The BlackRock letter: A turning point for real change?

Although greenwashing is far too common, recently there have been two powerful “green shots,” which show that business is finally taking sustainability a lot more seriously. These are, in our opinion credible signals that serious capital market decisions are beginning to factor in sustainability and the role of business in society in a new way.

Most recently, Larry Fink, founder of investment management giant BlackRock, wrote in his 2018 letter to chief executive officers that “to prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society. Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate.”

We agree. And we would argue that to avoid getting locked into value extraction for shareholders, firms have to proactively identify the extent to which their business model depends on what we call “negative externalities” like activities that damage the environment, and be wary of the related risks.

We would also argue that companies need to identify clearly how their business model creates value and rewards critical stakeholders in order to maximize the firm’s long term value.

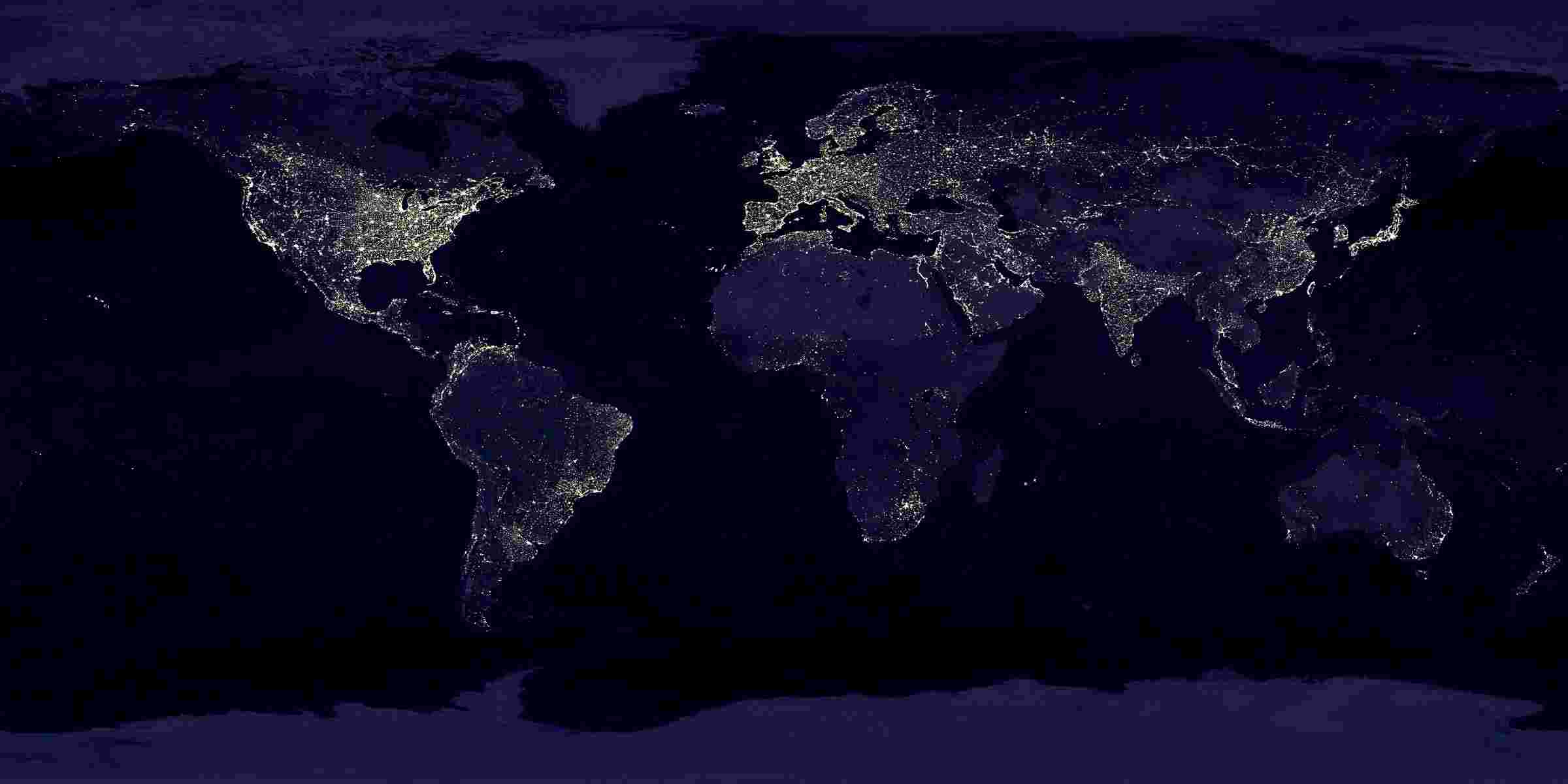

Why? Because societal legitimacy is critical for long-term value creation in today’s transparent world, in which case the positive societal externalities associated with the firm’s activities have to exceed the negatives.

For fast growth companies in need of capital, shareholders are value-critical. But, for slowly growing companies, shareholder pay-outs are not as value critical. If corporations distort markets to increase profits and distribute the proceeds as dividends and buybacks, the firm and its shareholders do well, but others do not benefit.

Favoring shareholders at the expense of other stakeholders who are more critical for value creation makes both society and the firm worse off in the long run. Ideally, before paying out to shareholders, firms should distribute rewards to the value critical stakeholders up to the point where greater rewards do not create additional firm value.

The Larry Fink letter is a strong endorsement of the emergence of a serious approach to sustainability.

Here is the other “green shot”. Exactly one year ago we also saw a serious testimony to the new realities of corporate capitalism when Unilever received – and were able to thwart – a takeover bid from Kraft Heinz (backed by Warren Buffet’s Berkshire Hathaway and PE fund 3G Capital).

At the time of the bid, Unilever was running multiple sustainability initiatives that could be at risk if the takeover proved successful. For instance, the company was piloting projects to reduce waste through circular economy design thinking and aimed to reach 100 per cent recyclable plastics. It was also deeply invested in sustainable agriculture in areas such as soil and biodiversity protection, water usage, smallholder income and poverty reduction.

Taken together, Unilever’s initiatives aimed at improving the health and well-being of over 1 billion people and halving the company’s environmental impact. The company had shown top line growth of about 5 per cent per annum between 2009 and 2017. This represented approximately twice the market growth rate. Products labelled as “sustainable” showed robust performance.

Of Unilever’s Top 40 brands, 18 were identified as sustainable. These brands – such as Dove, Hellman’s or Ben & Jerry’s – were reported to be growing approximately 50 per cent faster than the rest of Unilever’s brands. In CEO Paul Polman’s words, the bid was “clearly a clash between a long-term, sustainable business model for multiple stakeholders and a model that is entirely focused on shareholder primacy.”

So are these only two random occurrences, or are they green shots promising real change?

We believe the latter. According to a 2016 study by the Massachusetts Institute of Technology and Boston Consulting Group, investors believe that sustainability creates tangible value.

For example, 75% of top executives in investment firms agree that a company’s good sustainability performance is materially important to their firm when making investment decisions.

Yet, only 60% of managers in publicly traded companies believe good sustainability performance matters to investors. Moreover, investors are willing to divest for sustainability reasons. 57% of investment firms‘board members state that they exclude or divest from companies with poor sustainability performance.

So slowly but surely there are signs that greenwashing is giving way to serious attempts at sustainability.

Knut Haanaes is a professor of strategy at IMD and was previously senior partner and Global Leader of the Strategy Practice in BCG.

Paul Strebel is an emeritus professor of governance and strategy at IMD, a director & advisor to boards and top management teams.

This article was first published in Eco Business.

Research Information & Knowledge Hub for additional information on IMD publications

Global trade is re-wiring without the US leading to the rise of new trade coalitions according to trade experts from IMD and the Hinrich Foundation.

Energy efficiency is the fastest and cheapest way to cut emissions. Business leaders must do more to translate words into action.

Many C-suite executives are torn between the need for a green transition and maintaining a competitive advantage. Here are five ways to find a clear path ahead.

GEA Chief Sustainability Office Nadine Sterlye explains how the engineering giant is working with upstream suppliers and downstream customers to reduce Scope 3 emissions

Leaders must balance conviction with caution. Speaking Up and Staying Strategic explores how to advance inclusion goals while navigating polarized workplaces.

Novonesis CEO Ester Baiget shares how advanced tech and a unique ‘library of strengths’ are transforming food production and laundry solutions globally.

The case follows Kristin Hull, founder and CIO of Nia Impact Capital, a mission-driven investment firm in California, as she faces a pivotal decision in July 2025: Should she file a shareholder resolution against Tesla, Inc.? Hull and Nia have eng...

In this edition of Leaders Unplugged, IMD President David Bach and Vestas CEO Henrik Andersen discuss Europe’s energy risks and bold leadership.

Novonesis CEO Ester Baiget shares how the Danish biosolutions leader uses science, AI, and culture to transform food, detergents, and sustainability.

Philip Morris International Sustainability explores PMI's shift from cigarettes to smoke-free alternatives, delivering measurable change across global markets.

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications