Dream small: The best path forward for AI in supply chains

Artificial intelligence (AI) remains a controversial topic in the supply chain community, something that is fueled by huge aspirations but is hindered by data availability, employee training and actual business case validations.

We have written before about the potential of AI in supply chain, specifically with regards to demand planning. Our thesis is that there are serious challenges to the widespread adoption of AI in demand planning, but the challenges are not intrinsically related to the performance of AI in improving demand planning accuracy.

There are two pillars to this conclusion. The first relates to the availability of important market intelligence. Information that shapes demand, such as promotion sizing and timing, media campaigns, competitor actions and customer behavior are often known by sales or marketing, but organizations have trouble marshalling this collective information together in order to build effective demand plans.

While sales data might be available, possibly even across different sales channels, this contextual data, if not missing entirely, would typically require tedious manual extraction to feed an AI tool for demand planning.

The other pillar concerns the explainability problem. In mature sales and operations processes, the GM is required to link their demand plan to their financial plan in order to both secure necessary cross-functional collaboration, and to avoid post-hoc manipulation of the demand plan by the GM. It is understandable that a GM would not feel comfortable ceding this key role in part to AI-produced demand plans that are difficult for planners to explain and defend.

If one takes a step back, this example provides a broader insight into the areas of supply chain where AI may be able to make rapid inroads and the areas where adoption will be more challenging.

In the case of demand planning, the explainability challenge of AI is amplified due to the strategic nature of financial planning to GMs. The commitment of the GM to a projection of financial performance is a key accountability, one that will drive decisions that can have wide-ranging impacts.

On-the-ground operations: logistics

A look at the areas of supply chain often mentioned as promising for AI in the shorter-term tend to be applications that are very ‘on the ground’, such as transportation and logistics. This includes using AI for more efficient freight tendering and delivery routing along with warehouse optimization and automation. An analysis from McKinsey identifies Transport and Logistics as having the second highest potential incremental improvement potential from AI. A major eCommerce player we spoke to uses AI for estimating fulfillment lead times within Europe.

Beyond the size of the prize, logistics has several attributes that make it attractive for AI in a way that demand planning is not. In logistics, there is a wealth of available, unambiguous data regarding costs, distances and weights. There is a lot for AI to ‘chew on’ to identify underlying patterns opportunities.

Also, logistics has long been fertile ground for quantified research and trials to improve performance. Thanks to the continued rapid expansion of Transportation Management Sytems (TMS) and the sophisticated efforts of delivery companies like UPS, there are fewer managerial barriers as the key decision makers are likely already open to AI solutions they (understandably) may not fully grasp. In fact, the growth of TMS provides a natural channel for a low-friction deployment of AI routing optimizations.

On-the-ground operations: maintenance

There are similarities to be found with another Industry 4.0 technology that uses Machine Learning (a subset of AI) that we have discussed before: Predictive Maintenance. The adopters of Predictive Maintenance are often manufacturing or maintenance engineers that are more apt to embrace a new technique that continues in the spirit of Lean or other optimization efforts, and in fact usually play a central role in defining the scope of the program.

As important as logistics and asset maintenance are to the financial success of a company, they are more operational than strategic in the wider scope of most companies. They carry less long-term implications for senior managers, particularly those outside of supply chain. In other words, the more critical the decision, the more it leaves the realm of supply chain and enters into broader business decisions, and so the greater the managerial barrier. The explainability issue of AI in supply chain grows more prominent as the decisions become more strategic and spill out of the scope of supply chain.

In the realm of supply chain planning, the handful of use cases for AI that we have seen have not been at the level of demand planning or production planning. The use cases usually involve the deployment of inventory between distribution centers, or perhaps the sequencing of a production plan on a line, all based on AI-derived projections of short-term demand. These are exciting demonstrations of the optimization potential of AI, but they are also squarely in the operational sphere, as opposed to decisions such as affectation of production to manufacturing sites or medium-term production.

All of this points to a near-term role for AI in supply chains that stays firmly rooted in the ‘here and now’ operational level. This is where the explainability problem can be mitigated by both avoiding the strategic levels and the managers less likely to embrace the AI-generated solutions. Perhaps this will offer a route for managers to grow trustful of AI and erode the explainability problem from within.

Ralf W. Seifert is Professor of Operations Management at IMD. He directs IMD’s new Digital Supply Chain Management program, which addresses both traditional supply chain strategy and implementation issues as well as digitalization trends and new technologies.

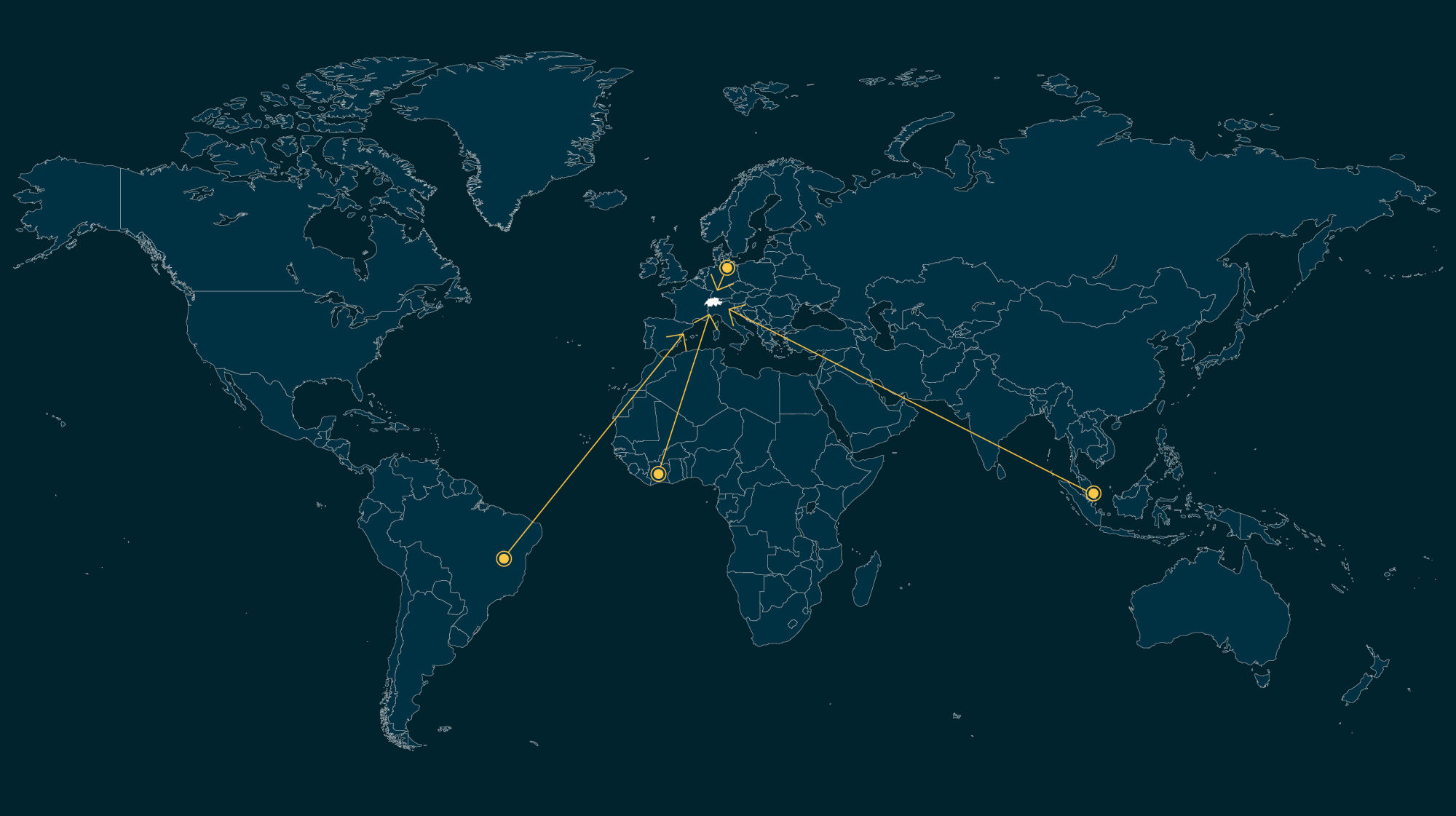

Richard Markoff is a supply chain researcher, consultant, coach and lecturer. He has worked in supply chain for L’Oréal for 22 years, in Canada, the US and France, spanning the entire value chain from manufacturing to customer collaboration.

Research Information & Knowledge Hub for additional information on IMD publications

Digital tech, established businesses, and governments can combine to help bridge formal and informal supply chains.

Resilience and efficiency of supply chains should no longer be viewed as competing goals but rather as complementary aspects of a well-calibrated supply chain management strategy.

GenAI is becoming a more common feature of the supply chain function, but significant areas of opportunity remain, suggests IMD's Carlos Cordon.

Manufacturers must adopt a unified strategy across different divisions if they are to extract the full value of Industry 4.0.

The supply chain risk management literature differentiates between disruption risk that arises from supply disruptions to normal activities and recurrent risk that arises from problems in coordinating supply and demand in the absence of disruption...

Supply chain management experts Ralf Seifert and Richard Markoff pose the question: is fulfilment still an FMCG core competency?

As society moves further into the digital age, emerging technologies bring unprecedented opportunities for economic growth, operational efficiency and societal advances. Emerging technologies such as artificial intelligence (AI), quantum computing...

Demand Planning Key Performance Indicators (KPIs) are frequently criticized for being too complex or irrelevant. However, an emerging approach is gaining popularity: evaluating the effectiveness of the planning process itself, rather than just the...

Turbulent times can leave businesses scrambling for measures to help them bounce back after disruption. But these actions may in fact increase overall supply chain fragility.

The sheer complexity of trade regulation and the risk of non-compliance mean companies are missing out on billions in tariff savings from Free Trade Arrangements (FTA) in their global supply chains. New AI tools can help remove some of the barrier...

in I by IMD 5 February 2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in Production and Operations Management 16 November 2024, ePub before print, https://doi.org/10.1177/10591478241302735

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

World Economic Forum White Paper, October 2024

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications