 billion new friend connections were made. In 2017, Alipay launched an augmented reality hongbao where, inspired by Pokémon Go, participants scanned various fu characters to collect a lucky card. Companies such as Coca-Cola, KFC and Procter & Gamble signed up to hand out cash and vouchers to game users, thus taking the red envelope war to the offline physical realm. Tencent quickly responded by releasing its own location-based AR virtual red envelope game through its instant messaging app QQ.

New for 2018

As the Year of the Dog approaches, the two technology giants are once again engaged in an intense red envelope battle. It is believed that the pair will give away an incredible US $826 million in virtual Hongbao and electronic shopping coupons. Sending free cash through simple gamification, such as tapping or shaking a phone, has proven to be a bonanza for both companies.

Tencent introduces QQ’s fitness red envelope and WeChat’s golden red envelope

WeChat has been at the center of Tencent’s hongbao battle so far, but it looks as if Tencent wants to duplicate WeChat’s success with its older sibling, QQ, possibly to stem the loss of users from the platform. While WeChat’s active monthly users are still growing at 15.8% per year, QQ user numbers have been falling. But QQ still has 842 million active monthly users, and more importantly, they are young – most were born after 2000. QQ plans to combine cash giveaways with fitness tracking, a popular feature in China. According to QQ Big Data, Chinese people walk an average of 5,678 steps every day, but walked only 5,016 steps on the first day of 2017. The QQ fitness tracking feature monitors data from user smartphones, and will offer users a chance to enter a draw for more than US$32 million for every 100 steps taken during the first three days of the New Year. In addition, QQ has teamed up with four luxury brands, Ferrari, Burberry, Kenzo and YSL beauté, to create limited edition New Year red envelopes.

On Valentine’s day, WeChat launched the “Spring Festival Shake” promotion – an upgrade version of the “Weekend Shake” mini program – to enrich the offline consumer experience. The campaign will last for one week and users who use WeChat to pay over RMB 2 (USD 30 ¢) at offline partner stores can participant in a lucky draw to win two kinds of red envelopes: one that represents a free purchase, or a red envelope up to RMB 200 ($31.6) that can be used for subsequent purchases.

WeChat is set to release the golden red envelope. Gold is traditionally a favorite gift amongst the Chinese. Similar to the digital red envelope, users can buy grams of virtual gold and send them to friends, either via the regular red envelope or the red envelope lucky draw. The virtual gold trading platform is built as a WeChat Service Account, backed by WeChat pay and the ICBC bank. Recipients can opt to sell the gold based on the current gold price on the Shanghai Gold Exchange by paying 0.5% transaction fee, or keep it as an investment. This affords Tencent an opportunity to make a return on its investment. With the golden red envelope, Tencent is now competing directly in the mobile finance field with Alibaba’s Ant Financial, which offers a robust array of financial services on the Alipay app, including gold investment.

Alibaba pushes Taobao

Alibaba is eager to build its own social platform, either with Alipay, through startups such as Dingding, Laiwang, or with Taobao, its online C2C marketplace. While Tencent is focusing on the young Chinese, Alibaba seeks to engage an older segment of the population. Taobao has also released a new channel on its platform aimed at senior users and their families. The new channel seeks to expand the current Taobao from a tool for individuals to a social platform for families. After signing in, seniors can chat with their family members, share products, and utilize the new “pay-for-me” option.

Alipay will continue its Lucky Card Collection Game, using location based AR technology. This year, users can collect lucky cards via Alipay’s social mobile game “Ant Farm” and “Ant Forest”. The first is a charity program, and the latter allows users to turn so called “low-carbon” activities such as paying a bill via Alipay or traveling by metro into desert tree planting.

Figure 2, Tencent vs Alibaba: The New Year Giveaway War

The red envelope war has resulted in massive engagement for both digital giants. As a consequence, China’s fintech industry is in many ways moving ahead of the rest of the world. In 2018, Alipay and WeChat Pay dominate mobile payments for almost everything from utility bills to taxi fares to peer-to-peer transfers to charity donations.

Michael Wade is the Cisco Chair in Digital Business Transformation, and Professor of Innovation and Strategic Information Management at IMD. He is Director of the Global Center for Digital Business Transformation.

Jialu Shan is a Research Associate at the Global Center for Digital Business Transformation.

Research Information & Knowledge Hub for additional information on IMD publications

All organizations should have a plan to secure trust during, after (and even before) a crisis hits. Here are a host of examples, good and bad, to learn from.

Medacta Group SA is a rising star in the orthopedics market, achieving global success through innovative products and techniques, with a particular emphasis on minimally invasive techniques that bring meaningful value to its patients. With its app...

China’s apparel sector in 2025 sees local brands rise and global players adapt amid digital, Research & Development, and innovation-led growth.

Explore how innovation, R&D, and policy reforms are reshaping China’s pharmaceutical sector amid rising healthcare demand and demographic shifts.

10 years of exclusive surveys reveal top supply chain strategy challenges—and how tools like AI, ML, and digital twins are reshaping the path forward.

Uncover AI use cases and opportunities with 4 clear imperatives that align data with business value. Avoid pitfalls and ask the right questions.

IMD produces a yearly Smart City Index offering a balanced focus on economic and technological aspects of smart cities on the one hand, and “humane dimensions” of smart cities (quality of life, environment, and inclusiveness) on the other. In this...

Stay ahead in a shifting global economy. Learn how to build resilient supply chains, manage currency risks, and adapt strategies for long-term business success.

The case study introduces an original way of exploring the many questions and concerns around AI adoption in business. Based on a true story, it discusses the dilemma of AI implementation through Joe, the CIO of ParcelFlow. Joe is getting ready to...

#post_excerptHannele Jakosuo-Jansson of Neste and Finnair shared key insights on board roles in CEO transitions and culture shifts with IMD’s High Performance Boards program.

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Case reference: IMD-2663 ©2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

IMD World Competitiveness Center Report, 8 April 2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications