At a glance

- Embracing a sustainability agenda is first and foremost a process of developing organizational learning. It is also an opportunity to re-examine a company’s value drivers.

- SITA’s foray into securing a sustainability-linked loan became a catalyst for a number of organizational and cultural shifts, largely powered by improved cross-functional collaboration between Finance, Treasury, Corporate Social Responsibility and the rest of the organization. The outcomes of these shifts have significantly surpassed the loan’s financial benefits.

- SITA’s experience corroborates the findings of IMD studies on sustainability and ESG in that true sustainability (i.e. the impact a company has on the planet and society) involves broadening the definition of a company’s long-term value creation.

As SITA – the air transport industry IT provider that delivers solutions for airlines, airports, aircraft and governments – emerged from the pandemic-induced downturn and began renegotiating some of its credit arrangements, it was attracted to the idea of sustainability-linked instruments. Having already been certified carbon-neutral, SITA appeared to be in a good position to earn favorable financing terms on the strength of its decarbonization journey and broader environmental performance. Nevertheless, the process of negotiating a sustainability-linked revolving credit facility (RCF) proved to be a complex and arduous journey.

The broader issue

Executives at organizations that have expressed their commitment to sustainability may believe that the perks will start pouring in: better financing terms, improved risk and reputation profiles, extra leverage in recruiting and retaining talent. In reality – and as SITA’s experience bears out – embracing sustainability is a (rarely pain-free) process of collective learning and developing adaptability; a new set of management vocabulary; an opportunity to re-examine the company’s long-term strategy and main drivers of value creation; a pathway to future–proofing the business; and a catalyst to deeper cultural and organizational change.

A new approach

Our discussions with the company’s Finance and Treasury executives revealed that SITA’s initial impetus behind embracing environmental, social and governance (ESG) targets as part of renewing its credit facilities had to do with alleviating financial risk. Concurrently, its wider goal was to lead the aviation sector out of the pandemic-induced crisis.

During our field work we discovered that since well before the pandemic, SITA had considered itself a sustainability frontrunner. The internal initiative that guided many of its decisions in areas such as emissions reduction, offsetting and renewable energy dated back to 2018. Its Planet+ program, which aimed to reduce its greenhouse gas (GHG) footprint, was recognized by the UN as an outstanding example of Sustainable Development Goals (SDG) Good Practices – no small feat. In 2021 SITA was certified a CarbonNeutral® company, one year ahead of schedule. Moreover, specialists from its Treasury and Corporate Social Responsibility (CSR) teams had a solid conceptual understanding of the issues.

Despite these strong credentials, committing to the intricate mix of financial and behavioral metrics that is ESG – and incorporating that mix into a specific credit facility – proved to be a challenging task and a dynamic, fluid process that involved a number of moving targets. A new class of sustainability-linked products had emerged that pegged ESG targets to potential pricing benefits. Nonetheless, SITA’s executives soon realized that standardizing ESG performance measures was a work in progress – not only for individual organizations but also for virtually every player in the sustainability landscape: banks, auditors, even the target-setting bodies who became inundated with applications. Multiple bodies provided different guidelines or principles for what constituted an ESG-compliant investment. On top of that, there were several ESG rating agencies to engage with, whose role was to certify ESG compliance of a specific transaction (usually by issuing an ESG opinion).

Did it work?

In 2022 SITA signed its inaugural sustainability-linked loan (SLL) transaction, raising $400 million at three-year maturity with two additional one-year extension options. The purpose was to support its investment in developing innovative solutions that tackled the aviation industry’s current and future challenges. The loan was directly linked to pre-agreed environmental KPIs and yearly targets, with a bonus or a malus on the interest margin depending on SITA’s performance.

With hindsight, we could see how tracking performance against ESG targets became a catalyst for several organizational and cultural shifts within SITA. First, it reaffirmed that decarbonization was the right thing to do – and one that reflected SITA’s and its members’ best interests. It also spearheaded an internal debate on how to include sustainability in financial discussions. Finally, ESG goals and performance indicators began manifesting in the company’s management parameters and reporting lines.

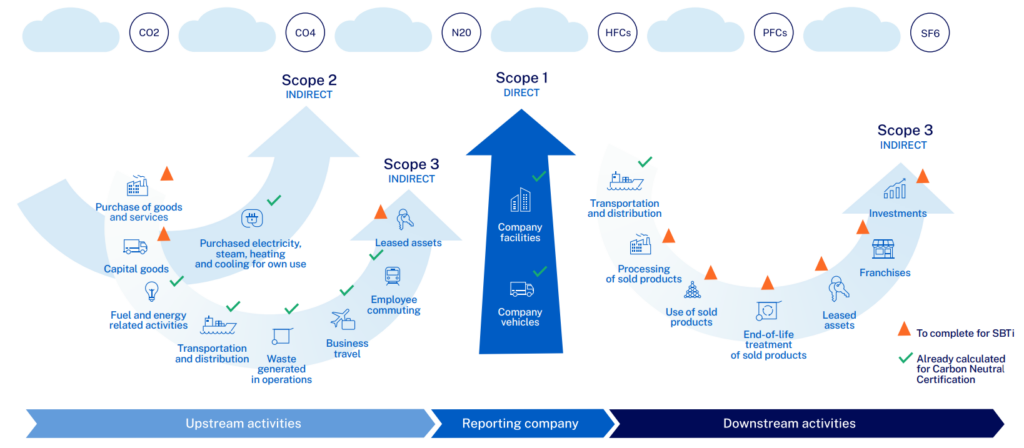

In the process, SITA embraced the principles of double materiality – combining the outside-in view of how its business was affected by sustainability issues with an inside-out perspective on the impact of its activities on society and the environment. In late 2023 the company reached another milestone on its net zero journey when its near- and long-term emission reduction targets were officially validated by the Science-Based Targets Initiative (SBTi).

Reaping the benefits

Overall, SITA’s commitment to sustainability enabled it to stay ahead of regulatory requirements, to build reputation and trust among customers and business partners, as well as to obtain real value and better terms from the financial sector. Internally, the organization was able to take a multidisciplinary approach to how it reviews the use and allocation of capital and then map it onto its strategic objectives, ratings aspirations, and other goals and targets.

For SITA as a data-driven company, the journey to internalize and operationalize a set of ESG metrics reinforced its use of coherent, data-based vocabulary. It also sharpened its customers’ and partners’ focus on deepening their digital adoption as part of the sustainability agenda. SITA is now in a strong position to anticipate the adoption of smart, predictive and prescriptive indicators.

Most importantly, the journey to date was a powerful enabler of individual, team and organizational learning. The ability to manage assessments, data points and metrics was critical – as was the implementation of meaningful frameworks that help improve and streamline data collection. Yet, SITA’s executives are conscious that indicators are not the be-all and end-all. Rather, they are a reflection of how the change toward sustainability is progressing. They continue to signal current as well as emerging gaps in strategizing and knowledge about aviation as a complex business landscape in which fundamental assumptions (regarding, for instance, maximizing shareholder returns in the short term vs. achieving net zero commitments in the long term) may turn out to be competing or even contradictory.

In our conversations with SITA’s executives, they emphasized the impact that cross-functional teams have produced by pooling expertise ranging from finance to facilities, as well as combining hard and soft skills – thus coupling analysis and keeping abreast of regulatory trends with communication and creative thinking that spans emissions reduction with mitigation and adaptation.

Studies by IMD have proposed that true sustainability (i.e. the impact a company has on the planet and society, beyond meeting ESG targets that are primarily rooted in risk management and investment frameworks) involves broadening the definition of value creation. For SITA, the journey toward sustainability was much more than a standard reporting exercise. It presented SITA with the opportunity to restate its story, identity and value creation model; to strengthen its stakeholder management; and to better orchestrate its collaboration with internal and external partners. To that end, SITA went on to expand its Investor Relations and further empowered the interactions between Treasury and the business.

The learning that SITA undertook has reinforced its long-term strategic vision of working toward reducing the company’s carbon footprint while promoting environmentally friendly practices within the aviation industry. In that context, tracking the targets of the sustainability-linked RCF has opened the door to shaping indicators that will reflect the long-term health of the organization, its members and its industry. It involves forward-looking domains such as resource use, energy transition, return on digital investments, rolling out AI-enabled business processes and applications, and other themes. Moreover, as human capital gains prominence within sustainability and ESG, the relevant discourse increasingly reflects trends that affect the future of work, employee experience, and learning and development investments.

According to SITA’s CFO Nicolas Husson: Sustainability is high on our agenda, and we are deeply committed to ensuring a sustainable future for all, including for our employees, customers and partners.

This article is based on IMD case IMD-7-2452, available from The Case Centre at www.thecasecentre.org